Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 08, 2023

By Jingyi Pan

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

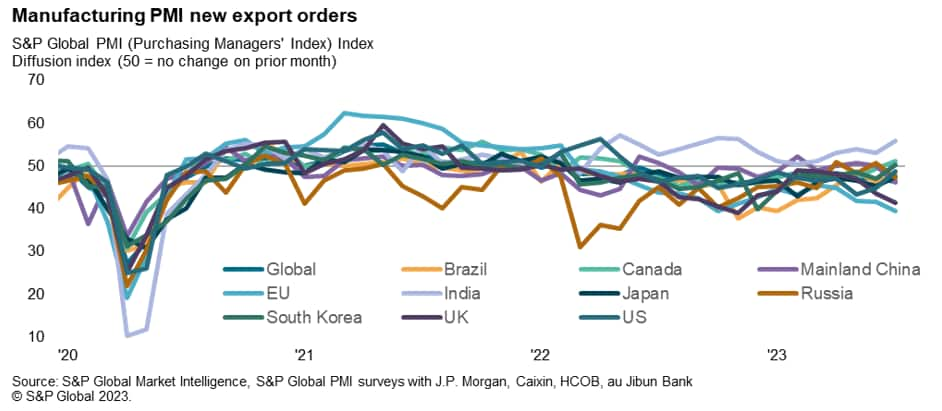

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a seventeenth successive monthly fall in global export orders for goods and services, signalling an extension of the deterioration in global trade performance into the second half of 2023. Falling to 47.8 in July from 48.3 in June, the seasonally adjusted PMI New Export Orders Index signalled a steepening of the downturn in global trade at the joint-fastest pace since last December. Historically, this represents the worst prolonged period of global trade decline since the financial crisis.

The divergence in performance between goods and services exports remained significant going into the third quarter of the year, with the gap widening over the latest survey period. This was attributed to a sharper decline in goods trade, though the growth in trade of services also slowed fractionally in tandem.

Globally, manufacturing new export orders extended the period of contraction that commenced March 2022. Furthermore, the pace of decline accelerated from June to the fastest in the year-to-date. A shallower fall in investment goods trade contrasted sharper downturns in consumer and intermediate goods trade, though all three product areas experienced historically elevated rate of deterioration in export performance in July.

The steepest downturn in goods exports by sub-sectors were again seen for 'raw materials' such as paper & timber products and other basic materials. This remained a phenomenon aligned with the destocking trend observed at global manufacturers. Meanwhile global machinery and equipment exports shrank again at a marked pace, which remains concerning given its broader implications of reduced global investment spending.

In contrast, service providers globally continued to find their new export business on the rise, though the pace of expansion eased further from the peak observed in May. The spring surge in travel and tourism, which provided a key support the latest boon in service sector exports, appears to be tapering into summer. To some extent, some of this weakness may represent payback after the warmer-than-usual weather over spring encouraged early consumption on travel and leisure, a payback which has been exacerbated by extreme heat during the summer months. However, the impact from rising interest rates upon goods is reported to have also eroded consumer demand into the latter half of 2023.

Comparing the regions, the weakness in trade was again more apparent for developed economies, though emerging markets have worryingly registered a renewed contraction in exports, driven by a downturn in manufacturing.

Measured across both goods and services, the majority of the top 10 economies monitored reported lower trade activity over July, led by the EU. Both the manufacturing and service sectors within the EU registered a steepening loss of new export orders over the month of July, with the manufacturing sector notably seeing the fastest decline since the pandemic. Among other major developed economies, a steeper rate of export decline was also registered in the UK, led by slumping goods trade.

Meanwhile the opposite was the case for Japan, where overall new export orders performance remained subdued in contraction territory but the rate of decline moderated to show the smallest decline since April.

Finally, the US was the outperformer of the major developed economies, reporting a return to growth of exports - albeit only marginal - for the first time since May 2022. New order inflows from abroad rose at the fastest rate since May 2022 for US services while US manufacturing new export orders contracted at a markedly slower pace.

Looking at the major emerging markets, India remained the brightest spot in terms of trade growth, reporting an eleventh successive monthly export gain in July thanks to rising foreign sales of both goods and services. The rate at which India's trade growth ballooned was also the fastest since at least September 2014, when comparable data were first available. Brazil, while still experiencing declining trade performance, saw conditions ameliorate in July, though exports still fell for a seventeenth successive month.

Russia notably saw exports decline again having briefly returned to growth in June, as softer goods exports and near-stagnating services trade led to lower overall export business in July.

Overall, however, it was again mainland China's performance that was disappointing, with new export orders sinking into sharp contraction at the start of the third quarter. A renewed fall in manufacturing new orders underpinned the latest trade decline, though services exports rose at the slowest rate seen so far this year to indicate a near-stalling of China's post-pandemic revival.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.