Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 31 Jan, 2023

Highlights

The top three global over-the-top video providers — Netflix, Disney and Amazon — are expected to generate two-thirds of total European subscription video-on-demand revenues in 2023.

Organic subscriber growth is tapering, switching the focus for operators to customer satisfaction, churn control and diversifying revenue streams.

With streaming becoming mainstream and connected TV usage on the rise, free ad-supported streaming TV should continue to grow in popularity, bridging the gap between free-to-air linear TV and SVOD.

A projected annual rise of 12% in paid subscriptions for 2022 is becoming less meaningful among media industry experts as progress toward profitability takes center stage. Both local and international media groups that operate in the streaming space are looking for ways to improve their finances, diversify their revenue sources and keep customers satisfied in a fragmented and saturated media landscape.

Key trends

The significance of customer retention

The combined annual subscription growth rate for all services is projected to drop to mid-single digits for the first time in years as the rising cost of living and overall streaming fatigue impact the industry. Netflix Inc., the leading SVOD service in EMEA, saw paid members decline for two consecutive quarters before resuming growth in the third quarter, albeit still down 0.7% year-to-date. Direct-to-consumer platforms are proving loss-making for most streamers, and therefore keeping churn levels under control is becoming more crucial than ever since the bulk of marketing spending goes to enticing new subscribers rather than maintaining the existing ones.

U.S.-based streamers' dominance

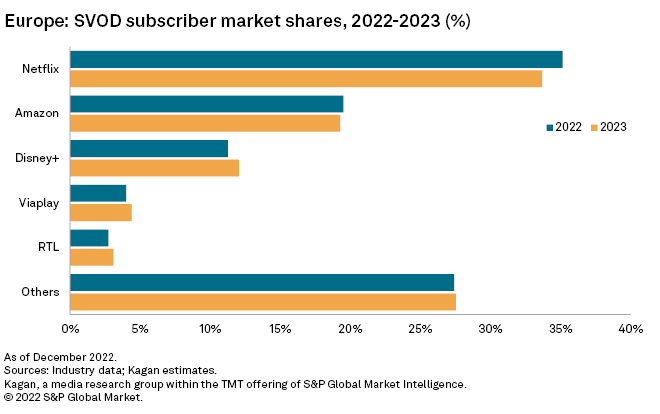

We expect Netflix, Amazon.com Inc. and Walt Disney Co. to generate two-thirds of the total revenue from OTT subscriptions in Europe, with Warner Bros. Discovery Inc. and Paramount Global outside the top five by paid subs. Regional players, such as Viaplay Group AB (publ) and RTL Group SA, are expanding outside their home markets to achieve economies of scale and other efficiencies.

Hybrid revenue models are becoming the norm

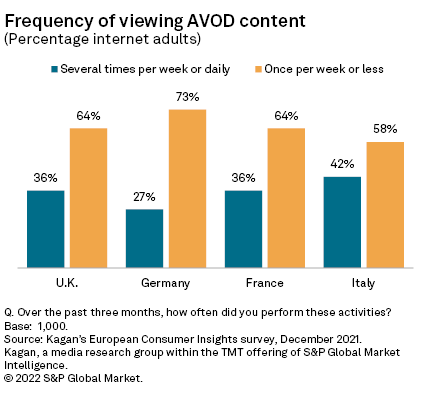

Ad-supported subscription tiers could be one answer to lackluster SVOD growth as it allows streamers to present consumers with a wider range of price point options. Netflix's Basic with Ads became available in France, Germany, Italy, Spain and the United Kingdom in November 2022 while Disney's similar offering should launch in 2023 in select markets. This so-called hybrid revenue model is not new to the industry, with European players such as the Danish commercial broadcaster TV 2 | Danmark A/S and Luxembourg-based media conglomerate RTL Group having adopted it many years ago. In four of the five European markets where Netflix has launched its ad-tier plan, frequent viewing of any form of free ad-funded video ranges between 27% and 42%, according to the latest Kagan consumer survey results. This shows a considerable consumer appetite outside the SVOD and broadcast TV format.

Increasing popularity of FAST platforms

Free ad-supported streaming TV, or FAST, is becoming more popular as SVOD reaches saturation and connected TV usage rises. Comcast Corp.-owned Peacock, Paramount Global's Pluto TV, Rakuten Group Inc.'s Rakuten TV, Roku Inc. and Samsung Electronics Co. Ltd.'s Samsung TV are amongst the most popular platforms that are available in multiple territories. Magna Global forecasts digital video's share of the combined digital ad spend in the U.K., Germany and France will rise from 8.1% in 2021 to 10.0% in 2026, indicating a move from linear TV, radio and print to digital formats, in line with the growing popularity of OTT video. Corroborating this trend, S&P Global Market Intelligence research shows that the big four advertising groups have twice revised upward their 2022 annual forecasts, citing increased annual organic growth, fueled in part by digital advertising growth.

The need for consolidation leads to M&A

Consolidation through M&A could continue in 2023 as media groups seek to benefit from synergies, reduce costs and increase scale across multiple regions. This would be a continuation of the trend in 2022, which saw the completion of the Warner Media/Discovery merger in April followed two Europe-based deals: the acquisition of Premier Media Broadcasting Ltd. (Premier Sports) and Eleven Sports Network Ltd. by Viaplay Group and DAZN Group Ltd., respectively, in bids to strengthen their content portfolios and expand their household reaches in the region.

Research

Infographic