Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Apr, 2023

By Joe Mantone, Gaurang Dholakia, and Peter Brennan

Investment bankers had hoped that M&A announcements and equity offerings would start to return to more historical levels by the middle of 2023, but turmoil in the banking sector has added to economic volatility, reducing the momentum of a nascent dealmaking rebound. At the same time, inflation remains stubbornly high, making further rate hikes more likely. Higher interest rates tend to slow dealmaking as they increase the cost of acquisition financing and lower equity valuations. These challenges will pressure potential sellers and add to the likelihood of more distressed activity. Carve-outs and divestitures will also become more likely as companies shore up balance sheets.

For the second year in a row, the backdrop for dealmaking is marred by uncertainty. This year the culprit stems from upheaval in the financial sector, which has seen two of the three largest bank failures in US history and the emergency sale of global giant Credit Suisse Group AG. Meanwhile, the Russia-Ukraine war and soaring inflation linger. Given that backdrop, executives have little confidence to pursue significant M&A deals as there is little desire to execute a transformational deal ahead of a potential economic downturn. However, the equity markets offered some glimpses of optimism. The S&P 500 finished the first quarter up about 7%, and in the weeks following the bank failures in March, the average close of the VIX — the Chicago Board Options Exchange S&P 500 volatility index — was 22.3, lower than the average close of 23.5 during the same period in March 2022.

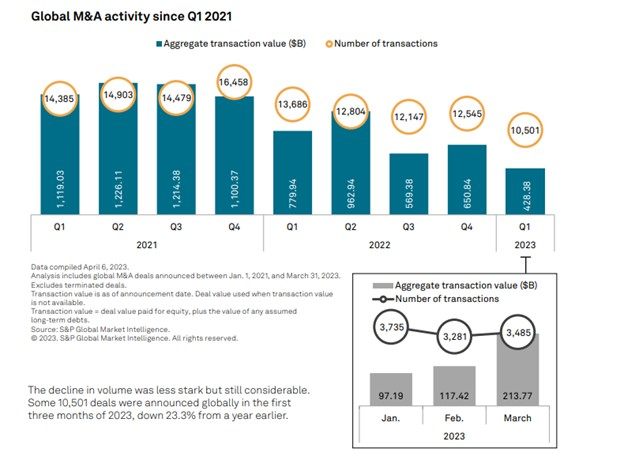

Still, dealmaking activity was sparse at the start of 2023. The total value and number of global M&A deals announced in the first quarter were both lower than any quarter in 2022.

The global IPO market recorded its lowest total value since 2019. Most first-quarter IPO activity came from the Asia-Pacific and Middle East regions. The $2.48 billion IPO of ADNOC Gas PLC was the largest.

Much of the M&A activity occurred in the US, which accounted for more than half of the total value of global announced deals. The largest M&A deal of the period was pharmaceutical company Pfizer’s $42.84 billion agreement to buy biotech Seagen Inc. For part of the first quarter, some positive deal momentum showed signs of building. Debt issuance activity was extremely active in February, and through March 8 the US IPO market recorded more $100 million-plus IPOs than the two previous quarters. However, Silicon Valley Bank failed on March 10 and the US did not record another $100 million-plus IPO the rest of the quarter.

Key findings

Theme