Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 07, 2022

One of the main issues for voters in our seven swing states as they head to the polls this Election Day is the US economy. Since the pandemic-induced economic decline of 2020, most states in the South and West have recovered fairly quickly, and, indeed, have been thriving; but recovery in the Northeast and Midwest has been slower and more variable. In addition to post-2020 economic recoveries, voters are now also looking ahead to a potential recession, and how well their state is positioned to weather 2023 will likely loom large on November 8th. A look at how our seven major swing states are faring as voting gets underway.

Arizona

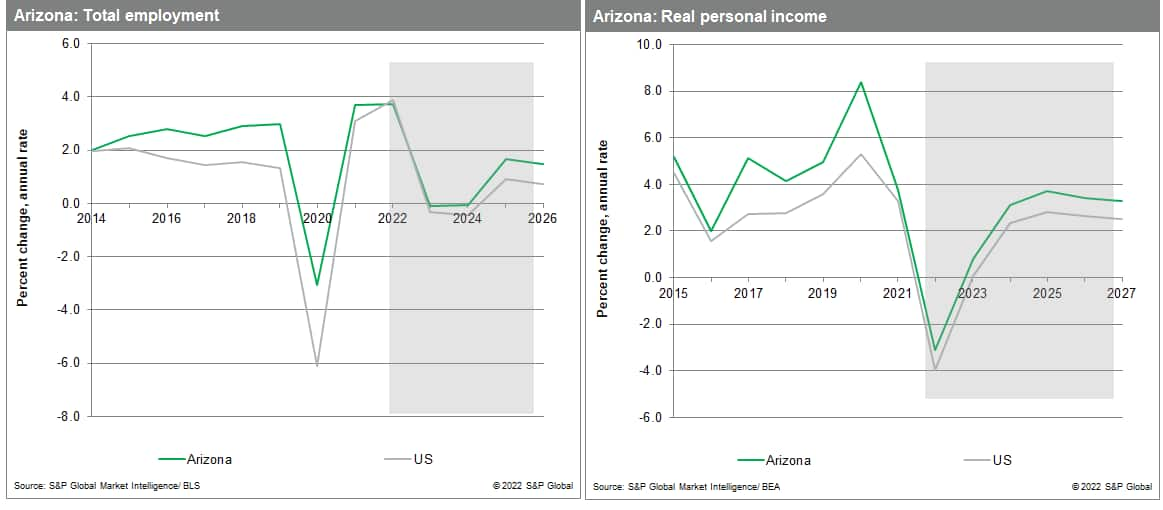

The Arizona economy weathered the onset of COVID-19 pandemic and its aftermath better than most of the nation, with some of the strongest payroll growth among states in 2022. The recovery has been broad-based, with employment levels in nearly all major sectors having now surpassed their pre-pandemic levels. Further contributing to Arizona's strong economic performance is the advantageous sectoral makeup of its jobs recovery; of the nearly 100,000 jobs the state has added since the first quarter of 2020, about 95% are in above-average wage sectors such as professional, scientific, and technical services, and finance. Growth in these high-income sectors has increased the state's personal income levels by more than 16% over the past two years, the 6th-highest increase among states.

Arizona's strong recovery has had its drawbacks, eroding affordability levels in both housing and overall price levels. In the second quarter of 2022, for example, home values rose more than 25% compared to the year prior, the second-strongest appreciation rate in the country. Further, CPI inflation in the Phoenix metropolitan area measured an eye-watering 13% in August, the highest in the US. That said, Arizona boasts a highly diversified economy, and its strong population gains have been attracting a variety of industries. Several high-tech manufacturers have significant operations in the state including Intel, Honeywell, and Raytheon. Additionally, relatively low business costs (particularly in comparison to neighboring California) have made the state appealing for sizeable back-office operations, with companies such as Freeport-McMoRan, PetSmart, Carvana, and Banner Health also now headquartered in the state. Indeed, the sizeable footprint of industries ranging from high-tech manufacturing to mining to retail to healthcare underscores the diverse success of the state's economy.

Georgia

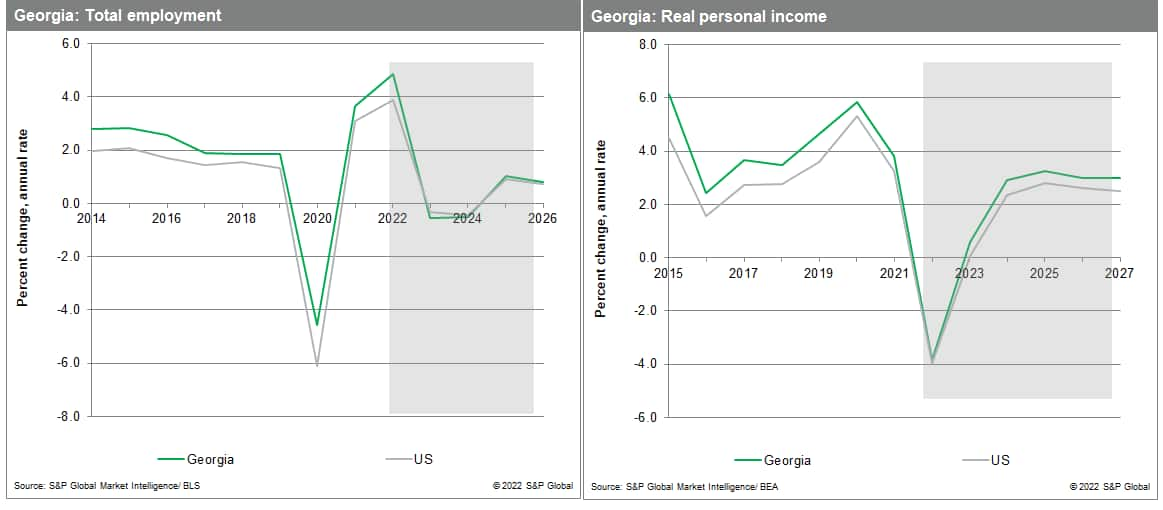

Georgia's economy has outperformed the nation in the wake of the COVID-19 pandemic, with total employment surpassing its pre-pandemic level in early 2022. Thanks to ports in Savannah and Brunswick, a large rail network, and the nation's busiest airport at Atlanta Hartsfield-Jackson International, the state's trade, transportation and warehousing industry has surged in importance over the past decade, and that growth intensified after the pandemic. Indeed, the transportation and warehousing sector was one of the first to recover, in 2020. Meanwhile, Georgia Tech serves as an important catalyst for scientific and technological research, along with the Centers for Disease Control and Prevention, and Atlanta continues to attract technology companies and major corporate offices such as Alphabet, Microsoft, and Visa. As a result, Georgia's professional and business services industry is expanding at a robust pace.

A dip in economic growth is likely over the next year. Wavering global demand and supply chain disruptions remain obstacles to quicker recoveries and more vibrant growth in Georgia's manufacturing sector. Tight labor markets are affecting service industries; indeed, Georgia's unemployment rate fell to 3.0% in the second quarter of 2022, its lowest rate since 1990, and well below the national rate of 3.7%. The outlook for Georgia is bright, however; with a young population and steady influx of prime-age workers that will bolster the economy into the medium term, and a low corporate tax rate and right-to-work laws that enhance Georgia's ability to attract businesses into the state. Several automakers, including Rivian Automotive, Hyundai, and battery maker SK Innovation have announced plans to build large production facilities, as Georgia looks to become a hub for electric vehicle production over the next several years.

Nevada

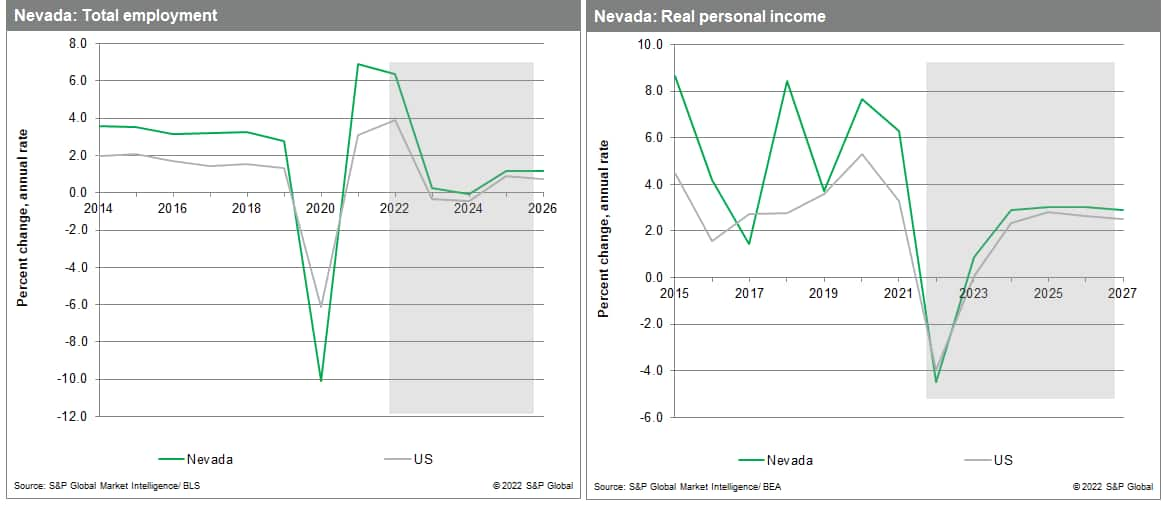

The Nevada economy has bounced back remarkably well from the pandemic-induced economic decline. The state surpassed its pre-pandemic peak employment level in June 2022, the 12th-fastest state to achieve this feat, despite suffering exceptionally deep job losses in the 2020 downturn due to the tourism-dependent nature of its economy. The state's recovery has been broad-based and led by the transportation/warehousing and manufacturing sectors, which as of fall 2022 boast headcounts that are 30% and 13%, respectively, above their February 2020 levels. Employment in the ever-important leisure/hospitality sector still faces a considerable climb, with payrolls there measuring 7.6% below their pre-pandemic levels. The return of consumers to socially dense activities in the state has been gradual thus far, with Las Vegas visitor levels in August 2022 more than 10% lower than the same month in 2019. Yet with tourism volume still subdued, and the leisure/hospitality sector continuing to face a considerable employment deficit, Nevada's rapid return to peak employment in 2022 underscores the extent to which the state economy has impressively diversified over the past decade.

Nevada's considerable economic diversification away from leisure and hospitality industries over the past decade has and will continue to insulate it from economic downturns. Between 2011 and 2021, Nevada's economy saw the 2nd largest improvement amongst all states in S&P's Global Market Intelligence's diversity measure. The state's geographic location and favorable tax environment have made it attractive for back-office operations as well as manufacturing and transportation/logistics facilities. Reno, in particular, has emerged as a regional manufacturing and logistics hub thanks in part to the presence of the Tesla Gigafactory. Furthermore, as home to the only lithium production site in the country, Nevada is poised to attract more high-tech manufacturing and battery companies in the future as automakers continue to ramp up the production of electric vehicles. As a result, Nevada's labor market is expected to fare better than most states in the impending global slowdown, and employment growth here will be some of the strongest in the nation.

North Carolina

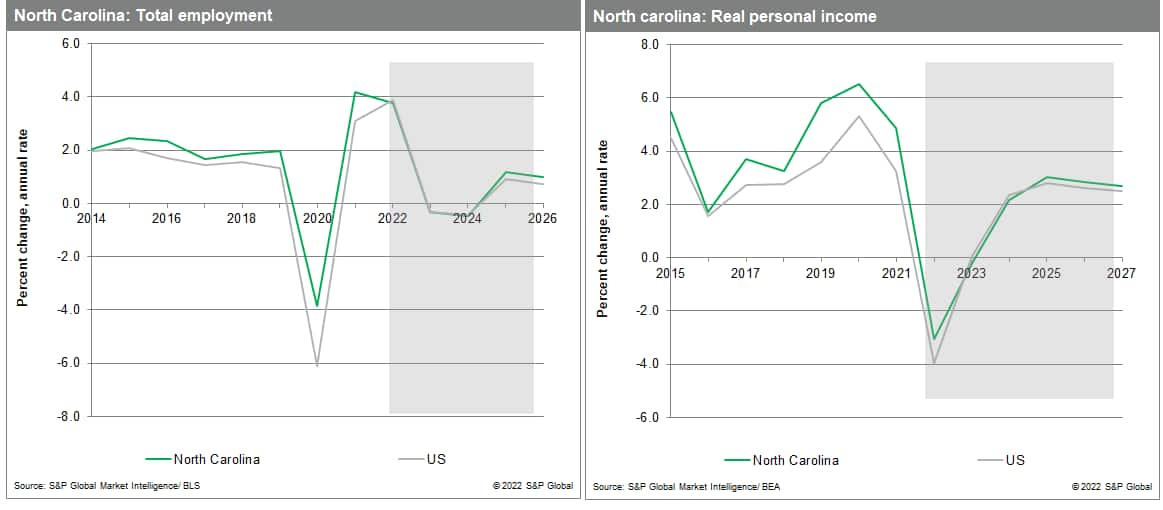

North Carolina's recovery following the onset of the COVID-19 pandemic well outpaced the national average, with the state returning to its pre-pandemic employment level by July 2021, the fourth fastest state to achieve this feat. As it did pre-pandemic, the state continues to attract technology and financial firms thanks to a young, well-educated workforce and a business-friendly climate. Indeed, North Carolina is an example of a state that has successfully shifted away from an economy centered on labor-intensive manufacturing and toward high-value technology and financial services employment. Boosting the workforce is a growing population, a trend that accelerated during the pandemic. North Carolina had the 11th fastest population growth in 2021, increasing 0.9% compared to 0.1% nationally, as people migrated from Northeastern and Middle Atlantic metros seeking an escape from high living costs, cold weather, and strict Covid-19 containment measures.

This past year has seen The Tar Heel State notch strong job and income growth, with mid-2022 payrolls in business services, for example, registering 9.5% above their pre-pandemic peak. There are signs of headwinds, caused in part by rising interest rates and labor force growth that has not kept up with the demand for workers. Hiring in the finance sector has expanded at a healthy pace, as mortgage originations rose despite increasing interest rates - but we do expect it to slow in the near term, and for home prices to decline. The state's unemployment rate rose slightly to 3.5% in August 2022, 0.3 percentage point below its average monthly level during 2019, furthering concerns about labor shortages and driving up business costs through wage inflation. We expect North Carolina to weather an impending recession very well and continue to outpace the national economy in the years to come, but a bumpy near-term economic future may make it even more of a battleground state than before.

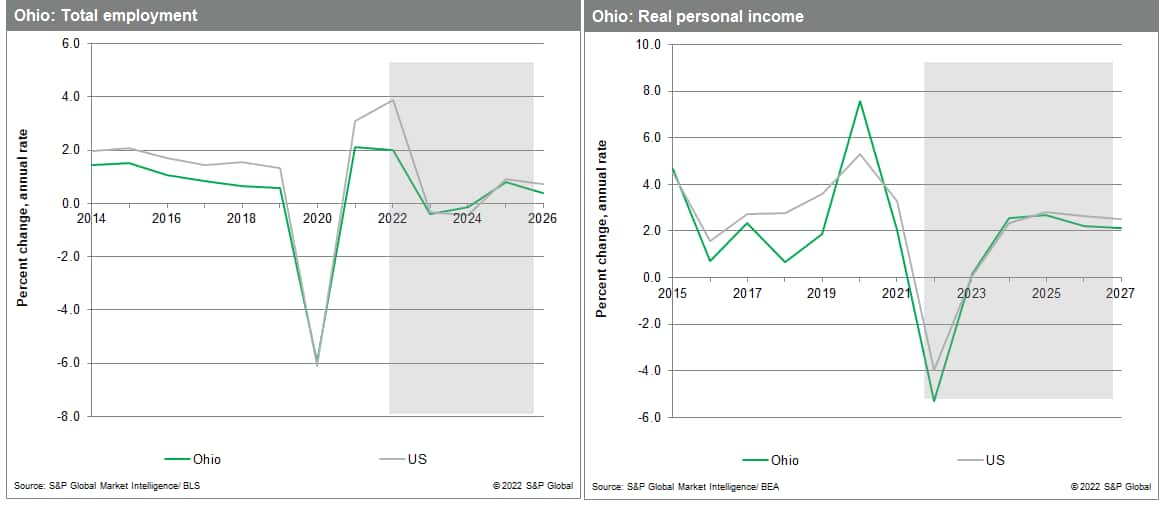

Ohio

Ohio has experienced steady employment gains since autumn 2021, but its total payrolls are still down about 2.0% from their pre-pandemic peak in February 2020. For comparison, payrolls in the US are 0.3% higher than in February 2020. Ohio's job shortfalls are concentrated in three industry sectors: leisure and hospitality, education and health care services, and state and local government. In most cases, the weakness in hiring is as much a supply-side issue as a demand-side one, with many businesses reporting a dearth of qualified applicants. Ohio's unemployment rate was 4% in August 2022, compared to the US rate of 3.7%, as the state's relatively low population growth is constraining the potential growth of its economy by limiting gains in the labor force and in consumer demand.

Ohio secured several high-profile economic development wins in 2022. Intel's plans to build a semiconductor plant east of Columbus garnered national headlines, while several major automakers announced plans to invest billions in new or upgraded plants to construct a new generation of electric vehicles. These investments, along with similar plans in neighboring states such as Indiana and Michigan, signal an ongoing commitment by automakers to maintain a substantial presence in the region at a time of industry upheaval. Ohio's economy is not nearly as reliant upon manufacturing as it was years or decades ago, but the state is well-positioned to take advantage of new opportunities thanks to its experience and existing facilities in manufacturing. As a result, despite a slowing economy from the end of 2022 through early 2024, Ohio payrolls will return to their pre-pandemic levels by mid-2023.

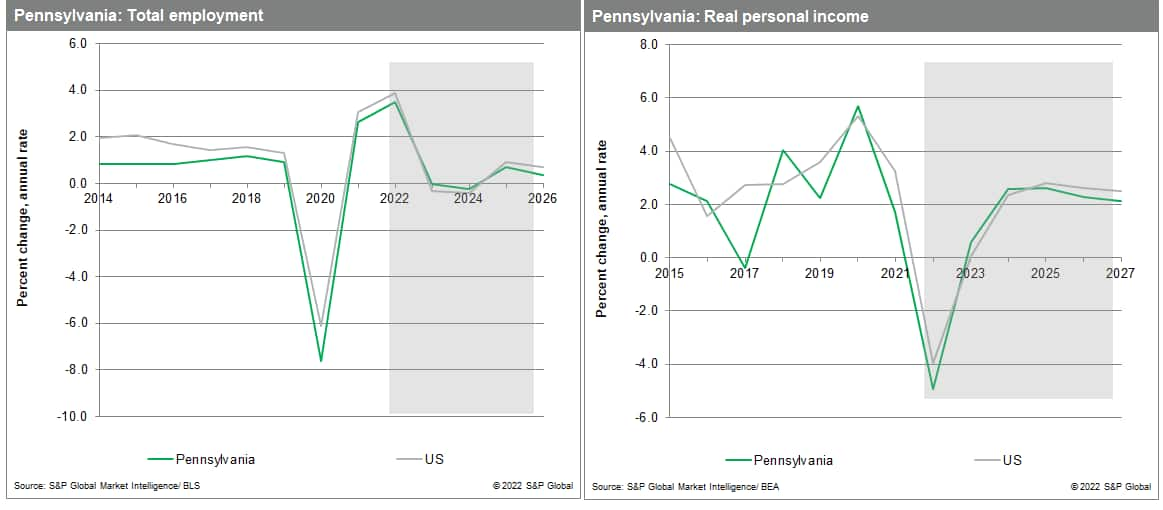

Pennsylvania

By the fall of 2022, The Keystone State had recouped 91.4% of the more than 1.1 million payroll jobs lost at the onset of the pandemic, leaving payrolls 1.6% below their February 2020 mark. The leisure and hospitality sector is a leading contributor to this job shortfall, along with education and health care services, and state and local government. Ongoing high rates of job vacancies statewide indicate that demand for labor is outstripping supply. The state's high-tech sectors continue to make outsized contributions to the state's economic growth, however. Pittsburgh has emerged as a leading center of research into and commercial development of robotics, advanced manufacturing, artificial intelligence, and related technologies. Philadelphia's life science sector, in the meantime, is seeing a resurgence of investment in the development and manufacturing of new technologies.

The Marcellus Shale natural gas deposit is a long-term asset for the state and region, although drilling in Pennsylvania has seen little growth in 2022, despite historically high output prices. The rapid increase in production over the past decade spurred a wave of pipeline-building to move the gas to markets, but that buildout has since stalled, creating a firm ceiling on output in the short- to medium- term. That said, the state's massive reserve of natural gas in the Marcellus and Utica led to construction by Royal Dutch Shell of a large plant in western Pennsylvania to process natural gas liquids into pellets to be used in producing plastics. The state is also pursuing projects in developing hydrogen production and carbon capture and storage, part of the ongoing evolution of the state's energy sector.

Wisconsin

Despite a robust recovery in The Badger State in 2020-21, Wisconsin's post-pandemic economy has begun to lose steam, with weak employment growth that ranked 49th in the country in the second quarter of 2022, second only to Kansas. Total employment is still about 2% below its pre-pandemic peak. Sagging momentum was most notable in the finance and education and healthcare services, but Wisconsin's crucial manufacturing sector has provided a bit of a boost. Despite a persistent national trend away from goods-producing industries to services, Wisconsin still has the second highest share of manufacturing jobs in the country behind Indiana. And outside of leisure and hospitality services, which continue to recover from deep pandemic losses, the factory sector added the largest number of jobs among the major employment sectors in the first half of 2022.

The silver lining to Wisconsin's recent economic underperformance is that labor markets are exceptionally tight so most people who are looking for a job have one. On the flip side, the constraint in labor supply has impacted growth, as openings remain elevated and employers scramble for hires. Wisconsin's demographics are largely to blame; the prime age workforce as a percent of the population is much lower than the nation, while the cohort aged 55 and older is greater than the US and is growing at a faster rate. Net migration to the state is also at historical lows.

Posted 07 November 2022 by Dave Iaia, Director - US Economic Service, IHS Markit and

Heather Upton, Senior Analyst, US Regional, S&P Global Market Intelligence and

Karl Kuykendall, Associate Director, US Regional Economic Service, S&P Global Market Intelligence

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.