Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 13 May, 2021

What are the key themes we expect to shape the Financial Industry in H2 2021 and beyond?

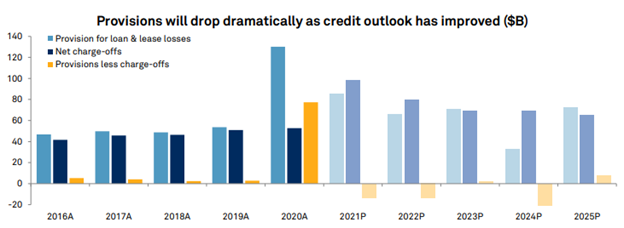

1: Credit quality

Government stimulus programs greatly eased the pandemic’s economic impact, but credit quality may fare worse in some countries than others amid an uneven recovery.

U.S. credit losses should be manageable as the economy transitions from relief efforts to growth mode. Many U.S. banks are increasingly optimistic about the economic outlook. Their earnings outlook remains subdued because of weak credit demand and excess liquidity. But as the recovery matures, banks expect loan demand to increase, perhaps in the second half of the year.

Markets are waiting to see if asset quality deteriorates more rapidly in Spain, Italy, and Portugal —tourist hotspots that were badly hit by COVID-19— than in northern Europe. Many emerging markets in Asia-Pacific are still grappling with lockdowns and vaccine delays. Limited ability to ease fiscal response and a coronavirus resurgence could pose headwinds in countries like India. Asset-quality risks will come into focus once forbearance measures are withdrawn.

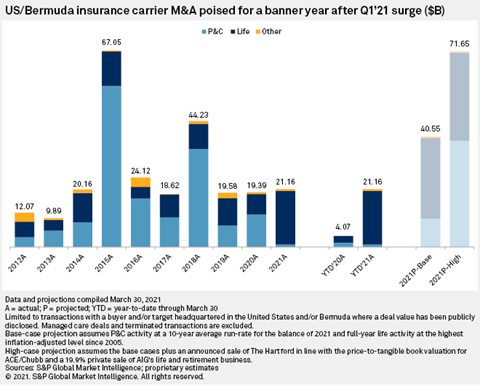

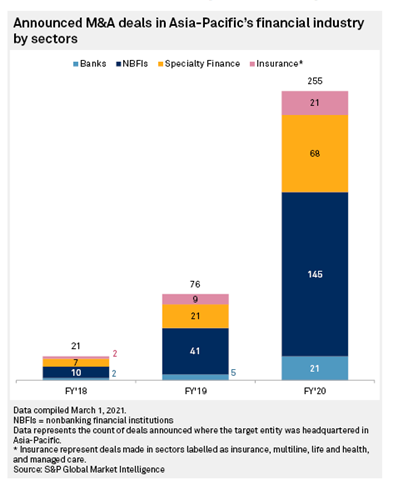

2: Mergers and Acquisitions (M&A)

M&A is top of mind for many financial institutions —now more than ever as they seek efficiency in this challenging environment. Low interest rates have hindered earnings potential at companies from banks to life insurers.

The insurance sector has attracted a lot of interest from private equity buyers, as these investments provide permanent capital and deliver a steady stream of fees.

M&A could remain robust in the APAC region as regulators in large economies like China and India ease rules for the participation of foreign financial institutions. Meanwhile, growing competition from domestic consumer banks could prompt international banks to rethink their operations.

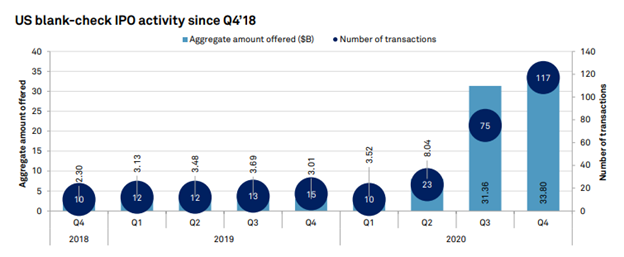

3: The rise of Special Purpose Acquisition Companies (SPACs)

The market for SPACs exploded in 2020. Blank-check companies offered private companies an alternative to go public when market volatility spiked during the pandemic. But enthusiasm has waned as SPACs face questions about their accounting methodology and their targets' revenue projections. The scrutiny will likely intensify in the U.S.

In Europe, more SPAC-related activity is expected in Amsterdam and London. Asian countries including Singapore, Hong Kong, Indonesia, and Japan are contemplating a change in regulations to allow SPAC listings.

4. Low rates and wildcards

In the coming year, financial institutions of all types will monitor rising —but still low— interest rates.

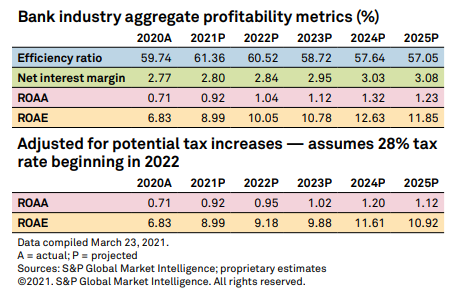

In the U.S., further stimulus —and bottom-line pressure— could come from the Biden administration’s infrastructure proposal, which would likely entail a higher corporate tax rate.

Other wildcards could include further geopolitical and social unrest, catastrophe losses, and a more widespread COVID-19 resurgence.