Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 04, 2024

The worldwide PMI surveys recorded a further modest acceleration of global economic growth in March, taking the pace of expansion to the fastest since last June. The upturn is also becoming more broad-based, both by sector and geographically.

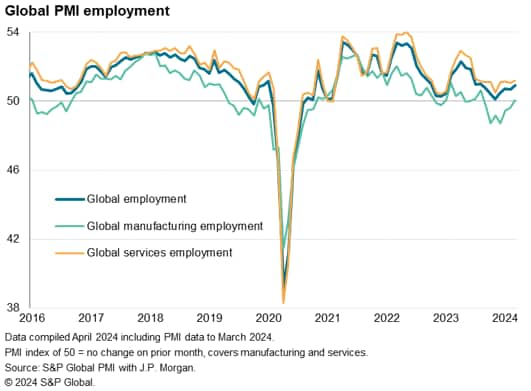

Forward-looking indicators have meanwhile likewise improved, boding well for the upturn to gain further pace in the second quarter, encouraging firms to take on staff at an increased pace in March. The overall rate of job creation remains only modest, however, reflecting a mixed hiring trends among the major economies.

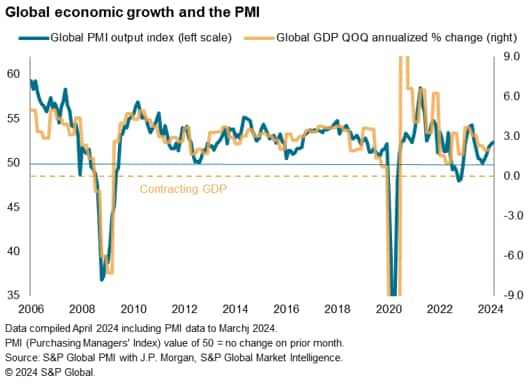

S&P Global's PMI surveys indicated that the global economy gained growth momentum for a fifth successive month in March. At 52.3, up from 52.1 in February, the headline PMI covering manufacturing and services in over 40 economies hit a nine-month high to signal an accelerating expansion at the end of the first quarter. Historical comparisons indicate that the latest PMI reading is broadly indicative of the global economy growing at an annualized rate of 2.6%.

The March surveys also brought signs of the upturn becoming more broad-based.

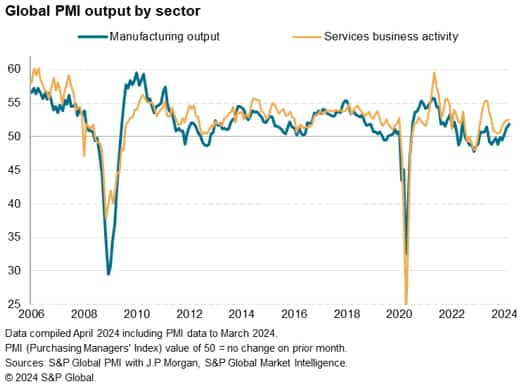

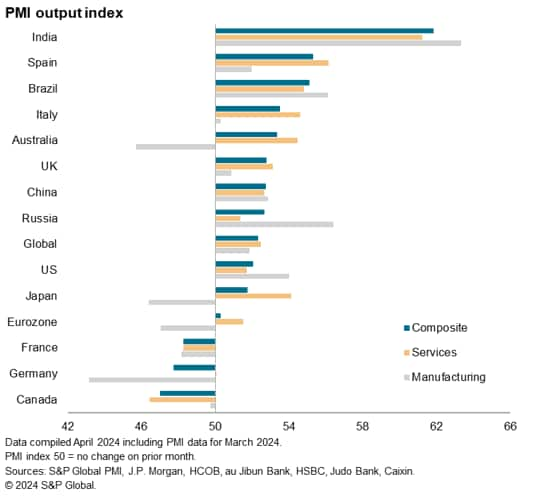

While still being led by the service sector, which reported the sharpest rise in output (or business activity) since last July, manufacturing output grew in March for a third successive month, rising at the sharpest pace since June 2022.

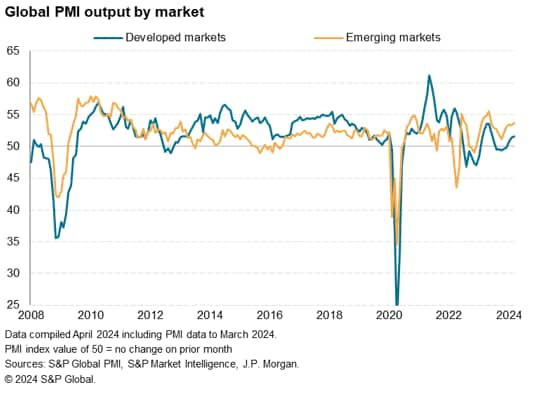

By market, the emerging economies collectively reported the sharpest growth since May 2023, with output expanding for a fifteenth straight month, while developed world growth hit a nine-month high, as output grew for a third successive month.

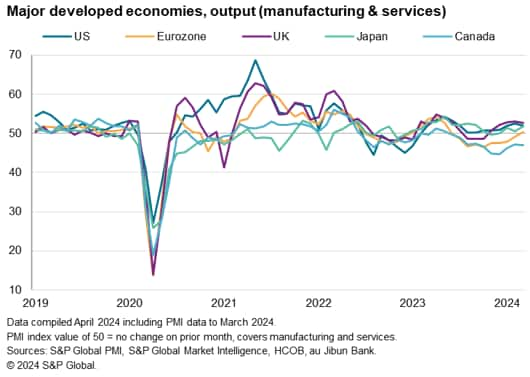

Business activity growth in the developed world was led by the UK and the US, though in both cases rates of expansion slowed, followed by Japan, which in contrast reported the largest monthly output gain since last September. Japan's upturn notably remained lopsided, however, with manufacturing remaining in decline to contrast with better-balanced growth across goods and services in the UK and US.

The eurozone meanwhile returned to growth, albeit only modestly, with output rising for the first time since May of last year. A gathering upturn in the eurozone's service sector was partly offset, however, by falling manufacturing output.

Canada bucked the growth trend, remaining in contraction as output dropped for a tenth straight month in response to further declines across both manufacturing and services.

India once again led the emerging markets, reporting the fastest expansion since July 2010 barring only the slightly greater upturn seen last July. Growth accelerated in both manufacturing and services.

Strong growth was also reported in Brazil, with March's output expanding at an identical rate to the 19-month high seen in February amid robust gains for both goods and services.

More modest but still-solid growth rates were meanwhile reported in both Russia and mainland China, the latter notable in reporting the steepest upturn for ten months amid mild growth accelerations in both manufacturing and services.

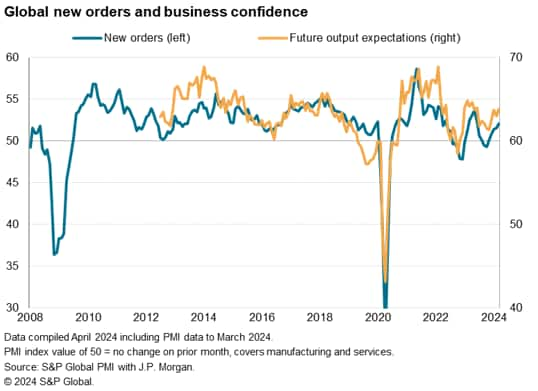

In terms of looking ahead, two key forward-looking indicators brought encouraging news in March.

First, inflows of new business rose globally for a fifth month in a row, the rate of increase having gained momentum over this period to result in the largest rise for nine months in March. The latest improvement reflected faster demand growth for both goods and services.

Second, companies' expectations of output in the coming year rose to a nine-month high, improving in services to a nine-month high and holding close to a one-year high in manufacturing.

The improving outlook encouraged more firms to take on additional staff, leading to the largest increase in global staffing levels for seven months in March. The bulk of the jobs gain was accounted for by higher payroll numbers in the service sector, but was also linked to the first - albeit marginal - rise in manufacturing employment since last August.

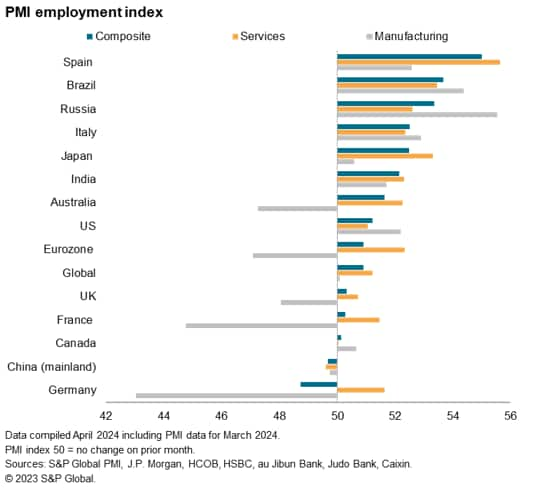

Jobs trends varied markedly among the major economies, however, though falling headcounts were only recorded in Germany and mainland China. The steepest rise in employment was recorded in Spain, followed by Brazil and then Russia, Italy and Japan.

More insights will be available with the flash April PMI data, published 23 April.

Access the Global Composite PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.