Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 11 Oct, 2023

By Nathan Stovall and Ronamil Portes

While some banks could restructure their bond portfolios, many more will continue to battle the drag from underwater securities and the related pressure on net interest margins and liquidity assessments during regulatory exams.

As banks gain more clarity about the direction of interest rates, more institutions could contemplate securities portfolio restructurings, allowing banks to alleviate one of the headwinds to their margins. However, with more increases in interest rates pushing bond portfolios further underwater, many banks do not have enough regulatory capital to withstand the hit from losses on security sales, which will limit future activity. Underwater bond portfolios are also negatively impacting liquidity ratings during regulatory exams as regulators focus on banks' contingency liquidity planning.

Underwater bond portfolios remain a headwind

Additional increases in long-term interest rates have pushed bond portfolios further underwater. Those positions serve as a continued drag on banks' net interest margins as many of the securities carry yields that are well below the cost of funding coming onto institutions' balance sheets. A handful of banks pruned their investment portfolios and sold securities at a loss in the second quarter but not out of a need for liquidity. In most cases, those banks either reinvested the cash at higher rates or used the proceeds to pay down higher-cost borrowings.

Renasant Corp. sold securities at a loss in the second quarter but had strong enough earnings to avoid a net loss in the period. The company said it sold securities yielding 2.9% and used the proceeds to pay down borrowings with a cost of roughly 5.5%.

More recently in the third quarter, Atlantic Union Bankshares Corp. announced a sale-leaseback of branches, a drive-through and a parking lot, and used the gain to offset the loss associated with the sale of a portion of its securities portfolios.

While more banks have likely considered the move, a lack of excess regulatory capital to shoulder the hit from the sale and further increases in interest rates will limit the number and scale of additional securities portfolios restructurings.

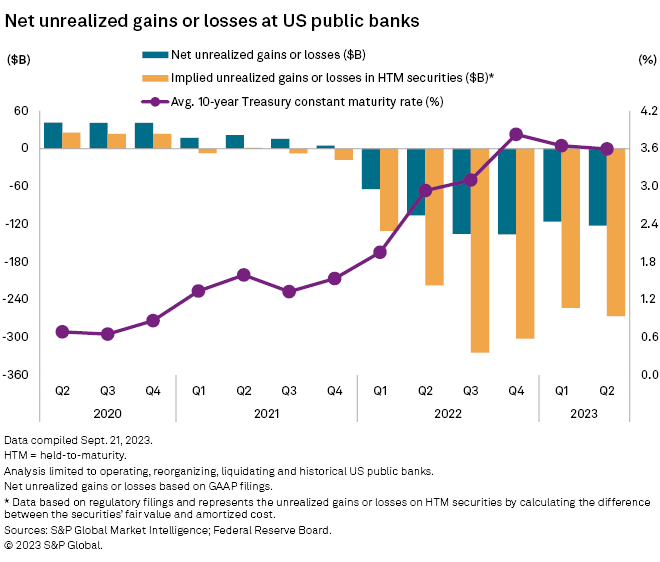

Unrealized losses in banks' available-for-sale (AFS) securities portfolios remained quite large at the end of the second quarter and likely stayed deep in negative territory through the third quarter as longer-term interest rates continue to rise.

In the second quarter, institutions including US commercial banks, savings banks, and savings and loan associations that file GAAP financials reported $122.25 billion in unrealized losses in their AFS portfolios, compared to $115.99 billion in unrealized losses in the prior quarter. Those losses have likely grown with the yields on the 5-year and 10-year Treasury rising 49 basis points and 78 basis points, respectively, since the end of the second quarter.

Unrealized losses in AFS portfolios are captured in accumulated other comprehensive income (AOCI). While AOCI does not impact bank earnings, it does impact tangible common equity and has depressed the capital metric considerably.

Unrealized losses negatively impacting liquidity during exams

Bank regulators have focused on the negative impact from AOCI on bank capital and the impact that underwater bond portfolios have on banks' access to liquidity. Banks have faced elevated pressures on liquidity in recent quarters with deposits declining for five straight quarters.

As liquidity has gotten stretched, regulators have recognized that most banks' securities portfolios no longer serve as the same source of liquidity as they have historically due to high levels of unrealized losses. Regulators have said that high levels of unrealized losses have led to downgrades on liquidity ratings in some bank exams.

While AOCI does not impact regulatory capital for most banks, regulators have paid close attention to the negative impact on tangible common equity. If tangible common equity (TCE) falls below 5%, banks will face greater scrutiny from regulators. If TCE falls below 3%, regulators will monitor the bank more closely and make sure they have options in place to access liquidity. Contingency liquidity plans have received greater attention from regulators as well, with examiners looking at the ratio of banks' liquid assets — cash, federal funds sold, securities purchased under agreements to resell and securities, including unrealized gains/loss on securities less pledged securities — to uninsured deposit to measure an institution's ability to meet deposit outflows.

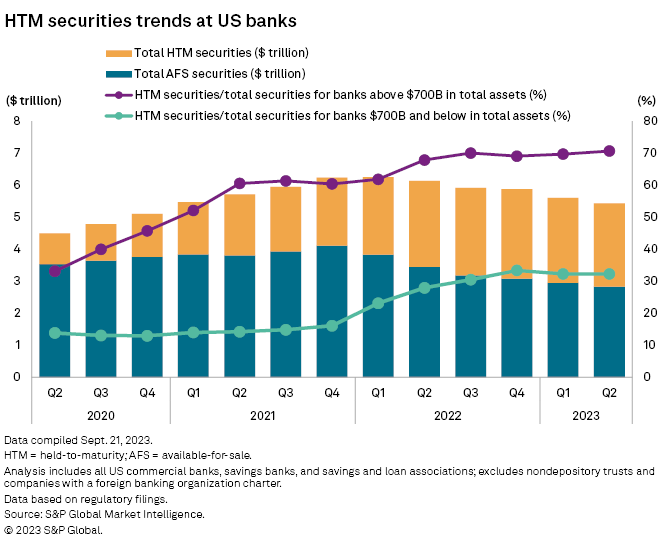

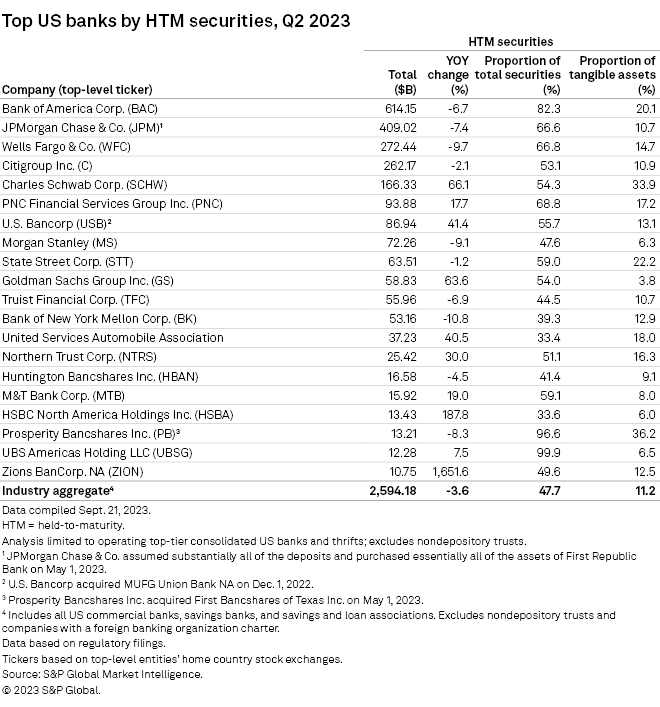

Given the headache from AOCI, many banks had parked larger portions of longer-term bonds, often seen as loan surrogates, in HTM portfolios. Accordingly, those positions were significantly underwater in the second quarter. Some banks, particularly the nation's largest institutions, relied heavily on the HTM designation since changes in AOCI impact tangible book value.

For large banks classified as US global systemically important banks (G-SIBs) — those with more than $700 billion in assets — changes in AOCI also impact regulatory capital. Those institutions had placed more than 70% of their bond portfolios in held-to-maturity portfolios at the end of the second quarter.

Unrealized losses in HTM portfolios at institutions that file GAAP financials totaled $266.40 billion in the second quarter of 2023, up slightly from $253.25 billion in the prior quarter. Some investors have applied the unrealized loss embedded in banks' HTM portfolios to tangible book value to reach an adjusted, burn-down value for the company. They believe that institutions still trading below historical price-to-tangible book values, on an adjusted basis, could screen relatively cheap. The investment community has also examined the ratio of loans plus HTM securities-to-deposits at a given bank to see how many deposits are tied up in less liquid assets.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.