Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 21, 2021

By Sara Johnson

The global economy has reached an important milestone in the second quarter of 2021, surpassing the pre-pandemic real GDP peak attained in the fourth quarter of 2019. The Asia-Pacific region was first to complete its recovery in late 2020, owing to a resilient mainland Chinese economy. North America's recovery has coincided with that of the world; IHS Markit US economists estimate that the US real GDP reached a new peak in May 2021. Africa and the Middle East will reach this juncture in the third quarter, and Europe and Latin America will complete their recoveries in the final quarter of 2021.

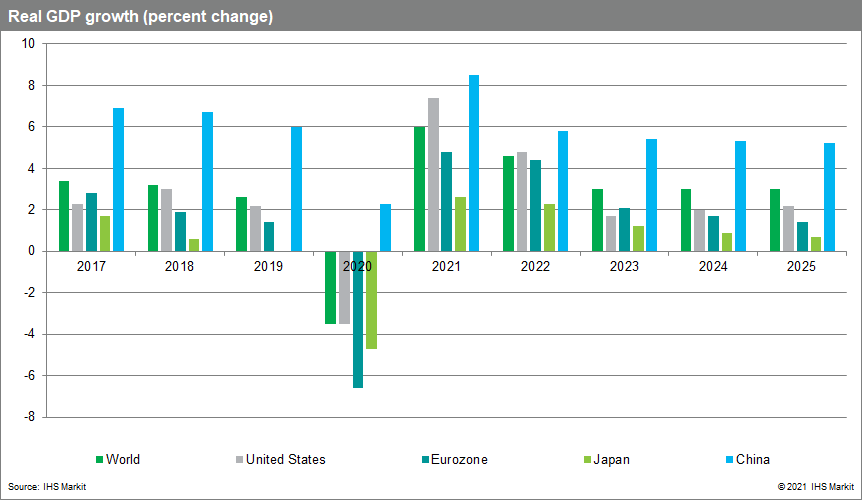

After a 3.5% contraction in 2020, global real GDP is projected to increase 6.0% in 2021, its strongest advance since 1973. Growth will continue at a robust 4.6% pace in 2022 before settling to 3.0% in 2023-25. IHS Markit upwardly revised our forecast by 0.3 percentage point for 2021, reflecting brighter outlooks for the United States, Europe, Latin America, and mainland China.

As recovery from the COVID-19 recession is completed, the global economy is moving into the sweet spot of the current expansion. World real GDP growth is picking up from an annual rate of 1.5% quarter on quarter (q/q) in the first quarter to rates of 6.0-7.0% over the remainder of 2021.

As vaccination rates increase and pandemic-related restrictions are lifted, consumer spending is surging. This is most evident in the United States, where pent-up demand for travel and all services involving social interaction is stronger than anticipated. Western Europe is in the early stages of a growth spurt as economies reopen, labor market conditions improve and household saving rates retreat from exceptionally high levels. Business investment is also picking up in response to more robust sales prospects and favorable financing conditions. Depleted inventories will be rebuilt, supporting economic growth in the second half of 2021. Meanwhile, commodity-exporting countries are benefiting from elevated prices and a strong resurgence in exports.

COVID-19 virus flare-ups remain a risk to the economic outlook in places where vaccination rates are lagging. This includes many emerging and developing countries where vaccine campaigns are just beginning and will extend into 2022. Parts of Asia have experienced COVID-19 outbreaks this spring, prompting lockdowns that have affected consumer spending and exports. Thus, India, Taiwan, Malaysia, Vietnam, and Japan have experienced setbacks in recent months but should rebound in the summer quarter. India's daily infection rate has fallen 80% from its early May peak. Declining cases will enable Japan to lift states of emergency in all areas but Okinawa prefecture on 20 June.

Global supply chains are severely disrupted, and rebalancing will take time. The IHS Markit PMI™ global manufacturing survey found that supplier delivery times lengthened in May to the greatest extent in survey history, contributing to the steepest rise in input costs in over a decade and record inflation in selling prices. While some of the delays emanate from suppliers in Asia, manufacturers in Europe and North America are most affected by delivery delays. With consumer demand expected to grow at a rapid pace through 2021, transportation delays are likely to continue into 2022. Semiconductor shortages have also disrupted several industrial sectors, including automobiles and parts, household goods and technology equipment. The shortages reflect sharp declines in exports of electronic components from mainland China and Taiwan.

Industrial commodity prices are beginning a correction, but downstream price pressures remain intense. Market forces are working, as high commodity prices are dampening demand and incentivizing production. The IHS Markit Materials Price Index (MPI) has fallen from early May to mid-June, and declines have been broadly based. Buyers are resisting high prices and mainland China has announced plans to sell state inventories of industrial metals. Despite the downturn, the MPI is up 25% year to date and nearly double its year-earlier level. Some of the increases will be passed downstream to finished goods prices in the months ahead.

Global consumer price inflation is projected to pick up from 2.1% in 2020 to 3.3% in 2021 before settling back to 2.7% in 2022 as supply conditions improve and commodity prices retreat. Forecast risks are on the upside and depend on the path of long-term inflation expectations, as well as monetary and fiscal policies.

Global economic growth is set to slow in 2022 and 2023. The post-pandemic economic surge is expected to subside by mid-2022, as pent-up demand is satisfied and global real GDP growth settles at a 3% annual pace. The withdrawal of fiscal stimulus will become a drag on growth as governments rein in spending and contend with higher debt burdens. Government fiscal deficits widened from 3% of world GDP in 2019 to 10% in 2020 and are expected to narrow to 7% in 2021 and 4% in 2022. As economies move toward full employment, transitory inflation pressures could give way to more persistent inflation pressures. In response to accelerating prices, currency depreciation and capital flight, central banks in Brazil, Russia, Ukraine and other emerging markets have already raised interest rates. In the United States, the eurozone, and other advanced economies where inflation expectations are well-anchored, monetary tightening can be delayed in the short term but not indefinitely.