Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 15 Dec, 2023

Shareholder activism campaigns continued to rise in 2023 as capital-raising and other growth avenues for issuers were disrupted. In our recent Evolution of Investor Activism webinar, our panel discussed major updates and trends within the world of shareholder activism. Our blog post below provides analysis from Ken Shimokawa, Director of Financial Institutions Desktop Products at S&P Global Market Intelligence, as he performed a deep dive into the most active industries, campaign success rates, and the growing importance of ESG components.

Investor Activism by the Numbers

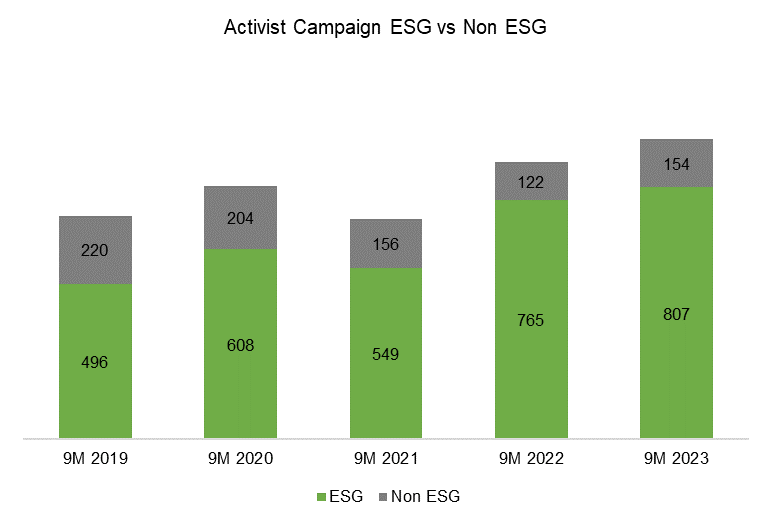

Data from S&P Capital IQ shows that investor activism was on a record-breaking pace through the first nine months of 2023. A total of 961 campaigns have been launched year to-date, and that figure is on track to, at the very least, match the total from 2022. Campaigns have increased by 8% from the prior year and we could very well end this year setting another new annual record (dating back to 2000, which is when we started collecting this data). This trend has seemingly emerged on the back of increased market volatility through the challenging macro and investing environment.

The activity is coming from all directions, whether it's A-list activists, newly founded groups, or occasional activists. It's become essential for companies to understand how they engage with these shareholders that act like activists in their own way.

Of all 2023 activist campaigns, 84% are related to ESG. To be fair, governance was typically a component of these initiatives, but that number marks a huge year-over-year increase. What's also interesting is the slowdown in the number of M&A-related campaigns, which might be tightly correlated to the decline in deal-making activity this year.

Source: S&P Capital IQ

In 2023 alone, the number of campaigns submitted in Japan have doubled compared to 2022. You could point to Warren Buffett investing in regional trading companies and the Japanese stock market doing well in 2023 as a correlation to increased campaign submissions, along with greater desire for cash allocation and more expectation on diminishing cross holdings. Regardless, this is an interesting trend we will continue to monitor.

The Effect of ESG

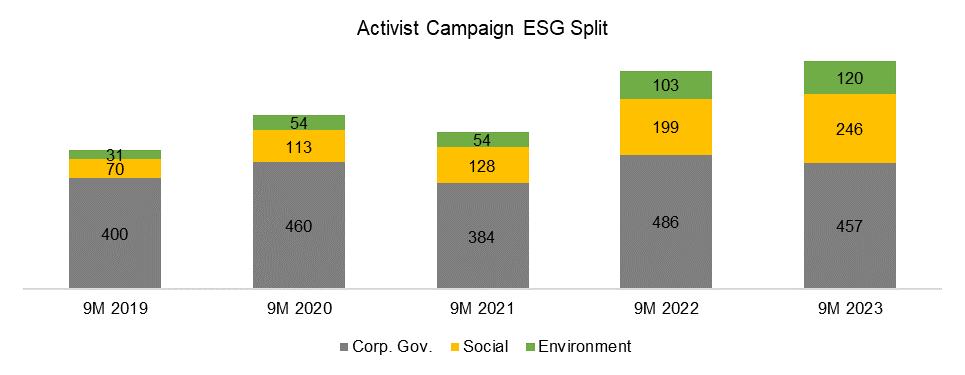

The inclusion of ESG components within activist campaigns is a trend that we have seen accelerate since 2020. In particular, the environmental aspect has seen a huge ramp-up in that time, going from about 27% of all campaigns to almost 45%. Proposals submitted with environment and social elements have largely been driven by a lot of first-time or newly founded activists. I think the universal proxy rule has made it easier for activists to raise proposals and contributed to the increase in volume of campaigns.

Source: S&P Capital IQ

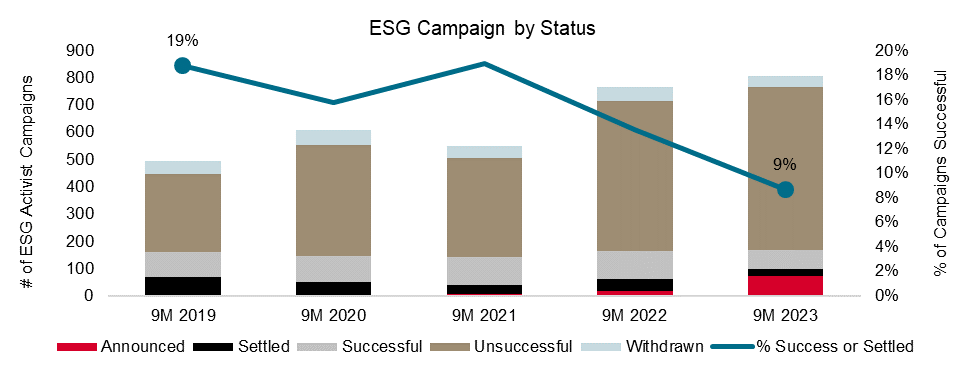

A lot of milestone campaigns took place in 2020, namely ExxonMobil and the Engine No. 1 campaign where they pushed Board member seats to drive cleaner energy. What's interesting is that, gradually, the number of successful campaigns has declined since then. About 20% of campaigns launched in 2019 were successful, but campaigns in 2023 year-to-date are only succeeding at a 9% clip.

Source: S&P Capital IQ

From my perspective, I think there are a couple of factors for this decline. One reason is the sheer number of campaigns submitted which is naturally lowering the success rate, so there's a bit of arithmetic involved. Companies are also a lot more transparent in their corporate disclosures and able to better articulate their ESG strategy, so that might have contributed to a lower success rate as they're already getting buy-in from the shareholders.

The last factor is a potential disconnect between the economics of the environmental and social campaigns versus the moral side of things. A bit of that disconnect may still persist between the shareholder value and the economics of it versus the environmental and social-focused goals.

What Do Industry Campaigns Portend for the Future?

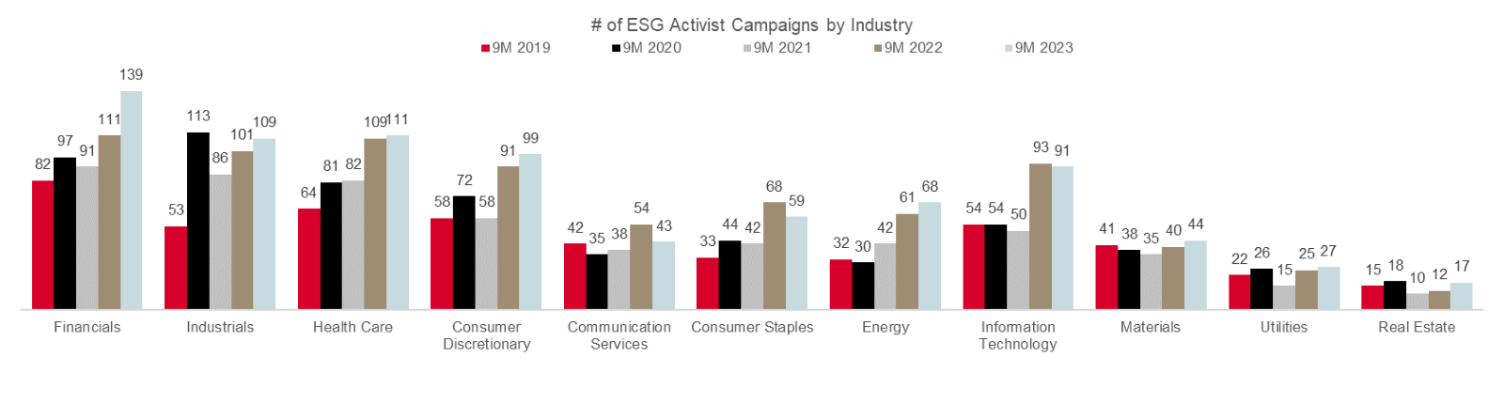

We've seen some significant upticks in campaign activity for the financials, industrials, health care and technology sectors. In particular, the increase for financial campaigns is interesting, given the banking liquidity crunch we saw earlier this year. Additionally, a lot of these banks have also had campaigns where shareholders were asking for greater disclosure around transition plans for how their financing activities are going to mesh with emission reduction targets or with the Paris Alignment.

Source: S&P Capital IQ

When thinking about potential future trends, we need to clearly monitor what's happening in the macro environment. Is the environment of higher interest rates going to continue, or will it go down? There's also a lot of global volatility that could impact things. Another factor for the future is M&A activity, which could highlight specific industries that are receiving more momentum.

Source: S&P Capital IQ

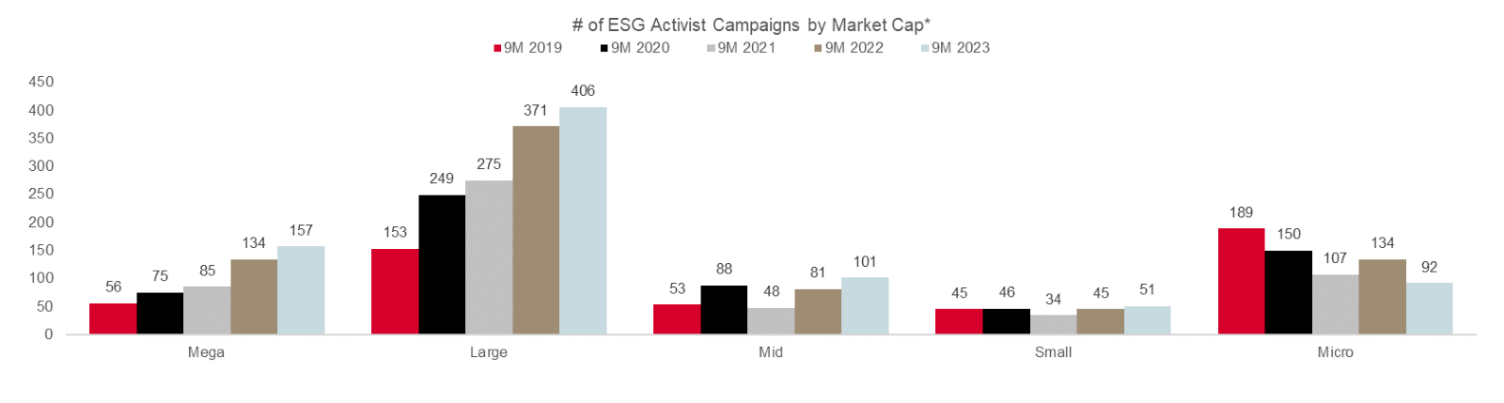

An interesting trend is the surge in activist campaigns targeted at large-cap companies. This surge in large-cap companies suggests that size alone isn't going to be enough of a defense tactic against well-funded, thoughtful activist campaigns.

Webinar

Campaign