Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Aug 06, 2024

By Jingyi Pan

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade continued to deteriorate headed into the second half of 2024.

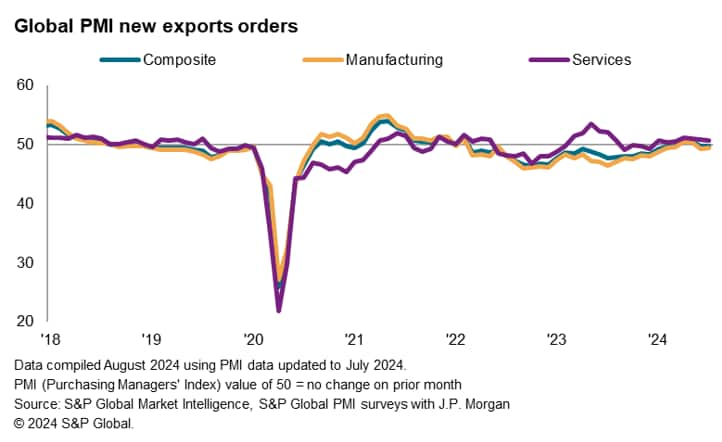

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, posted 49.7 in July, which was unchanged from June. The latest reading signalled that trade conditions deteriorated for a second successive month in July, albeit only marginally.

Excluding the improvements in April and May, export orders would have fallen continuously since March 2022. That said, the latest decline was partially underpinned by disruptions in supply chains which we will continue to monitor via the PMI Supplier Delivery Times Index for goods.

Manufacturing new export orders declined for a second successive month in July, attributed largely to shipping delays which intensified from June. Globally, manufacturing sector delivery times lengthened at the fastest pace since January, with anecdotal report from companies citing shipping delays as the cause for longer supplier delivery times spiked in the latest survey period. Furthermore, comments from panellists often pointed to disruptions in the Red Sea region as a key source for the delays globally. This clearly affected export demand, with the PMI Comment Tracker data showing a sharp rise in instances where falling goods exports were linked to shipping delays in July. Therefore, while weakness in underlying demand conditions partially dampened export orders, it was also the rise in shipping constraints that played a part, which we will be monitoring in the coming months. Broadly, sentiment in the manufacturing sector improved in July with the Future Output Index having risen from the eight-month low in June, which was a positive sign.

Meanwhile service sector export business remained in expansion, though the rate of growth eased for a third straight month to a level that was modest and the slowest since March. While we see most emerging markets and major developed economies, such as the US and UK, recording higher services export business, weakness in export conditions permeated a few key regions such as the eurozone and Japan. The trend of slowing export business expansion also contrasted with broader services new business which rose at an accelerated rate across the globe in July.

More detailed PMI data revealed four of the top five sectors that led the expansion in export business were all service sectors, namely the insurance, commercial & professional services, non-bank ('other') financials, industrial services and transportation. On the other hand, the real estate sector was the worst performing sector in July, followed closely by manufacturing companies including forestry & paper producers, resource companies and auto & auto part makers.

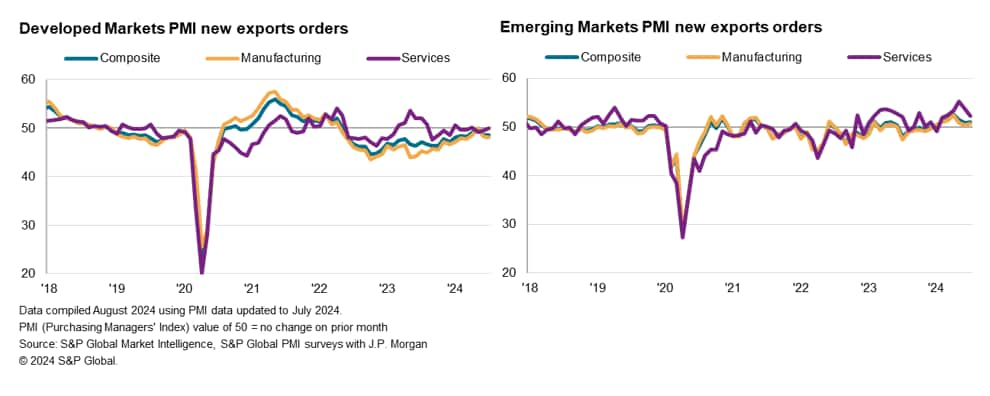

By region, the downturn in trade conditions was limited to developed markets, though the rate of reduction remained modest and unchanged from June. While developed market service sector trade conditions stabilised following two successive months of decline, manufacturing export orders remained in contraction and at a more pronounced rate in July.

Divergence in sector trends was also observed for emerging markets, though taking place in expansion territory in this case. A slight acceleration in overall export business growth for emerging markets was supported by faster manufacturing export orders expansion while services export business rose at the softest pace in four months. Services export business nevertheless continued to increase at a faster pace compared to manufacturing.

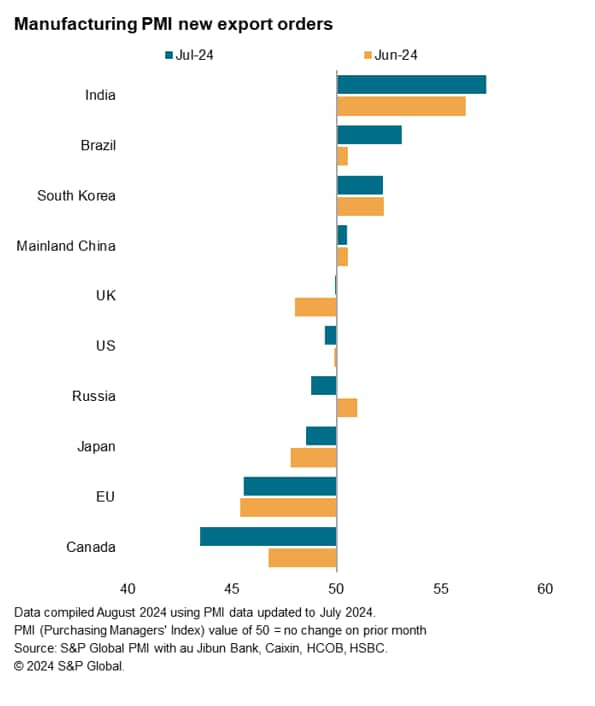

July Manufacturing PMI data outlined that the global expansion in goods trade was limited mainly to emerging market economies again among the top 10 trading nations. India retained the top spot for the seventeenth month running, further with the rate of export order expansion accelerating to the second-strongest in over 13 years.

Following India was Brazil, which recorded a solid expansion, the fastest since December 2021. Brazilian manufacturers indicated that the depreciation of the domestic currency helped to lift their competitiveness globally in July, driving the rise in export orders from Asia to the US. More muted growth was meanwhile observed in South Korea and Mainland China.

On the other hand, the EU and Canada continued to drive the downturn in export conditions among the top 10 trading nations with marked reductions in export orders in the manufacturing sector. According to the S&P Global Canada Manufacturing PMI, export orders fell at the most pronounced pace in over four years with market uncertainty, inflation and geopolitical tensions undermining demand.

Meanwhile Japan also recorded further reductions in goods export orders as weakness in demand permeated both the domestic and export markets in July. However, the rate of reduction eased from June. This was while the UK and US recorded only marginal rates of manufacturing export order contraction in the latest survey period.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.