S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Corporations

Financial Institutions

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Nov 24, 2023

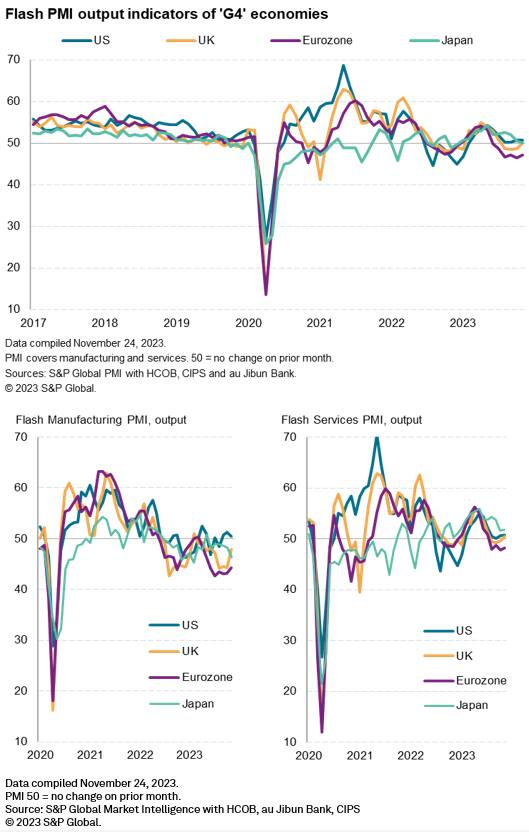

Early PMI survey data for November from S&P Global showed the major developed economies collectively contracting marginally for a fourth month. The decline was again led by the eurozone, though the downturn showed signs of bottoming out, with a steadying of output in the UK also bringing tentative welcome news of diminished recession risk. Growth in the US meanwhile continued to run much weaker than earlier in the year, and Japan's upturn showed signs of stalling.

The surveys continue to indicate that service sector growth remains very subdued in the G4 on average relative to surge seen in spring and summer, while manufacturing remains in decline.

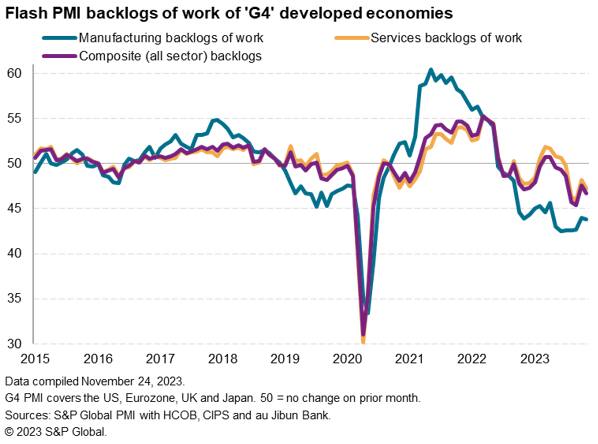

Further falls in backlogs of work in both sectors bode ill for the near-term outlook, but there has been some easing in the rate of decline of new orders, which even returned to tentative growth in the US.

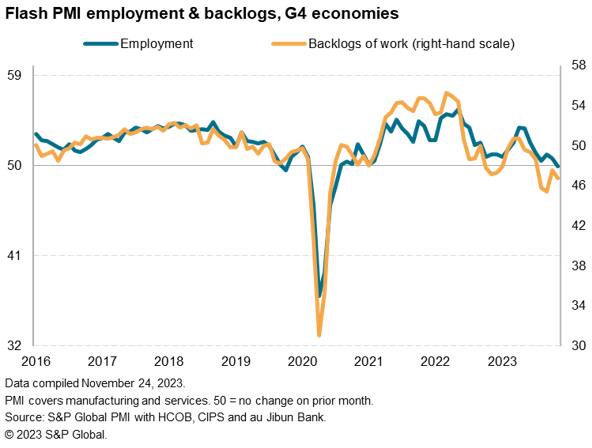

The sustained decline in order backlogs and inflows of new orders nevertheless encouraged firms to cut employment across the G4 for the first time since the early months of the pandemic, hinting that firms have become increasingly cost-conscious in the face of a challenging demand environment.

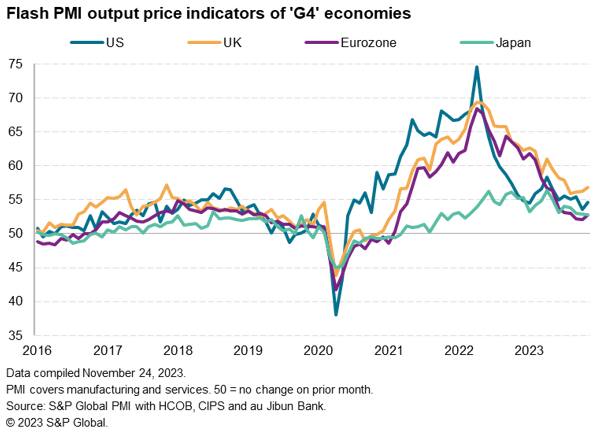

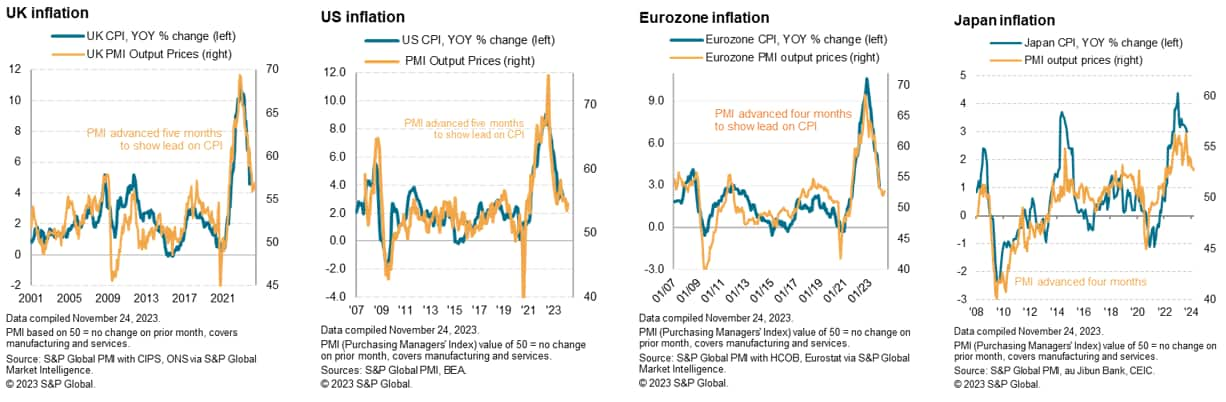

Inflationary pressures meanwhile ticked higher, albeit remaining muted by recent standards. Service sector inflation remains the key area of inflationary pressure, meaning the order book and employment trends for this sector continue to be the key indicators to watch in coming months to gauge the impact of pricing power and wage bargaining power on inflation, and hence the policy response.

Business activity across the four largest developed economies - the G4 - fell for a fourth successive month in November. However, the rate of decline remained only marginal, easing fractionally in October, according to provisional PMI survey data. The flash PMI output index for the G4 economies inched up from 49.5 in October to 49.7, a four-month high yet still below the 50.0 no change level.

By sector, weakness was led by manufacturing, where output contracted across the G4 for a seventh successive month. Factory output across the G4 has now in fact fallen continually over the past 17 months barring April of this year. Disappointingly, factories also continued to wind down their inventories of both purchases and finished goods in November to point to a sustained drag on global factory production from the inventory cycle.

A marginal rise in service sector output across the G4 improved on the fractional decline seen in October, but means activity in the sector has now been largely stagnant for four months, contrasting with the solid growth spurt seen earlier in the year.

Geographically, the flash PMI data add to indications that the eurozone economy is likely to contract in the fourth quarter, while growth in the UK has remained largely stalled and the US will see GDP expand, but at a much reduced rate compared to the second and third quarters. Japan is indicated to muster modest growth.

Eurozone output fell for a sixth month, albeit the rate of decline moderating in November. The flash composite PMI reading of 47.1, up from 46.5 in October, nevertheless indicated that the pace of decline remained one of the steepest recorded by the PMI since the debt crisis in 2012, if pandemic lockdown months are excluded. An eight month of falling manufacturing output was accompanied by a fourth month of contraction in the service sector, though rates of decline moderated in both cases.

The United Kingdom meanwhile reported a marginal rise in output, the composite flash PMI rising from 48.7 in October to 50.1 to thereby hit a four-month high and end a three month spell of decline. The improvement was led by the first improvement in service sector output for four months. Although manufacturing production fell for a ninth straight month, the decline was the smallest recorded since June.

The United States composite flash PMI meanwhile held steady at 50.7, registering a fourth month of very subdued growth yet still pointing to a more resilient growth trend compared to that seen in Europe. While service sector growth edged up to a four-month high, though notably remains far weaker than seen earlier in the year, factory output growth slowed close to stagnation.

Finally, growth stalled in Japan, which was the only G4 economy to see the level of the composite PMI fall between October and November, down from 50.5 to 50.0, its lowest since the recovery began in January. A modest gain in service sector output was offset by an intensifying downturn in factory output, which dropped at the sharpest rate since February.

The overall picture of largely stalled business activity was accompanied by the survey employment data pointing to a weakening labour market across the G4. Staffing levels across manufacturing and services declined - albeit only fractionally - for the first time since July 2020 (during the early pandemic lockdowns). Among the G4, only Japan reported higher employment, with marginal declines reported elsewhere. The drop in US employment was particularly significant in being the first seen since the early pandemic lockdowns, and in the eurozone the decline was the first since the lockdowns of early-2021. UK employment fell for a third month.

Factory jobs were cut in the G4 for a second successive month, dropping in all four economies. The eurozone factory payroll decline was especially marked and the sharpest since October 2012 if early pandemic months are excluded. UK job losses also remained steep, albeit easing. While the US factory jobs decline was far less severe than seen in Europe, the past two months have nevertheless seen the steepest payroll losses since the global financial crisis is early pandemic months are excluded. A marginal decline was recorded in Japan.

Service sector employment meanwhile came close to stalling on average across the G4. Resilient hiring in Japan was countered by the first drop in US services employment since the early pandemic months and only marginal gains in the eurozone and UK, albeit the latter representing an improvement on declines seen in the prior two months.

The overall worsening jobs picture at the G4 level was in part linked to a deterioration in business output expectations for the year ahead in November, but also reflected a fifth successive monthly drop in new orders across goods and services. Notably, demand - as measured by new order inflows - across the G4 continued to fall at a sharper rate than output, the latter being supported by firms continuing to eat into backlogs of orders accumulated in prior months. These backlogs across the G4 have now been in decline for seven successive months, dropping in November at one of the steepest rates seen since comparable data were first available in 2009, barring only the early pandemic months.

Backlogs of work fell at increased, and marked, rates in the US, UK and eurozone - hinting at persistent output growth weakness and pressure on payroll numbers in the months ahead - but remained steady in Japan.

One brighter note was a cooling in the rate of decline of new orders to only a modest pace in November. Upcoming data will be eyed for signs of new orders returning to growth, and hence providing a much-needed justification for firms' current production capacity levels. A tentative such return to new orders growth in the US was already signalled by the November flash PMI, and rates of decline eased in Europe.

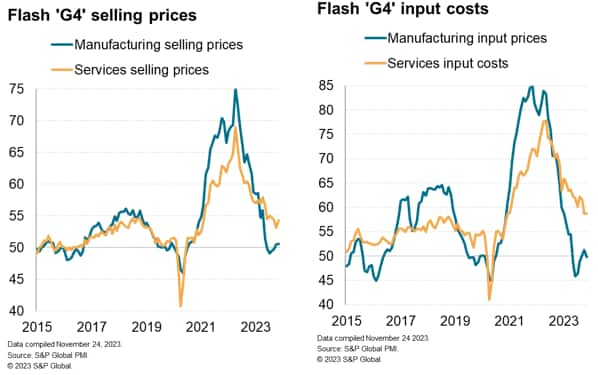

From an inflation perspective, average selling prices for goods and services rose at an increased rate across the G4, albeit still running at one of the lowest rates seen since early 2021. Input cost inflation meanwhile moderated further, slipping to its lowest since November 2020, to add some encouragement to the prospect of selling price inflation cooling again in coming months.

Selling price inflation picked up in the US, Eurozone and UK, the latter remaining especially elevated by historical standards. The eurozone reported the lowest rate of the three, reflecting the relatively weaker demand environment. The rate of increase in Japan eased to its lowest since February 2022.

Manufacturing selling prices barely rose across the G4 on average, albeit with a robust increase seen in Japan and to a lesser extent the US. A marked fall in goods prices was meanwhile seen in the eurozone, with UK prices largely unchanged.

Service sector selling prices meanwhile rose at a slightly increased rate compared to October, with input cost inflation softening slightly. Both rates consequently remain elevated by historical standards, including in all G4 economies, and persist as the principal area of concern in relation to stubbornly high core consumer price inflation.

The employment data will therefore be especially important to watch going forward, helping to assess wage bargaining power as labour costs typically represent the lion's share of service sector input costs, while new order inflows will be a key guide to demand-pull inflation pressure.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location