Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 Jul, 2023

By Paul Manalo

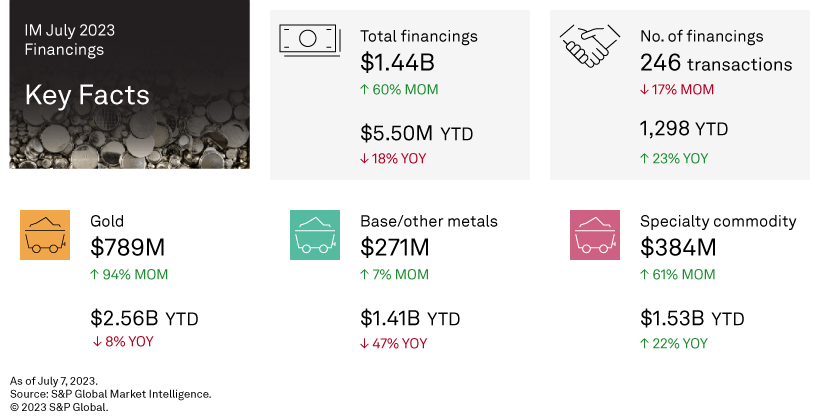

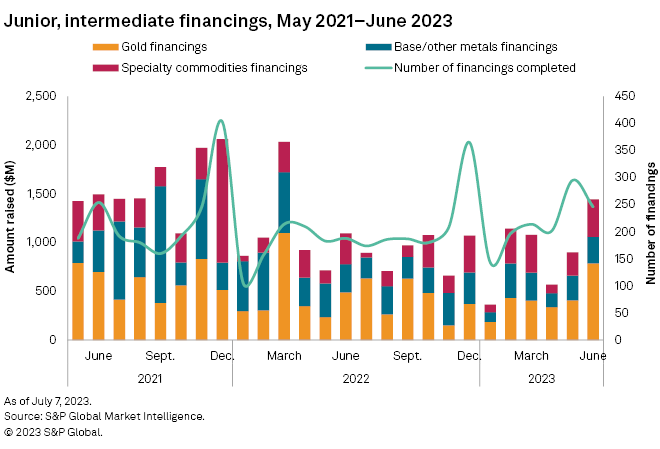

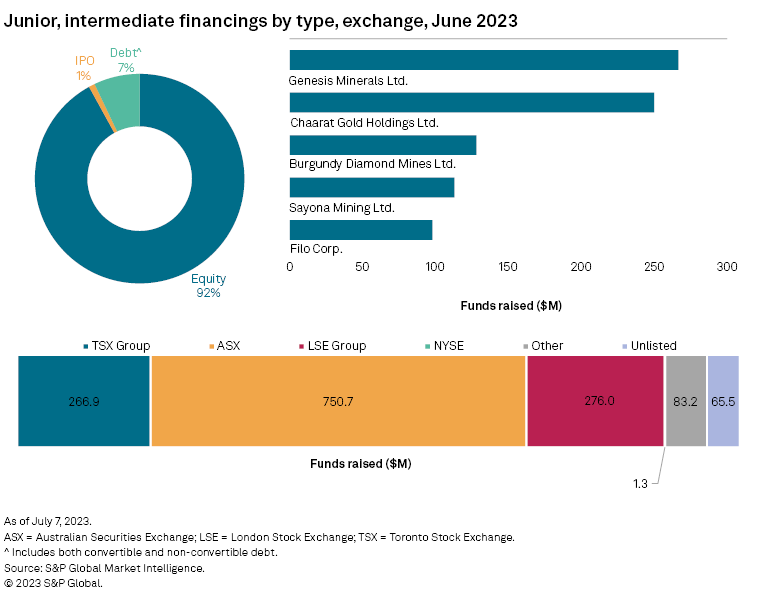

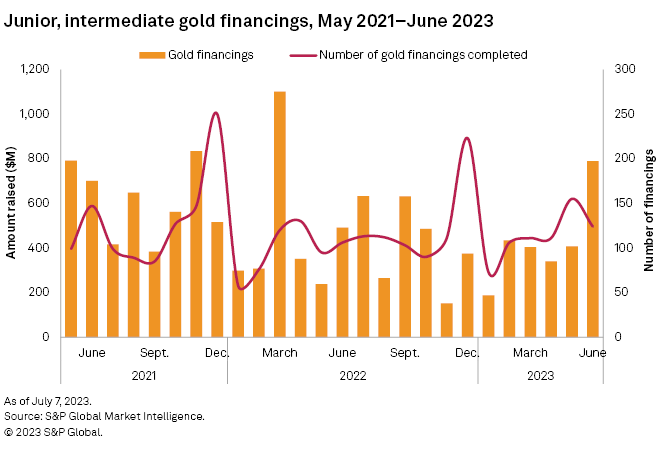

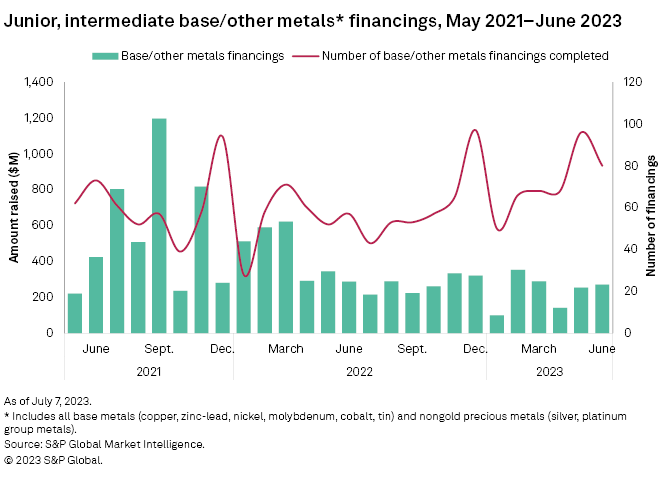

Funds raised by junior and intermediate mining companies jumped 60% to $1.44 billion in June — the highest monthly totals since March 2022 — fueled by high-value transactions for gold, lithium and diamonds. Despite the increase, the number of transactions declined 17% to 246 as significant financings drove the increase, accounting for 94% of the funds raised. The number of transactions valued at more than $50 million was six, compared with two in May.

Gold financings recover

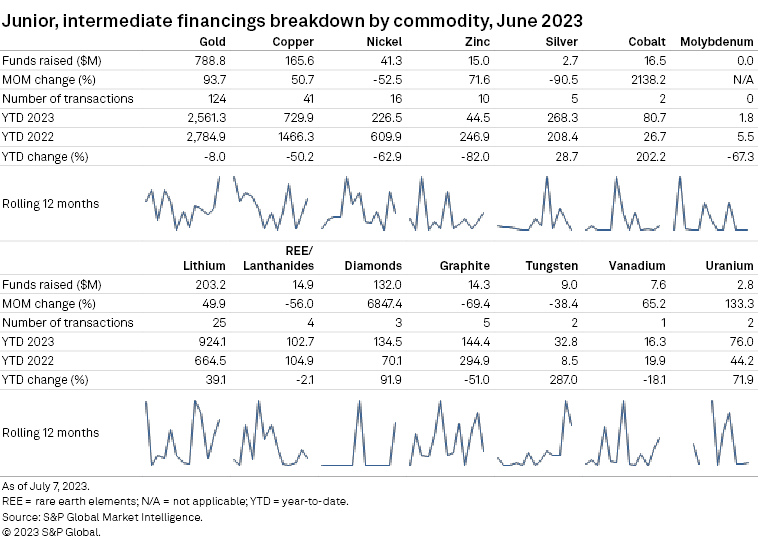

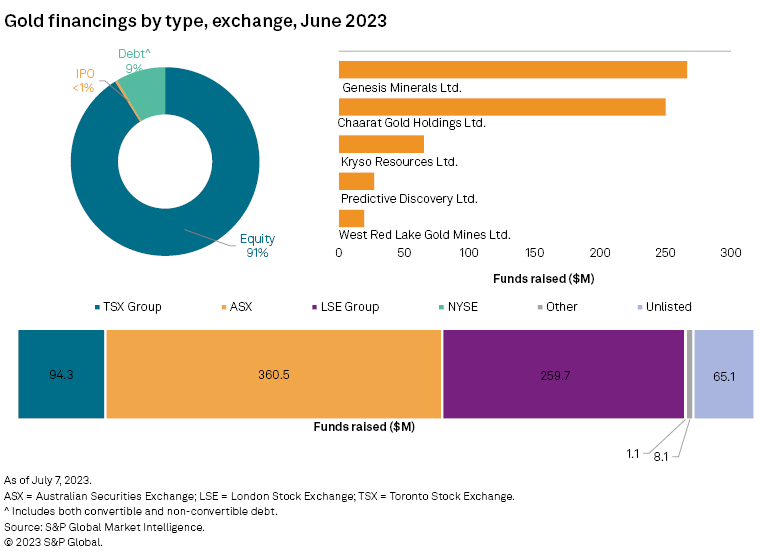

Gold financings nearly doubled to $789 million, the highest in 15 months, buoyed by two transactions valued at, at least $250 million each. The number of gold transactions fell to 124, down 20%, while the number of significant financings fell to 29 from 51.

The largest gold financing and the largest financing overall was a A$400 million private placement follow-on offering, including overallotment, by Australian Securities Exchange-listed Genesis Minerals Ltd. Proceeds of the offering will be used to develop the reserves of its Lakewood Tailings project and expand the historic Gwalia mine, both gold assets in Western Australia. Genesis recently paid for the Leonora assets that include Gwalia mine from St. Barbara Ltd. and aims to restart production at the historic mine in the September quarter and deliver its first ore in the last quarter of 2023.

Base/other metals slightly up, buoyed by copper financings

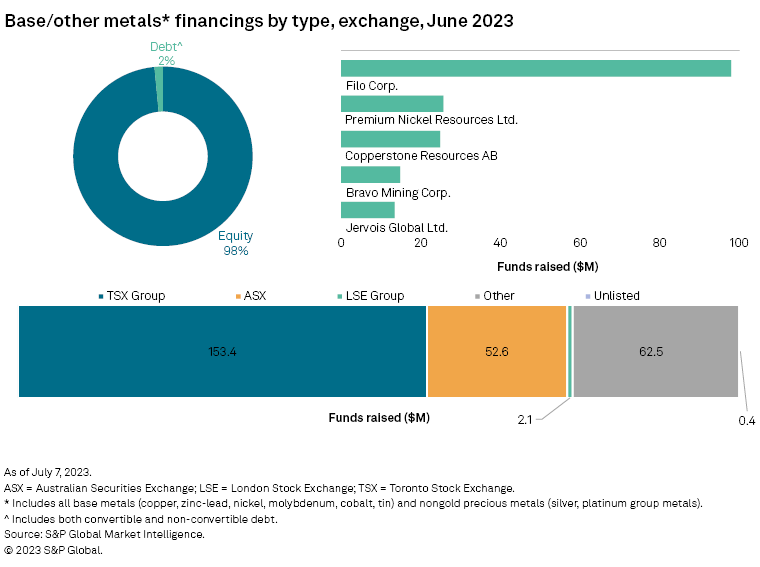

Funds raised for the base/other metals group increased 7% to $271 million, buoyed by increased copper financings but held back by lower funds raised for nickel and silver. The number of financings fell to 80, from 96 in May, while the number of significant financings fell to 25 from 29.

The largest base/other metals financing and the fifth-largest financing overall was a C$130 million private placement by Toronto Stock Exchange-listed Filo Corp. Proceeds of the capital raising will be used to finance the exploration and development of the Filo del Sol copper project in Argentina, with a mineral resources and reserves estimate of 644.2 million metric tons, grading 0.32% copper, 0.32 g/t gold and 10.2 g/t silver.

Lithium, diamonds financings boost specialty commodities

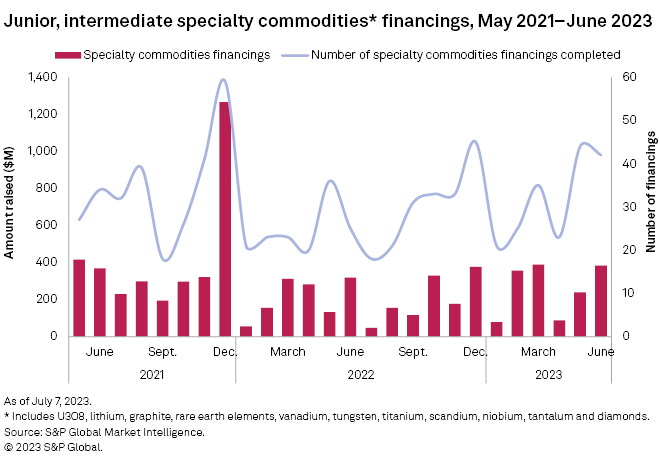

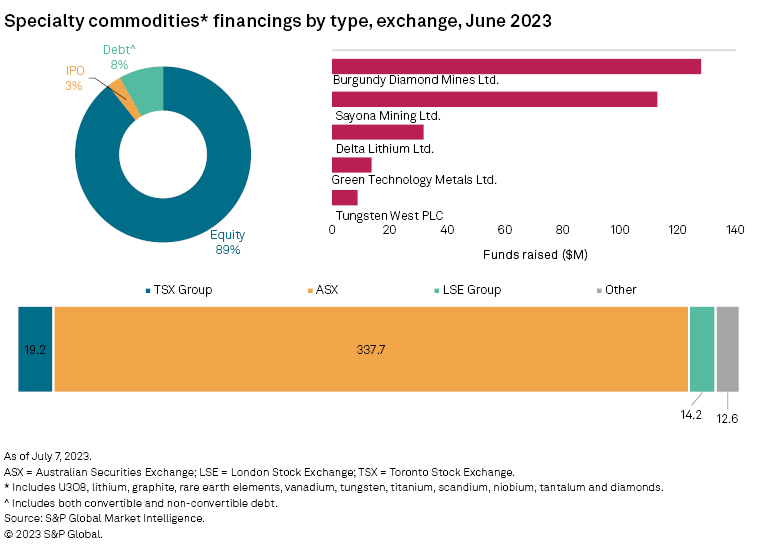

Fundraising for specialty commodities jumped 61% to $384 million in June, buoyed by lithium and diamonds financing. The number of financings fell to 42, from 44 in May, with significant financings increasing to 20 from 19.

The largest specialty metals financing and the third-largest financing overall was a A$193 million private placement by ASX-listed Burgundy Diamond Mines Ltd. Proceeds of the capital raising will be used to acquire Arctic Canadian Diamond Co. Ltd. and Arctic Canadian Diamond Marketing NV. Burgundy owns various diamond projects in Canada and Botswana and is engaged in diamond cutting and polishing services.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.