Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — April 11, 2025

By Paul Manalo

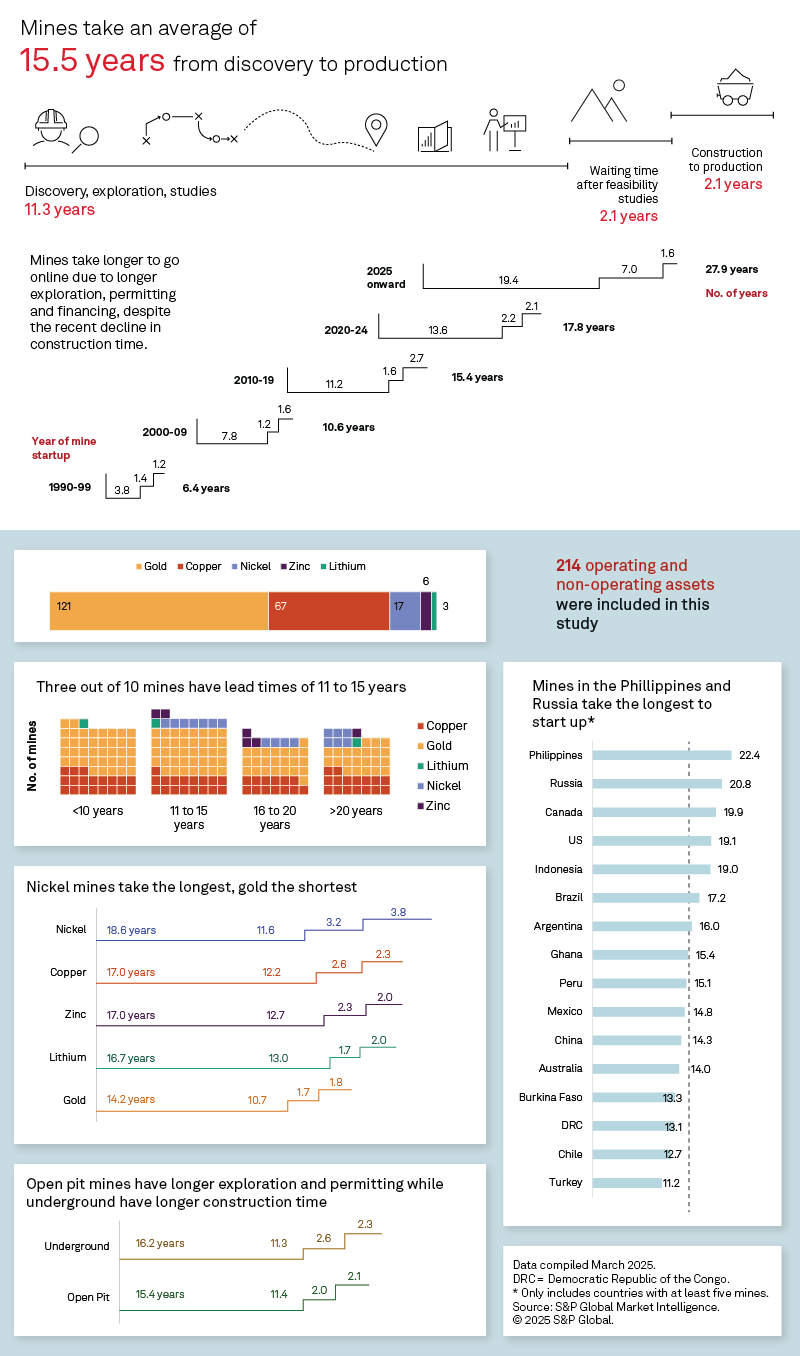

The average lead time for mines continues to rise, reaching 17.8 years for those that became operational between 2020 and 2024. This duration is nearly three times longer than the lead time for mines that began operations from 1990 to 1999. Extended periods for exploration, permitting and financing have significantly contributed to these longer lead times.

In this update of our previous article, we included 20 non-operating mines that are at least currently undergoing feasibility studies and estimated their startup date. The lead time for these assets has surged to 28 years — nearly five times the lead time observed in the 1990s. In addition to the prolonged exploration, permitting, and study phases, the extended waiting period between the end of feasibility studies and the start of construction has further increased lead times during this period.

Mines in the Philippines and Russia have the longest lead times in the industry. The Tampakan copper-gold project, situated on the southern island of the Philippines, has the longest expected lead time in the country, at 36 years. Discovered in 1992, Tampakan is estimated to begin operations in 2028, following the provincial government's lifting of a 12-year open-pit mining ban in 2022.

In Russia, three copper and gold mines discovered in the late 1980s to early 1990s — coinciding with the dissolution of the Soviet Union — contributed to the country's long average lead time. Additionally, these mines are in the eastern part of the country, a more remote area with more limited infrastructure compared to the western region.

The project with the longest lead time is the Wafi-Golpu copper-gold project in Papua New Guinea. The discovery occurred in 1990 but is only expected to start in 2030 or later. Ongoing regulatory, environmental and social factors have caused significant delays, and include disputes between the provincial and national governments regarding the environmental impact of deep-sea tailings placement. Negotiations between the government of Papua New Guinea and mining companies Harmony Gold Mining Co. Ltd. and Newmont Corp. have been intricate, with the government aiming to secure at least 55% of the project's economic benefits for stakeholders in Papua New Guinea.

The Donlin gold project in Alaska was also discovered in 1990. However, challenges from tribal governments and concerns about water usage and the project's environmental impact have delayed its timeline. The project is expected to begin operations in 2027. If this timeline is met, it will have taken 37 years from discovery to production.

Similarly, the Resolution copper project in Arizona has faced challenges from Native American tribes, who consider the site sacred, and federal agencies that have rescinded and paused permits. This is a high-profile project and could significantly meet US copper needs, particularly in light of the current US administration's reshoring agenda. Should the recent executive orders benefit the asset, Resolution could go online as early as 2030, resulting in a 35-year timeline from discovery to production.

These delays position the US among the countries with the longest lead times for mining projects. The average lead time in the US is 19.1 years, compared to the global average of 15.5 years.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.