S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — May 08, 2024

Global growth inched up to a ten-month high in April, according to the worldwide PMI surveys. The improving global economic picture reflects a myriad of factors supporting growth, including looser financial conditions, brighter signs of consumer spending, a shift to a more supportive inventory cycle, and fewer supply chain delays.

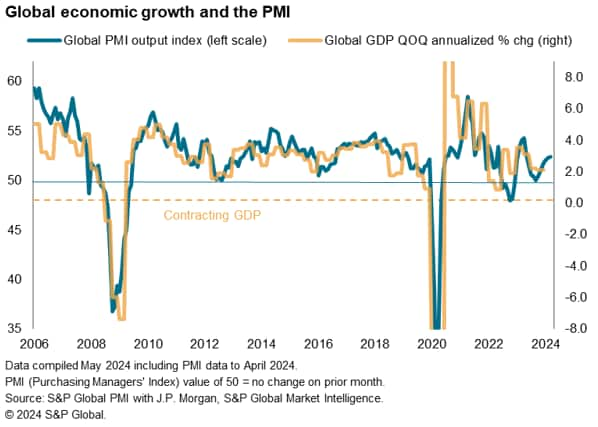

S&P Global's PMI surveys indicated that the global economy gained growth momentum for a sixth consecutive month in April, with growth reaching the highest since June of last year. The headline JPMorgan PMI covering manufacturing and services in over 40 economies edged up from 52.3 in March to 52.4 in April. At this level, historical comparisons indicate that the PMI is broadly indicative of the global economy growing at an annualized rate of 2.7%.

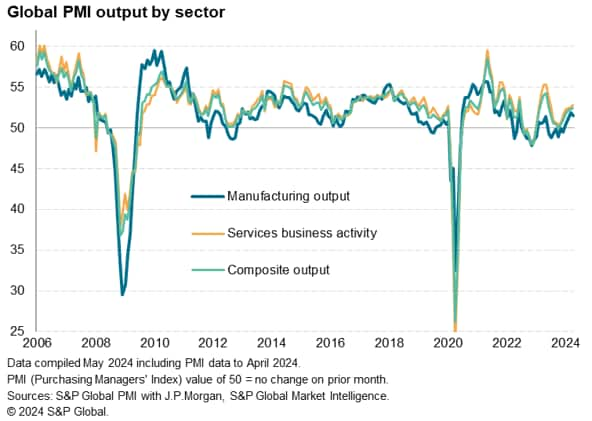

The upturn remained broad-based across both manufacturing and services, albeit with the rate of increase in the former cooling slightly in April while the latter reported the strongest expansion for ten months. The manufacturing sector's growth nonetheless remained the second sharpest recorded over the past 22 months.

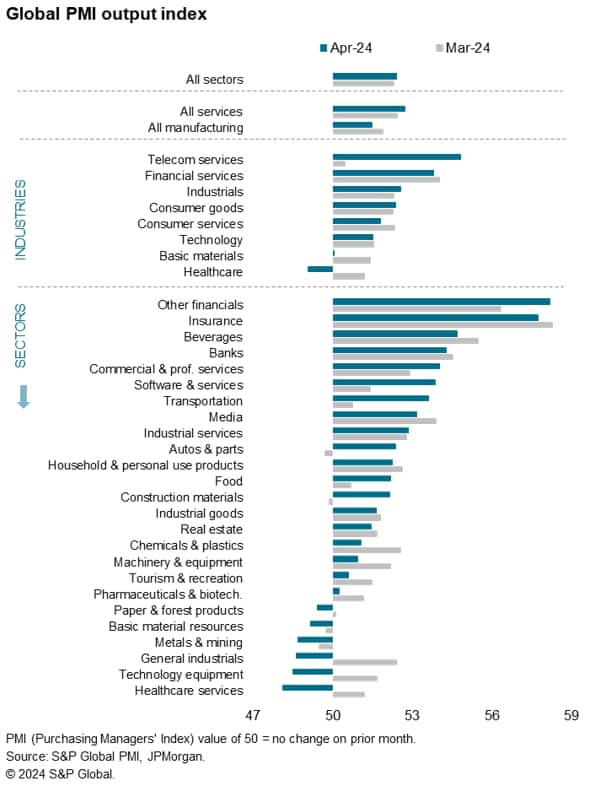

At a more granular sector level, all major industries bar healthcare reported higher output in April. The strongest upturn was recorded for telecom services, followed by financial services. Solid gains also continued to be recorded for industrials (which include many business-to-business service sector companies), consumer goods, consumer services, and - to a lesser degree - technology.

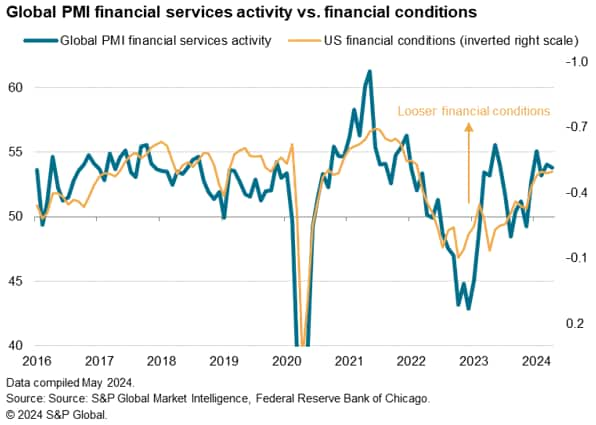

The strong performance of financial services companies so far this year coincides with a loosening of financial conditions (notably in the US) in recent months. Drilling further into the global sectors, the strong gains across financial services was further highlighted by 'other financials' and insurance topping the rankings in April, with banking in fourth place.

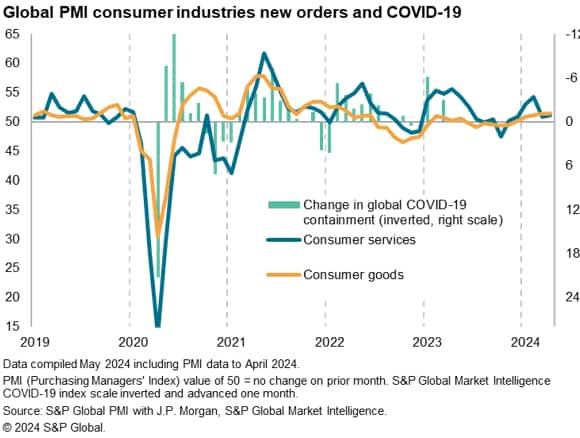

From a consumer industries' perspective, consumer goods producers are reporting their strongest sustained spell of growth since early-2022 so far this year, often citing improved consumer confidence amid lower inflation rates and hopes of falling interest rates in the coming months.

Consumer services output continues to also rise, though the rate of growth here has lost some momentum in recent months, in part reflecting a shift in spending towards goods which can be linked to less of a COVID-19 "re-opening boost" in 2024 compared to prior years. Whereas 2021, 2022 and 2023 saw demand surge early in the year alongside an easing of COVID-19 containment measures, there has been no such beneficial easing in 2024, albeit with some post-pandemic related demand for consumer services still reportedly apparent as travel in particular continues to rebound from the pandemic.

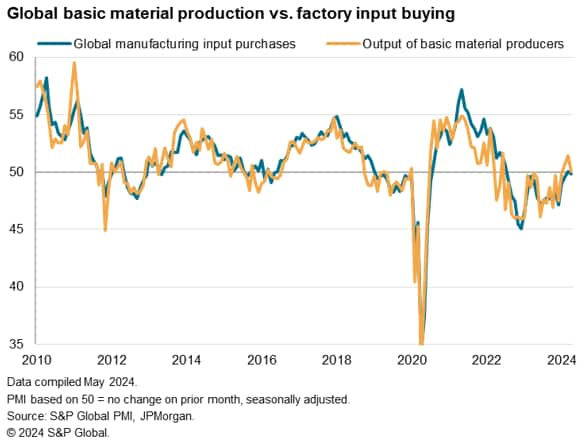

Only a marginal gain was meanwhile reported for basic materials, which has been the worst performing industry so far this year. However, the basic materials sector has seen an improved performance in recent months in response to manufacturers reporting fewer instances of deliberate inventory reduction policies. As a consequence, input buying by manufacturers has stabilized after two years of destocking, helping support some of the basic material producers that had been at the front end of this inventory reduction phase.

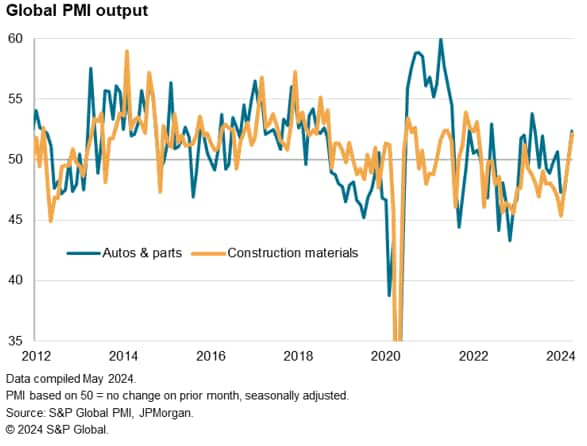

Only six of the 26 sectors reported lower output in April, of which healthcare services reported the steepest decline. Although general industrials, tech equipment and healthcare services fell back into decline, there were two notable sectors reporting renewed output growth. First, the construction materials sector reported the first output increase for 13 months, with growth jumping to a 26-month high. Second, the autos and parts sector reported the first rise in output since late last year, with output rising at the steepest rate for 11 months.

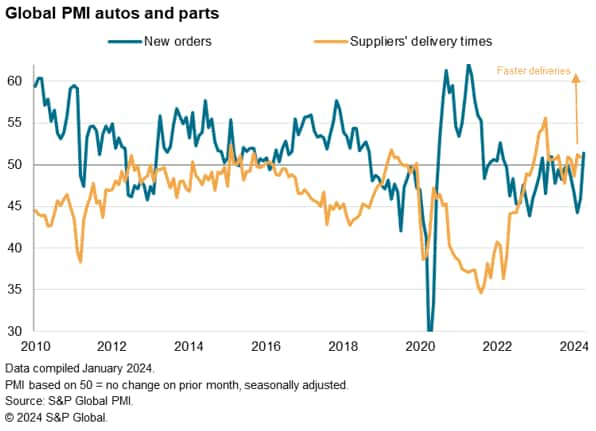

For the autos sector, the sector has benefitted from a renewed rise in new orders in April - representing the largest order book gain for just over two years - combined with an improvement in supplier delivery times. Whereas much of the past eight years had seen the sector struggling with supply chain issues, ranging from pandemic-related shortages to trade issues and more recently the Red Sea disruptions, the improving supply situation is now reportedly helping facilitate higher output to meet the order book improvement.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.