Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Nov 4, 2024

By Iuri Struta

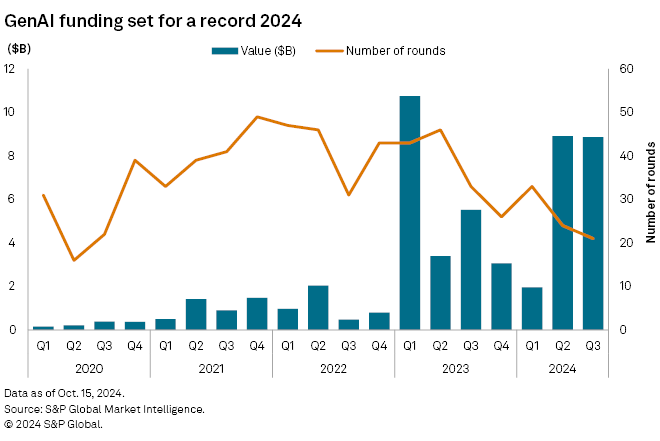

Venture capital funding for generative AI startups is poised to exceed the impressive records of 2023.

In the first three quarters of this year, GenAI startups secured over $20 billion, according to S&P Global Market Intelligence data. That puts 2024 on track to exceed the 2023 total of $22.7 billion.

As in the previous year, this year's funding surge was significantly driven by billion-dollar mega-rounds from prominent players such as OpenAI LLC and Anthropic PBC. The second quarter was propelled by X.AI Corp.'s $6 billion funding deal, while the third quarter was led by Sam Altman's OpenAI securing $6.6 billion. The momentum will likely continue, with Anthropic, which already raised $8.8 billion, reportedly in discussions for another fundraising round. The second and third quarters were equally strong and represented the highest quarterly funding total since the first quarter of 2023, which was marked by Microsoft Corp.'s $10 billion investment in OpenAI.

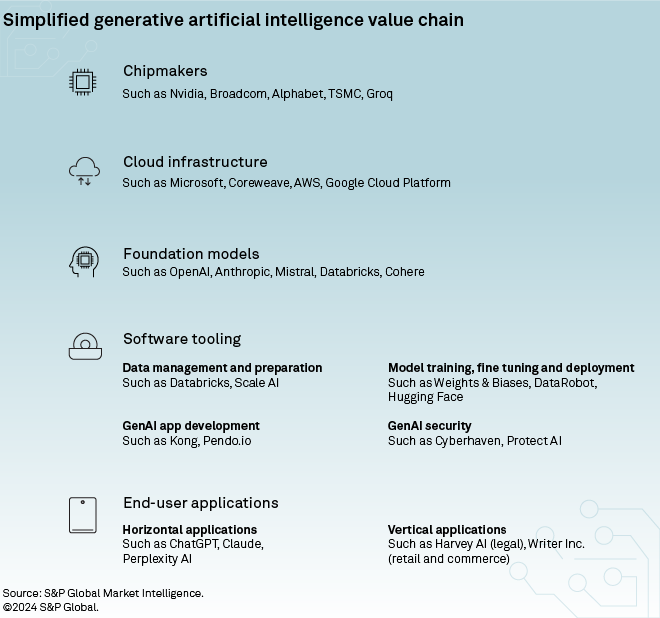

Frontier model stack

The competition in the frontier foundation model space is intense with new entrants this year such as Elon Musk's X.AI and Ilya Sutskever's Safe Superintelligence Inc., with the latter raising $1 billion. In the US and Europe, there are now at least six frontier foundation models to choose from and more are coming.

Investor interest in funding new ventures within the GenAI sector remains robust, particularly when led by experienced entrepreneurs. However, building a foundation model from the ground up is capital intensive and the competitive landscape is daunting, as deep-pocketed tech juggernauts such as Alphabet Inc. and Meta Platforms Inc. have access to significantly greater resources than more focused startups.

Although many of these startups are incurring substantial cash burn, investors are optimistic about the pace of revenue growth and the opportunity if GenAI emerges as the next transformative technology platform. According to a report from Stripe Inc., cited by the Financial Times of London, GenAI companies reached $30 million in revenue quicker than similar companies in other technology shifts, including software as a service.

|

RELATED CONTENT: GenAI rise spurs investor interest in AI infrastructure plays Generative AI Digest: Established AI players shift beyond model development

|

Smaller foundation model providers are looking for new ways to generate business. S&P Global Market Intelligence 451 Research analysts Melissa Incera and Alex Johnston said in a recent report that there is growing emphasis on the tooling offered around the models.

"This transition is driven partly by how challenging smaller foundation model providers are finding competing with the latest flagship models directly, and partly by a drive to improve the performance of open-source models," the report said.

Companies competing in the foundation model arena are investing significantly to develop the next iteration of GenAI models to escape commoditization. Having the leading model will enable them to capture a substantial share of a rapidly expanding market, the ultimate size of which is impossible to predict. As the competition intensifies, some disheartened players will likely exit the race or consolidate.

"This is a game of survival, if you are not early to build the moat around you, you are going to be left behind," Arun Bharath, chief investment officer at Bel Air Investment Advisors, said in an interview with S&P Global Market intelligence.

This fear of missing out is driving investment among those who can most afford it.

"If you're a big stack player like Meta, Microsoft, Alphabet or any of the foundation model pure plays, you have no choice but to keep raising your bet — the prize and power of winning is too great," Sarah Tavel, a general partner at venture capital firm Benchmark, wrote in a recent blog post. "If you blink, you are left empty-handed."

Already, companies such as Inflection AI Inc. and Aleph Alpha GmbH essentially dropped from the race by repurposing their businesses toward helping enterprises adopt GenAI.

This means, however, that the frontier foundation model startups will have to continue raising money to compete with the deep-pocketed hyperscalers, which have signaled they are willing to invest massive amounts in the new technology. Anthropic, which raised a total of $8.4 billion so far, is reportedly seeking to raise a new round at a $40 billion valuation.

App stack

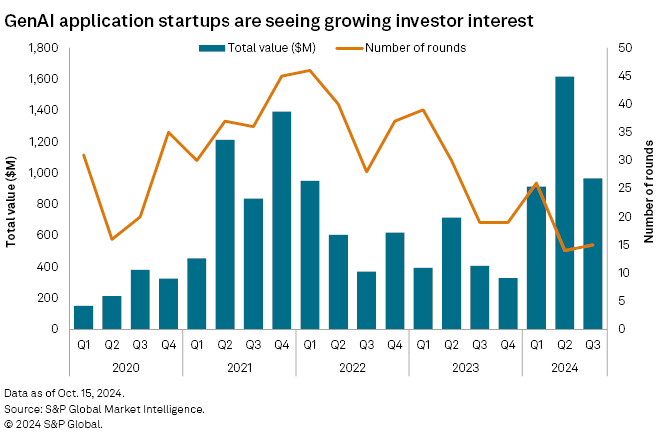

Venture funding this year already surpassed the dollar value of 2023 in the application layer, where startups combine third-party foundation models with their data or applications to create new use cases or target less competitive vertical markets.

The big challenge, however, is picking markets and use cases that are not of interest to frontier models.

Some of the markets being targeted by these companies are in search. Companies such as Perplexity AI Inc. and Ai Search Inc., or iAsk, are raising funding amid reports of rapidly growing revenue. There is a sense among the VC community that Google's dominance in search is at risk of disruption for the first time since its founding.

Experts generally believe that customer service and basic software development firms present an early opportunity for GenAI. Code generators and customer experience companies are seeing some of the highest interest in the application layer space.

"Outsourcing services could find themselves in competition with generative AI, which might lower demand for human-based customer services," S&P Global Ratings analysts Andrew Chang and David Tsui wrote in a recent report.

Deep specialization is also key for many startups in the application layer space. James Drayson, co-founder and CEO of stealth startup Appella AI, told Market Intelligence about moving Appella AI's focus from broad customer engagement AI conversational tools to fashion e-commerce, aiming to provide hyperpersonalized shopping experiences to customers.

"The AI space is moving quickly, so it's important for us to be agile and pick a specific vertical," Drayson said.

Startups are also targeting other vertical markets, including legal and healthcare, where GenAI tools can improve efficiencies in these highly bureaucratic industries.

This article was updated on Oct. 22, 2024, at 9:36 am ET to clarify that the second and third quarters of 2024 represented the highest quarterly funding total since the first quarter of 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.