Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Nov, 2022

Introduction

This year's Macroeconomic Outlook: Consumer Spending, Holiday Spending Preview survey uses the 451 Population Representative sample to get an advance look at consumer sentiment toward the upcoming holiday season. The survey looks at overall consumer spending, holiday plans and factors impacting spending, as well as consumer confidence in the economy and employment.

The upcoming holiday season is helping to lift overall consumer spending compared with the third quarter. Although the outlook for holiday spending appears lower than in 2021, the amount that households plan to spend should still raise overall consumer spending from where the baseline would otherwise have stood. Notably, this increase in spending is being driven by higher-income households. For lower-income households, the holiday season tends to add pressure on household budgets that have already been stretched by rising costs. Despite some improvements coinciding with the holiday season, consumer confidence in the job market and overall economy remains tepid as talk of a looming recession and persisting inflationary pressures dampen consumer spirits.

Summary of Findings

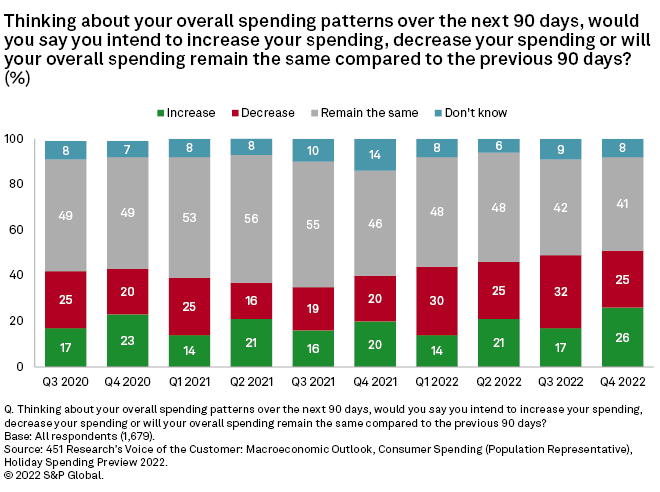

Consumer spending momentum remains extremely tight. Throughout 2022, the consumer spending outlook has oscillated between net positive and net negative, unable to maintain forward momentum, but also not falling off a cliff despite worries of a recession. In our latest survey, 26% of respondents (up 9 percentage points compared to last quarter) plan to spend more in the next 90 days than in the previous 90 days — including holiday shopping — for the highest total of 2022. This uptick is almost completely offset by the 25% of respondents who still plan to spend less (a 7-point increase compared with last quarter). This narrow net positive, which is also an improvement over last quarter's results, can be attributed to the power of holiday shopping to lift overall spending plans.

Holiday spending plans fall back to earth. Consumer holiday spending is showing a pullback this year, after a huge surge in pent-up demand and revenge spending, combined with pandemic-era government assistance programs, lifted the 2021 holiday season well past the abysmal showing of 2020. The survey shows 7% of respondents planning to spend more year over year, versus 26% saying they will spend less and 66% saying they will spend roughly the same amount. Despite the relatively modest number of consumers planning to spend more, it is enough to give a moderate boost to overall spending plans.

Holiday spending plans highlight the economic gulf between income groups. The positive spending outlook over the next 90 days is being driven by higher-income respondents making more than $100,000 per year (net +26) while lower-income respondents making less than $50,000 per year (net -10) are feeling rather gloomy. This also extends to holiday shopping, where higher-income households (net +6) are showing a positive outlook while lower-income households (net -29) are showing a big pullback. Since much of holiday spending is discretionary, these results, in particular, showcase contrasts as lower-income households — in the face of pandemic-era assistance programs ending and rises in cost of living — were already making tough choices about discretionary purchases before the holiday season added more pressure to already tight household budgets.

Lower-income households are being pummeled by higher inflation and energy prices. Respondents rank inflation and energy prices as the top economic threats to personal finances, with greater concern among lower-income households (57% said inflation, 33% energy prices) than those with higher income (38% said inflation, 26% energy prices). The full impact can be seen when we look back one year. Inflation and energy prices were among the top concerns, along with COVID-19. As concern over COVID-19 waned in the last 12 months, inflation and energy prices surged. Lower-income households have taken the brunt, as the threat of inflation among this group jumped 24 points and energy prices 11 points. For higher-income households, the increases are only 2 points and 5 points, respectively.

Higher-income households have more resources to offset the impact of inflation and energy costs. Almost universally, the first strategies respondents look to are earning more money or saving less in times of financial stress. These can be the easiest and most sustainable options. However, higher-income households have other cards they can play compared with lower-income households, including credit card use (37% versus 20%), taking money out of savings (34% versus 20%) and liquidating investments (12% versus 3%). Even taking out a loan is easier for higher-income households (14% versus 9%). Importantly, a much larger percentage of lower-income respondents (22% versus 8%) do not know how they will continue paying higher prices if inflation doesn't abate soon.

Lower-income households struggle with affordability of basic necessities, while higher-income households plan to increase discretionary purchases. An increased cost of living is affecting everyone, but it has a disproportionate impact on lower-income households. It is not just that cost of living has gone up, it is what lower-income households must do to make ends meet. To keep up with rising costs, lower-income households plan to increase spending on nondiscretionary items (net +36), with groceries, energy/utilities and housing taking the largest chunks of their budgets. To afford the rising cost of necessities, lower-income households plan to decrease spending on discretionary items (net -12), with travel/vacation, movie theaters, apparel and restaurants taking the biggest cuts. Higher-income households plan to increase spending on both nondiscretionary (net +27) and discretionary (net +6) items. Importantly, nondiscretionary items take up less of their household budgets, allowing them to spend more on travel, restaurants and consumer electronics, in addition to groceries and energy/utilities.

More consumers prefer online shopping this holiday season, even as some return to stores. The adoption of online shopping channels looks to continue this holiday season as 43% of respondents say it is their preferred way to shop. Furthermore, 31% of respondents indicate they plan to spend more online than in 2021, with Gen Z (52%) and millennials (46%) leading the charge. Interestingly, 17% say they plan to spend more in-store. While baby boomers (23%) stand out as the most likely to return to in-store shopping, all other generational groups are hovering at 14% to 15%, showing there is a consistent segment of consumers returning to in-store shopping that cuts across age groups.

Confidence in the job market remains mixed. We asked respondents how much they worry about someone in their family losing their job. While there has been a lot of fluctuation in recent quarters, the current data shows a net four-point improvement over the third quarter. While consumers are comfortable in their personal job situations, the number of respondents citing the overall job market as a threat to their personal finances ticked up as well, driven mostly by rising concerns among Gen Z and millennials. These results reflect an environment in which talk of a looming recession makes consumers uneasy, but repeatedly strong jobs reports show there are also many open positions that need to be filled.

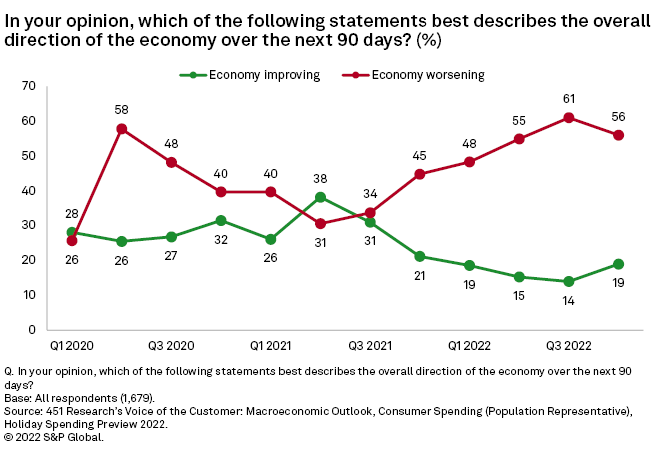

Confidence in the economy shows some improvement as well. After declining for five straight quarters, consumer sentiment about the direction of the economy has improved somewhat. Still, the results reflect a high level of negativity among consumers, with 56% saying the economy will worsen over the next 90 days, compared to 19% who say it will improve. Sustained inflationary pressures resulting in higher prices for essential items and the ending of pandemic-related government assistance continue to drag on overall consumer sentiment. Improvements this quarter are likely a shorter-term uptick due to the upcoming holiday season.

451 Research's Macroeconomic Outlook product line combines two survey methodologies that together deliver a holistic view of the connected user. The combination of 451 Research's Population Representative surveys and Leading Indicator surveys provides a comprehensive package of quantitative and qualitative analysis.

The U.S. Consumer Population Representative survey was fielded Oct. 7-26, 2022. It poses a core set of questions on demographics and device ownership before each respondent is randomly assigned to one of three sections that dives deeper into current ownership, usage trends and future buying plans for specific topic areas. The Consumer Spending section contains 1,700 U.S. respondents.

The Leading Indicator survey was conducted Oct. 4-21, 2022. It tracks overall spending patterns as well as cost of living and retirement plans among a targeted group of business and tech professionals, as well as early-adopter consumers.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is part of S&P Global Market Intelligence. For more about 451 Research, please contact 451ClientServices@spglobal.com.