Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 May, 2022

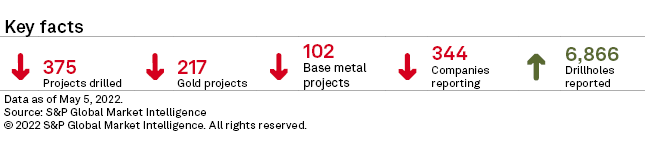

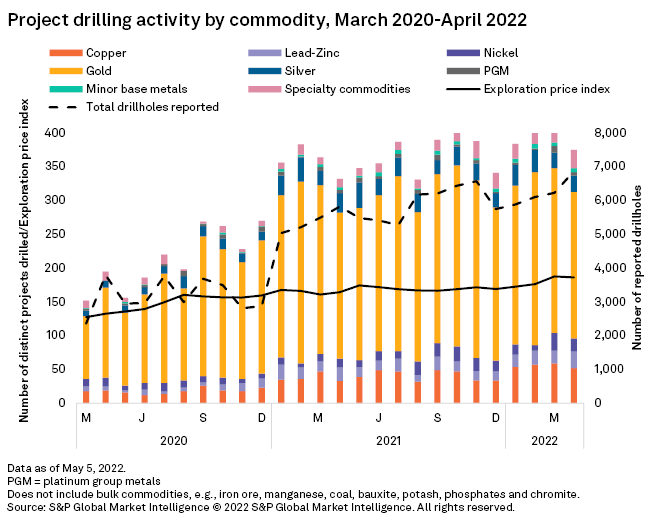

Drilling metrics decreased generally month over month in April, although the number of distinct drillholes reported rose 10.2% to 6,866 across 43 countries, reaching an all-time high. Projects drilling decreased 9.4% to 375 projects, a four-month low. Minesite drilling increased 10.2% to 65 projects, while late-stage and early-stage both decreased 21.1% to 153 projects and 2.5% to 157 projects, respectively.

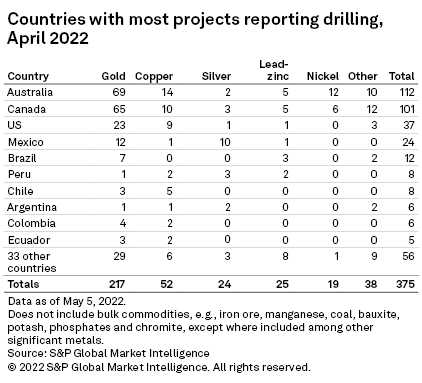

After a consecutive increase in projects drilling for three months, April remained slow for most commodities. Gold decreased for the second month, dropping 11.1% to 217 projects, with only one project in April higher than 2021's low of 216. Copper decreased 11.9% to 52 projects — still significantly higher than the 2021 average of 40 projects — while nickel decreased 26.9% to 19 projects, platinum group metals by half to five projects and specialty metals by one project to 27. Lead-zinc projects increased, rising 31.6% to 25 and surpassing January 2021's record of 22 projects. Silver and minor base metal projects both increased by one to 24 and six projects, respectively.

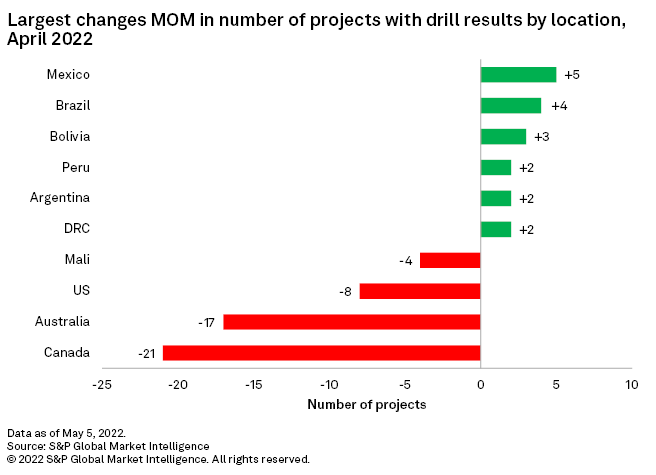

Projects drilling decreased in the top three countries, with Australia dropping 13.2% to 112 projects, Canada 17.2% to 101 projects and the U.S. going down 17.8% to 37 projects. Mexico continued behind the U.S. in fourth place, even with an increase of 26.3% that raised the number of projects drilling to 24 — a new high for the Latin American country.

April's top result came from Filo Mining Corp.'s Filo del Sol copper-gold-silver project in Argentina with an intersection of 0.91% Cu equivalent (0.56% copper, 0.41 grams per tonne gold and 6.6 g/t silver) over 1,251.5 meters. Drilling continues with seven diamond drill rigs and an additional reverse circulation rig, as the company continues to test the continuity of the Aurora zone and explore the area to seek edges of the mineralized zone of Filo del Sol.

Libero Copper & Gold Corporation's Mocoa copper project in Colombia had the second-best result, with an intersection of 0.42% Cu over 1,228.5 meters. The company announced results from the project's first diamond drillhole at month-end that demonstrated the deposit's potential. The Mocoa deposit appears to be open in both directions along strike, and at depth. Current work is identifying additional targets for expanding mineralization to be drilled in 2022.

Tesoro Gold Ltd. reported the most drillholes in April, with a total of 725 holes at its El Zorro gold project in Chile. The company announced the assay results from its 300-hole (over 100,000 meters) drilling campaign at the project's Ternera gold deposit. These results will allow the company to model and calculate an updated mineral resource estimate in May.

Equinox Gold Corp. reported the second-most drillholes, with a total of 372 at its Fazenda Brasileiro and Santa Luz gold mines in Brazil. The company announced positive drill results from its 2021 exploration drilling in the 70-km-long greenstone belt in Bahia State that hosts the two gold mines. With potential for both open pit and underground resource growth at Fazenda, as well as additional mineralized systems close to both mines, the company secured additional exploration permits covering 323 square kilometers.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.