S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 2 Nov, 2023

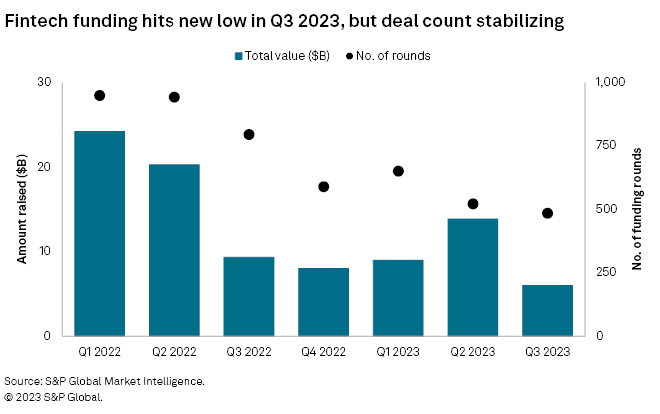

Venture capital flows into financial technology companies plunged globally by 36% year over year to $6 billion in the third quarter of 2023, according to our analysis of S&P Global Market Intelligence data. Funding deal volumes dropped 39% to 484 transactions. However, in what could be an encouraging sign for the industry, mature startups, which were hit the hardest in the previous quarters, made a comeback of sorts, reporting approximately 30% year-over-year increases in funding values and deal count.

The improvement in late-stage activity can be partly attributed to the low base effect, as the ongoing funding downturn originated in the third quarter of 2022, when venture capitalists (VCs) first scaled back their exposure to mature firms before cutting the pace of investments in firms at earlier stages. While venture funding pressures certainly eased for mature firms, it is too early to say whether the VC optimism in late-stage investing will sustain and trickle down to investors at earlier stages. For now, the VC activity has somewhat worsened for firms in seed to growth stages.

A few digital banks returned to the VC market and investor interest in AI-based fintech models continued in the third quarter, but those bright spots were not enough to arrest the funding decline across verticals and geographies. Some large fintechs are becoming pragmatic and warming up to down rounds to sustain growth, but there is also growing evidence of VCs backing leaders in their portfolios to extend their runways at valuations of previous rounds. While the growth of "insider rounds" in a capital-scarce environment is not uncommon, the industry would prefer to see new investors joining the capitalization tables as a sign of a turnaround.

To be sure, there are some macro signs pointing to a less pessimistic outlook, with the continued recovery in valuations of listed fintechs (the S&P Kensho Future Payments Index was up 10% in 2023 as of Oct. 3) offering a glimmer of hope for their private peers. Upending the current bearish cycle in venture funding would likely require a bump in exit opportunities for investors through initial public offerings and M&A activities to trigger another virtuous cycle of fintech funding.

Global funding hits new low

The first nine months of 2023 saw 1,655 funding rounds raising $29 billion, compared with 2,684 rounds worth $54 billion in the year-ago period. The third quarter of 2023 was the slowest funding quarter on record since the start of 2021 in terms of both volume and values.

When the funding environment was still exuberant in 2022, the monthly deal count averaged 270 and dropped below 200 only twice, in the last two months of the year. In contrast, 2023 deal volumes breached the 200 mark only in January and March. The deal count in September came in at 159, compared with 147 in August and 178 in July.

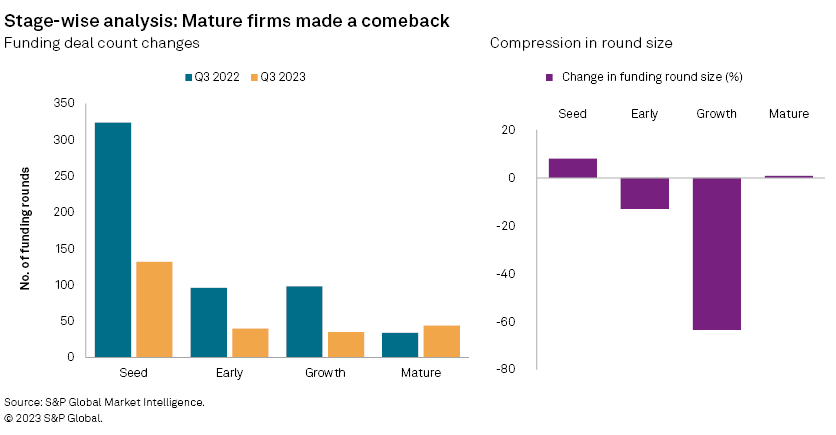

Late-stage startups shine, but valuations under pressure

Funding pressure further deteriorated across stages, except in late-stage investing, in the third quarter. Venture funding in late stages grew for the first time this year on a year-over-year basis, with the total deal count rising 30% to 44 and funding value growing 31% to $2.56 billion.

Seed-stage fintech investments totaled $539 million, down 56% from the first half of 2022. Early-stage fintechs attracted 64% less capital, with series A rounds generating $509 million, down from $1.4 billion in the third quarter of 2022. Growth-stage investments (series B and other growth rounds) fell 87% to $577 million.

As mature firms returned to raise capital, mega funding rounds (over $100 million) increased sequentially to 13 from eight in the second quarter of 2023. However, they were still slightly down from 15 rounds in the third quarter of 2022.

While compression in round sizes eased for seed and mature startups, it worsened for firms in early and growth stages. The average seed investment increased 8% to $4 million from the year-ago period, whereas late-stage startups' average ticket size remained flat at $58 million. The size of a typical series A investment on average slipped 13% to $13 million, and the average for growth investments saw the sharpest fall, at 63%, to $16 million.

Valuations of fintechs are adjusting to the new normal, with Ramp Business Corp. being the latest example of a large fintech undertaking a "down round." The business-to-business payments company's $300 million raise in August fetched a pre-money valuation of $5.5 billion, down from $8.1 billion following the previous fundraise in December 2021.

Funding rounds going through "time correction" are also becoming commonplace, where valuations remain unchanged for startups raising capital after a year or two. The latest funding round of Dutch digital bank Bunq BV falls in this category, as it retained its valuation of $1.8 billion following a $111 million round.

There are some aberrations too, with a couple of fintechs defying gravity even in the current funding environment. Beam Benefits, a US insurance technology company that offers dental, vision, life, disability and supplemental health coverage, raised $40 million in September at a 25% higher valuation compared with its funding round in early 2021. Korea Credit Data Co. Ltd., which offers financial services to small and medium-sized enterprises in South Korea, saw its $77 million round attracting a post-money valuation of $1 billion, up from $800 million following its October 2022 round.

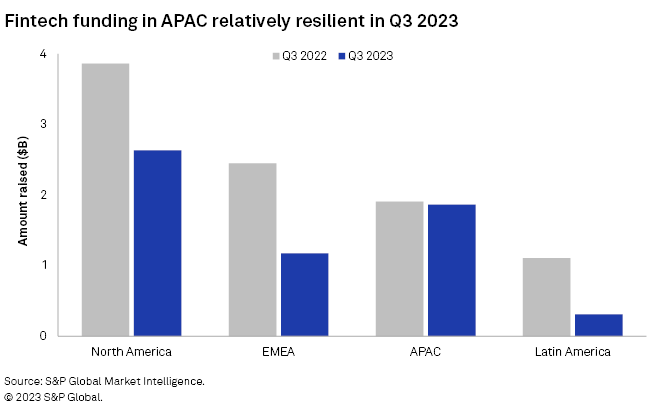

Regional analysis: Asia-Pacific resilient, Latin America worst hit

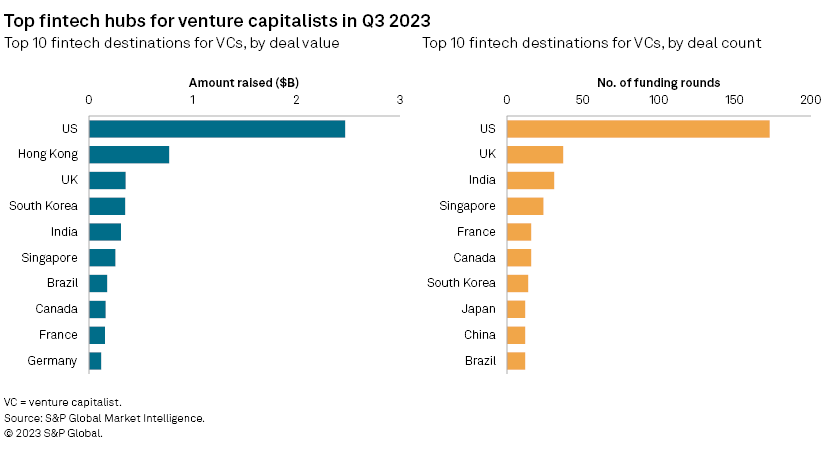

Latin America continued to witness the sharpest decline in VC investments, registering just $310 million, a 72% drop from $1 billion in the third quarter of 2022. Investment in Europe, the Middle East and Africa fell by more than half year over year to $1.2 billion. North America remained the top destination for VC investments, but funding value fell by one-third to $2.63 billion. Asia-Pacific emerged relatively unscathed, raising $1.9 billion, nearly flat compared with the year-ago period. In terms of deal count, North America's fintech rounds declined 31% to 191, EMEA fell 42% to 147, Asia-Pacific dropped 38% to 119 and Latin America decreased 64% to 27, from the year-ago quarter.

The US, UK, India and Singapore accounted for more than half of funding rounds during the quarter. The US witnessed 173 rounds, raising $2.5 billion during the quarter, down from 258 rounds and $4 billion in the third quarter of 2022. The UK saw 37 rounds worth $400 million, while India's 31 rounds resulted in $300 million. Singapore saw fintechs attracting $300 million through 24 rounds.

Segment analysis: Banking technology rebounds

Among fintech segments, banking technology and payments each raised $1.23 billion in the third quarter. Interestingly, banking technology was one of the hardest hit segments in the previous quarters as digital-only banking models of various kinds had somewhat lost their shine due to their high cash burn rates. Some of them seem to be on the mend and winning back investor support.

Bunq raised $111 million this year, comprising $47 million in August and a previously undisclosed tranche of $64 million earlier this year, led by existing investors including Pollen Street Capital, Raymond Kasiman, and founder and CEO Ali Niknam. The fintech, which already holds a full European banking license and has filed for a US banking charter, expects to report a profit for 2023.

South Korea's Toss Bank Co. Ltd., which reported its first monthly profit in July, closed its $150.8 million round in September, led by online retail platform Home & Shopping, Premier Partners and Korea Investment Capital Co. Ltd. The digital banking arm of fintech giant Viva Republica Inc. is in advanced talks to raise over $300 million via two funding injections later this year, according to a TechCrunch report. The VC interest in Toss Bank comes amid expanding profit pools for fintechs in South Korea, which now hosts three profitable licensed internet-only banks, the other two being KakaoBank Corp. and K Bank Co. Ltd. KakaoBank made its public debut in 2021, while K Bank awaits a turn in market conditions for its public listing.

In Brazil, Nomad landed a $61 million investment in a series B round, led by Tiger Global Management LLC, at a time when Latin American fintechs are struggling to raise capital. Nomad offers Brazilians a US dollar bank account, an international debit card and an investment platform. The Brazilian fintech does not hold a banking license and works with US-based fintech Synapse Financial Technologies Inc. to offer financial services, leveraging the charter of Evolve Bank & Trust.

Among other banking tech companies raising capital during the quarter was Solaris SE, which leverages its German banking license for its banking-as-a-service platform. The company's first close of a series F round, involving only existing investors, generated $41 million and will likely target more investments in subsequent tranches.

The payments segment, which historically drew more capital than any other fintech vertical, saw funding activity decline 61% to $1.23 billion from the year-ago quarter. However, VCs remain interested in fintechs that reduce friction in cross-border transactions, with supply chain fintech startup Tradeshift Inc.'s $70 million raise offering the latest example. HSBC Holdings PLC, which is injecting $35 million into the Silicon Valley-based fintech, will collaborate with the portfolio company to embed payment and fintech services into trade, e-commerce and marketplace experiences.

Insurance technology came in at just over $1 billion, and investment and capital markets technology dropped below the $1 billion mark, falling 20% and 26%, respectively. Digital lending pulled in $810 million, nearly half of its year-ago quarter funding amount. Financial media and data solutions drew only $480 million, down 31% from the year-ago period.

VCs hot on AI-led fintech models

VC interest in the AI-enabled fintech startups continued in the third quarter, resulting in 38 funding rounds worth $696 million.

Alphasense appears to have emerged as a favorite among VCs, with the market intelligence provider's $150 million series E round in September coming only months after its series D round ($100 million) in April. The latest capital injection, led by Bond, was an "up round," with the valuation rising to $2.5 billion from $1.8 billion. The company's plans to deploy its AI search capabilities, market intelligence and financial large language models, and generative AI capabilities within enterprise customers' private clouds is drawing investor interest.

Among other notable AI-enabled fintechs, Tractable raised $65 million in a series E round led by SoftBank Vision Fund in July. The insurance technology company claims to apply AI to automate auto and home insurance claims and damage assessment processes. ThetaRay, which picked up $57 million in a growth round in September that was led by fintech-focused VC investor Portage, leverages patented AI technology to monitor financial transactions to minimize the risk of financial crime for its customers.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is part of S&P Global Market Intelligence. For more about 451 Research, please contact 451ClientServices@spglobal.com.