Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 16 Dec, 2022

By Alexander Johnston

Introduction

Interest in data marketplaces appears to have increased in the past year, with data monetization services cementing themselves as a core component within enterprise digital road maps. Of respondents to 451 Research's Data & Analytics, Data Platforms 2022 survey, 38% "completely agreed" that data marketplaces would be among their organization's top five strategic priorities over the next three years. A further 44% "mostly agree." This compares with 33% and 42%, respectively, the year prior. This enterprise interest will be a welcome sign for data marketplaces, which have struggled to gain the traction expected since their emergence in the late 2000s.

Data marketplaces have had false starts — their history and that of monetization technology is littered with failed startups, vendors forced to diversify their offerings and aborted projects. The obituaries of these projects reveal a clear pattern. Technology vendors saw a market gap, evidenced by the growing importance of data in decision-making, but overestimated enterprise readiness for such services.

The value of third-party data has become clear recently, with sharp interest in supply chain and risk visibility given ongoing disruptions. Many enterprises have seen a major evolution in their ability to integrate, analyze and leverage diverse sources of data, and there is a growing pool of prospective customers that are digitally mature businesses. These companies are not only well positioned to drive new sources of revenue or integrate third-party data into product strategies, but increasingly have an appetite to do so. Vendors will play a key role in simplifying the process of acquiring or selling data and insulating monetization projects from an evolving regulatory landscape.

A long-heralded trend finally maturing

Data marketplace initiatives are not new. The opportunity provided by data marketplaces, as a means of simplifying the process of acquiring new data or monetizing data assets, is well established. Data marketplace offerings have had a number of false dawns, but an evolving regulatory landscape, fast-maturing data roadmaps and sustained enterprise interest suggest that the monetization technology may finally be coming of age.

The latest drive toward data marketplaces appears to represent a major step change for a space that has faced challenges due to lower-than-expected levels of enterprise uptake. These challenges have been particularly pronounced for startups. A notable pivot has taken place in recent years with some data monetization vendors appearing to shift away from large one-stop data marketplaces due to a struggle to establish data customers on their respective platforms. In some instances — as with Dawex Systems SAS and SettleMint NV through its Databroker offering — this shift has been toward white-label or marketplace technology offerings. In other cases, the transition has been more extreme.

The startup Streamr Network AG reframed its value proposition almost entirely to account for low levels of enterprise interest in its marketplace. A significant volume of projects, including those much vaunted in the blockchain ecosystem, appear to have majorly scaled down development, or disappeared entirely.

These failed projects joined a graveyard of earlier data marketplace initiatives. Microsoft Corp.'s Azure DataMarket, launched in 2010, was retired in March 2017 due to low customer interest. Kasabi, founded the same year, closed in 2012 with owner Talis Systems Ltd suggesting the market was growing too slowly to be sustainable. Infochimps, Inc., founded in 2009, initially centered on a data marketplace before pivoting to a big data platform-as-a-service offering prior to its acquisition by Computer Sciences Corp. in 2013.

The reason these projects failed to gain traction partly reflects the difficulties in establishing marketplaces flexible enough to address the diverse topics, formats and delivery mechanisms required by enterprises. However, the most pronounced challenge has likely been enterprise readiness. On the production side, businesses have prioritized cleansing and structuring datasets that provide competitive advantage or support mission-critical capabilities — assets they are unlikely to want to expose.

Even greater constraints were felt on the buyer side, with few businesses set up in a way to easily integrate diverse data sources, or with the analytics capabilities to take full advantage of them. Maturing enterprise digital and data roadmaps are broadening both the data assets suitable for monetization and customer pools, with a growing number of companies looking to augment their analytics capabilities with third-party data.

A monetization trend driven by the most mature

The opportunity provided by data marketplaces appears to be recognized across the industries that 451 Research surveys. A more indicative factor of data marketplace interest is digital maturity. Our Data Platforms survey showed 48% of respondents that are from companies where "nearly all strategic decisions are data-driven" agreed with the statement that "data marketplaces will be in my organization's top five strategic priorities in the next three years." This falls to 21% for respondents who indicated that only "some strategic decisions are data-driven" in their organization.

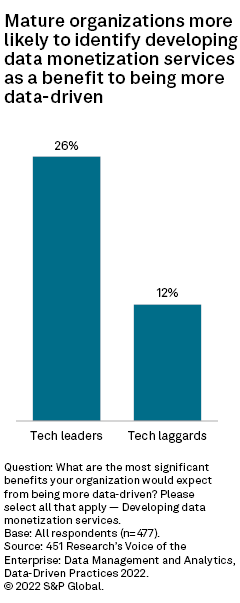

As the figure below illustrates, insights from our Data & Analytics, Data-Driven Practices 2022 survey corroborate these findings. Tech leaders — respondents who considered their organizations to be early adopters of new technology, or to act on them sooner rather than later — were more likely to view data monetization as a significant benefit in becoming more data-driven, compared to tech laggards, which are organizations that are conservative or late to the game.

To monetize data, enterprises need to have robust reporting and cleansing capabilities to refine data, clear legal frameworks surrounding data sharing, and technology to support its secure exchange. To benefit fully from purchasing third-party data, companies need to have a clear strategy for how the data will be used, alongside aligned tools and expertise.

Organizations are in the process of addressing the challenges that limit the volumes of data they will be able to monetize, or purchase and ingest. Just 7% of respondents to 451 Research's Data-Driven Practices 2022 survey faced "no barriers to being more data-driven." Areas where respondents identified serious challenges included data quality and consistency, with 35% of respondents identifying it as a significant barrier to becoming more data-driven, and 31% citing availability of skilled resources or talent.

Just under a quarter of respondents, or 24%, faced challenges surrounding the integration of legacy data sources and architecture. A similar proportion viewed achieving ease of use for relevant tools and applications as a significant challenge. As these limitations are addressed over time, a greater volume of businesses are likely to shift from being interested in the possibilities of monetization to seeing meaningful value from engaging with the trend.

Vendors and regulatory hurdles

Among companies that were targeting data monetization services, the identified barriers to becoming more data-driven indicate that technology and marketplace providers are well-positioned to capitalize on providing solutions to such common obstacles. For enterprises that viewed data monetization as a significant benefit provided by being more data-driven, just under a third of respondents saw "data exchange requirements with external parties" as a barrier to becoming more data-driven, while 30% identified "legal or compliance requirements."

This compares to 17% and 16%, respectively, from respondents in companies that did not view data monetization as a significant benefit, suggesting that an awareness of the opportunities it provides is paired with greater recognition of its legal and regulatory hurdles. Existing data protection laws, as well as evolving regulations such as the European Commission's proposed Data Act, complicate and place a significant risk profile on self-managed data monetization initiatives.

Competition in the market

The largest vendors in the data monetization space can be loosely split into two main categories. The first is third-party data marketplaces, commonly structured to reflect e-commerce platforms, connecting data consumers with providers. Marketplace providers range from hyperscalers, with Amazon.com Inc.'s Amazon Data Marketplace and Oracle Corp.'s Data Marketplace (BlueKai) prominent, to smaller specialist companies such as LiveRamp Holdings, Inc., Datarade, Openprise, Inc. and Eagle Alpha Ltd. These platforms are structured as a searchable portal for data buyers, with comprehensiveness and usability being key differentiating factors.

A more emergent space is marketplace technology. This refers to vendors that provide software to enable businesses to set up their own marketplaces, or exchange data securely with handpicked partners. The market has a number of emerging offerings, including Harbr Group Ltd.'s Data Commerce platform and Nokia Oyj's Nokia Data Marketplace. Two of the most prominent players, Snowflake Inc. and Dawex, bridge both categories. As indicated above, however, in recent months Dawex has emphasized its technology offering over its Global Data Marketplace. Marketplace technology is often used to create smaller communities of companies where data can be more closely targeted than it is with a global marketplace approach.

These established players will be set to benefit from the trends in enterprise maturity and interest that are driving data monetization initiatives forward. A more challenging question is whether a new breed of blockchain startups, taking advantage of Web3 liquidity and the trustless peer-to-peer functionality of distributed ledger technology, can eat into this market share.

Currently, this appears unlikely. Established vendors like Dawex, Nokia and SettleMint already leverage distributed ledger technology within their offerings, closing off one angle of competitive differentiation. Ongoing concerns surrounding the robustness of the crypto market both reduce the capital that new blockchain startups have access to and contribute to a reluctance among enterprises to trust their data to vendors operating in a space so prone to crises. Where these approaches may gain some traction is in the zero-party data space where consumers package their data together to sell to enterprises.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is part of S&P Global Market Intelligence. For more about 451 Research, please contact 451ClientServices@spglobal.com.

Products & Offerings

Segment