Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 29 Apr, 2022

This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.

Since the start of the Russia-Ukraine war on February 24, the global financial markets and supply chains have been stressed. With the sanctions imposed by the United States, the European Union and other countries against Russian individuals and businesses, investors are deeply concerned about the credit quality of Russian companies and the adverse spillover effect on other countries. In this article, we studied the short-term and long-term credit implications on firms in selected countries, using RiskGauge™, one of S&P Global Market Intelligence’s Credit Analytics models.

We first looked into the changes in RiskGauge scores of public companies in the United States (US), Russia, Ukraine, and some European countries. RiskGauge score is a statistical-based, holistic and timely assessment of a company’s creditworthiness comprising quantitative elements of a company’s fundamental credit risk and market-based signals. The scores are expressed in lowercase letter grade symbols (i.e., aaa, aa+, aa, …, c).[1] By comparing the pre-invasion (January 31) and post-invasion (March 31) RiskGauge scores, we can get insights on the short-term credit deterioration due to the military invasion and the subsequent sanctions. We observed 72% of Russian public companies with credit scores deteriorated by two or more notches, according to RiskGauge. Among the major Western European countries, the Netherlands, Italy, and Germany were most affected, with 43%, 42%, and 38% of their public companies with credit scores deteriorated, respectively. The credit deterioration of US public companies was also non-negligible, albeit more moderate than their European counterparts.

Figure 1: RiskGauge score migration of public companies (1/31/2022 vs 3/31/2022)

Source: S&P Global Market Intelligence. As of April 12, 2022. For illustrative purposes only.

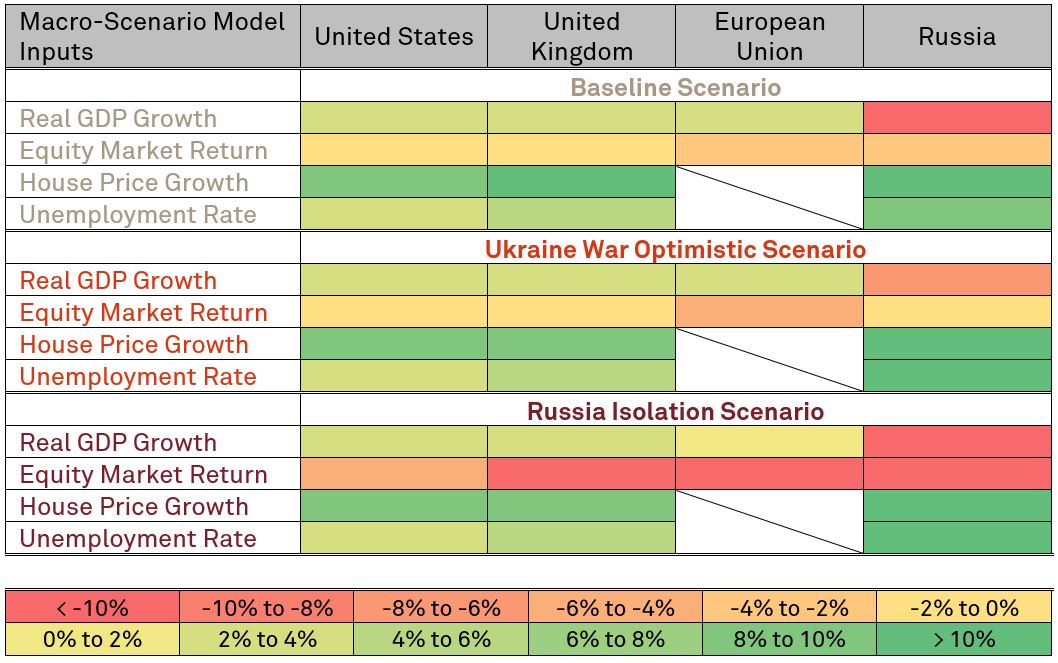

To assess the long-term credit implications, we applied the Macro-Scenario Model (MSM) on the pre-invasion RiskGauge scores. MSM enables users to estimate how a company’s credit risk may change with respect to forward-looking macro-economic scenarios. Three sets of scenarios were quantified using S&P Global Market Intelligence’s proprietary Global Link Model (GLM) for this study to gauge country specific impacts on the economy. In the Baseline scenario, it was assumed that the COVID-19 pandemic will recede significantly globally; the Russia-Ukraine war will continue for several months; and the exports of Russia and Ukraine will be durably reduced. The average price of Brent crude oil in 2022 will be around $127 per barrel.

The Ukraine War Optimistic scenario looked at the most positive outcome possible, given the present state of antagonism and destruction. In this scenario, energy flows from Russia continue, albeit at a lower level than previously; agricultural prices remain high in 2022 as the planting season is missed; and the damage to European industrial fabric is limited due to the fiscal and monetary policy support. The average crude oil price of the year will be significantly lower compared to the Baseline scenario.

The Russia Isolation scenario looked at the consequences for the global economy of cancellation of all trade with Russia and most trade with Ukraine in the years to come. This scenario quantified the implications of a destruction of trade flows to and from the region by assuming Russia and Ukraine lose up to 90% of their exports to, and imports from, the rest of the world. The average crude oil price of the year will be significantly higher compared to the Baseline scenario.

Table 1: Macro-economic scenarios for 2022[2]

Source: IHS Markit, now a part of S&P Global. As of April 12, 2022. For illustrative purposes only.

The average stressed RiskGauge probability of default (PD) for 2022 Q4 under the Baseline, Ukraine War Optimistic and Russia scenarios is shown in Figure 2. In the Baseline scenario, the average PD will increase by 0.8% in US and 1.6% in Russia. The impact to Western European countries is milder, with an average rise in PD of 0%~0.3%. The average PD in the Ukraine War Optimistic scenario is lower than that in the Baseline scenario, but only by a little. If the Russia Isolation scenario is realized, the average PD of Russian public companies will increase by a further 0.5%. Italy displays the largest PD increase among the major Western European countries in the Russia Isolation scenario, due to its heavy reliance on natural gas imported from Russia.

The average RiskGauge PD as of March 31 is also shown in Figure 2 for comparison purposes. We can see a significant difference between the short-term the long-term credit deterioration in both US and Russia. The United States will undergo a steady PD increase throughout 2022, whereas the short-term credit deterioration in Russia will partly reduce in the long-term.

Figure 2: Average RiskGauge PD and scenario-stressed PD of public companies

Source: S&P Global Market Intelligence. As of April 12, 2022. For illustrative purposes only.

Last but not least, we want to find out the industries most impacted by the Russia-Ukraine war. We expanded the dataset to include large private companies (turnover>$50 million). Again, we applied the three country-level scenarios to the pre-invasion RiskGauge PD using MSM and calculated the average scenario-stressed PD per industry.

In the United States, the most impacted industry is the Airlines, followed by the Wholesale and Retail, and Automotive, due to the globalized nature of their supply chains and business models. These 3 industries are sensitive to the oil price and hence will suffer if the oil price remains high at the end of 2022. In contrast, Energy, Real Estate, and Financials are least impacted by the war. The average stressed PD are similar in the Baseline and Russia Isolation scenario, except Energy and Automotive. The higher oil price in the Russia Isolation scenario is beneficial to Energy industry, whereas the slower economic growth and higher unemployment rate place extra pressure to the Automotive industry.

In Russia, the war is destructive for the Hotel and Gaming, Services for Business, and Airlines sectors, as the average PD will increase by about one-third in the Baseline scenario. In the Russia Isolation scenario, the average PD of Automotive, Utilities, and Transport will increase by more than one-half. The creditworthiness of energy industry remains stable in both the Baseline scenario and the Russia Isolation scenario.

Figure 3: Average RiskGauge PD and scenario-stressed PD per industry

Source: S&P Global Market Intelligence. As of April 12, 2022. For illustrative purposes only.

If you would like to learn more about the solutions we used to conduct this analysis, please click here >

[1] S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

[2] The detailed dataset is available to the users of IHS Markit’s Economics and Country Risk products.

Products & Offerings