Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Jul, 2016 | 11:30

With continued low interest rates, the availability of easy credit and record levels of cash reserves, Europe continues to be a target for Asian companies looking to diversify away from their slowing domestic growth. Despite struggling economies, we saw M&A activity in 2015 flourish especially for Chinese and Japanese companies and expectations were that 2016 would see a general slowdown. Given the record levels in 2015, we thought it would be interesting to provide a focus on Chinese and Japanese acquisitions of European companies and to see whether those expectations have been realized so far in 2016.

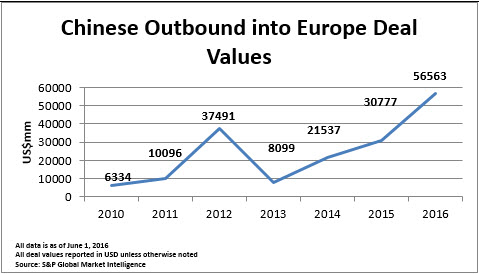

According to data from S&P Global Market Intelligence, by June 1, 2016 Chinese outbound into EMEA deal value, at just over $56bn, has already surpassed the entire deal value from 2015. A significant contribution to this was the largest overseas purchase by a Chinese company, when China National Chemical Corporation announced their intention to purchase the Swiss seeds and pesticide group Syngenta for $46.5bn back in March 2016.

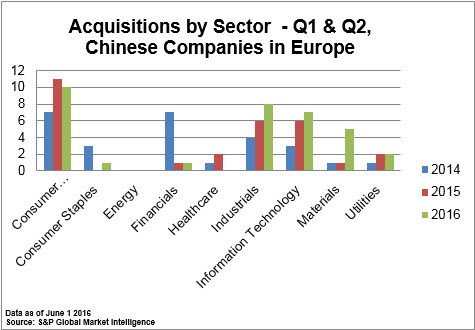

Indeed, Chinese companies have also increased the number of acquisitions being made during the H1 of any year. By June 1, Chinese companies have already acquired an all-time H1 record high of thirty four targets in EMEA, up 17% on the first half of 2015. Typically the Consumer, Industrials and IT sectors are the most active for acquisitions in EMA by the Chinese, but what is interesting is that there have already been five acquisitions in the Materials sector which is as many as we have seen in the last two years combined for this sector.

Four of these five acquisitions have been for companies specialising in fertilizers or pesticides. The inefficiencies in Chinese farmland, including low margins and lack of information with regards to crop demands combined with the continued rise in food supply mean that Chinese companies are now looking abroad to diversify and invest in foreign companies that can help support these agricultural needs.

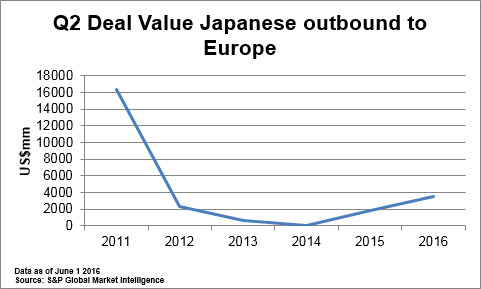

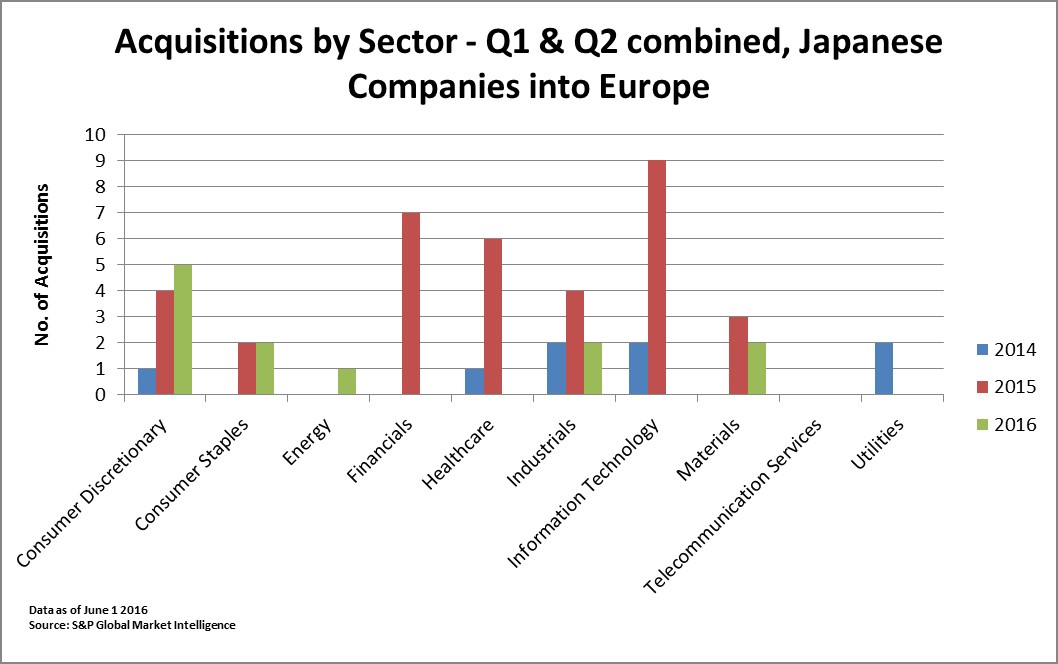

What about Japan? With the low cost of borrowing, an ageing population and an extremely competitive domestic M&A market have they taken the opportunity to venture into Europe? Well, if we look at Q1 2016 compared to Q1 2015 we see that the amount of deals announced was down 50% from 12 to 6 and the deal value was down by 72% from $6.06bn to $1.72bn. This slowdown was perhaps due to the negative interest rate policy put into action earlier in the year. However, despite the stock market volatility, Q2 saw the 8th largest Japanese acquisition in Europe with Asahi announcing a $2.9m deal to acquire Peroni, Grolsh and Meantime beer brands from SABMiller. Typically the mega deals that Japanese companies have been involved in are in the Healthcare, Industrials and IT sectors when buying in Europe. This deal also took the total Q2 2016 deal value to $3.55bn, the highest Q2 total since 2011 and an 88% increase on Q2 2015 activity.

Like the Chinese acquisitions in Europe in 2016 the Consumer sector has seen the most activity in with 7 out of the 12 deals announced so far announced by Japanese companies. Typically Industrials and IT sectors are the most active but so far this year there have only been 2 deals in these sectors compared with 13 at the same stage last year.

With the outbound activities from both China and Japan into Europe hitting record Q2 highs this year it certainly seems as though a robust deal corridor is being established into Europe, which should make for an interesting second half of 2016. After a record breaking year for M&A activity in 2015 it was perhaps inevitable that we would witness a slowdown in 2016, wasn’t it? Well, maybe someone should have told the buyers from the East.

To read a blog post about our recent live M&A webinar, click here.