Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 15 Jun, 2022

Introduction

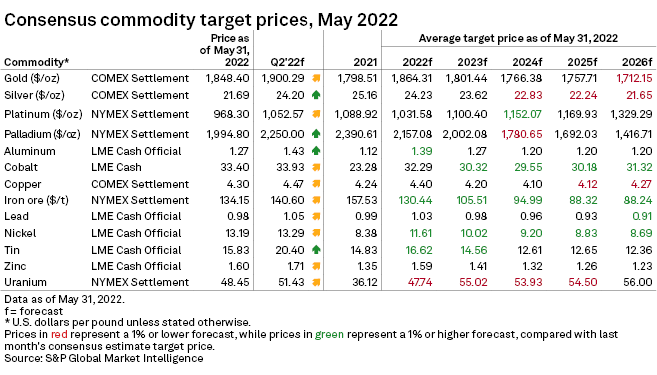

S&P Global Commodity Insights discusses consensus price forecasts for industrial metals and precious metals, including platinum group metals, amid broader market trends. Most metals prices dropped month over month in May, following the U.S. Federal Reserve's 50-basis-point rate hike, with a broad market sell-off of industrial metals further weighing on prices.

As April turned to May, headlines seemed to stay the same. Inflation reached multidecade highs in the U.S., U.K. and Eurozone. China was battling a resurgence of COVID-19 cases with citywide lockdowns that have stalled production and further weakened already fragile supply chains. Central banks were trying to counter rising inflation with interest rate hikes, or the prospect of hikes, while in China the government planned to deploy large-scale economic support. Metals markets were strained by these measures, as a strengthening U.S. dollar weighed on prices and the overall macroeconomic uncertainty triggered a broad market selloff. Consensus price forecasts were surprisingly positive for the most part, with only precious metals gold and silver, and bellwether commodity copper, downgraded on the prospect of further and more substantial interest rate hikes worldwide.

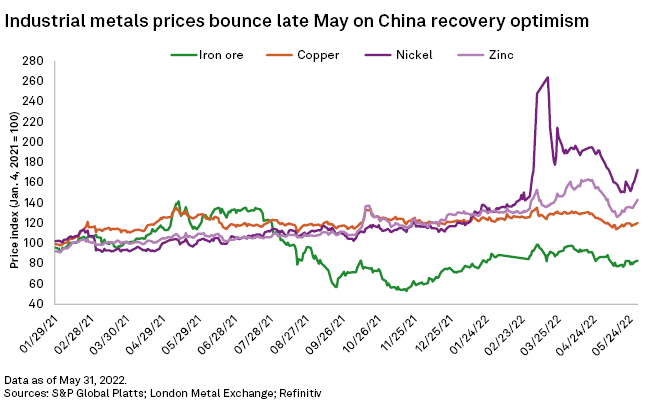

The macroeconomic environment remained in turmoil in May. The war in Ukraine has taken its toll on European economies, with disruptions to supply chains and commodities markets stoking inflation. The Eurozone could be headed for a recession, as inflation spreads beyond energy to nondurable and durable goods alike, prompting the European Central Bank to signal the possibility of its first interest rate hike in a decade. Global economic woes also stem from the slowdown in China as the repercussions of its strict zero-COVID policy are being felt. The country's factory output and new orders fell in the month despite lower selling prices aimed at stimulating demand, and both the Caixin and National Bureau of Statistics purchasing managers' indexes remained in contractionary territory. On a positive note, the easing of lockdowns in June, along with tax cuts, lower borrowing costs and several stimulus measures geared toward various sectors such as real estate, automotive and aviation, have fueled optimism for a stronger second half for metals demand in China.

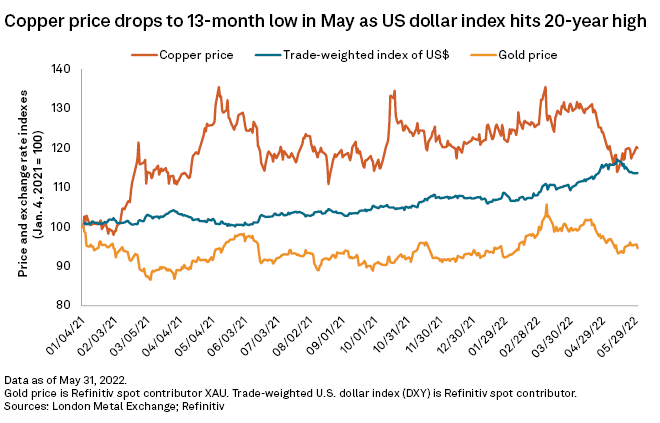

In the U.S., the first signs of a softening inflationary trend have emerged, with the U.S. Consumer Price Index up 8.3% year over year in April, down from the 8.5% increase in March. A second interest hike, which went into effect May 4, lent support to the U.S. dollar trade-weighted index, or TWI, which was up 13% year over year and 6% year-to-May 31. The U.S. Institute for Supply Management purchasing managers' index showed an unexpected increase month over month in May, indicating that manufacturing improved, although supply chain issues, specifically from locked-down China, have constrained activity.

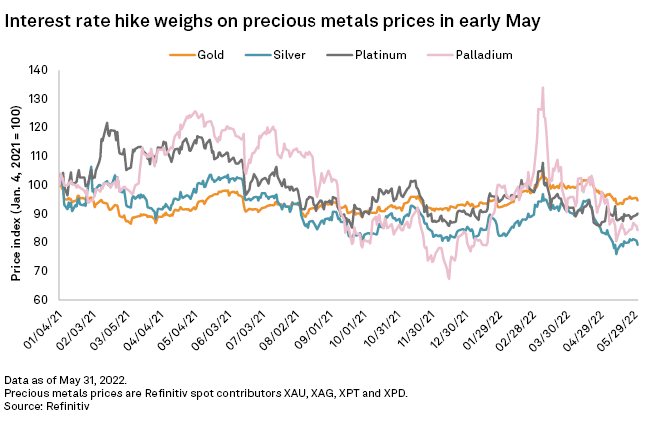

The macroeconomic environment turned against gold in May, as the Fed hiked interest rates for the second time this year in its most aggressive move since 2000. U.S. real yields moved into positive territory in May for the first time in two years, and the 10-year Treasury Note yield rose 89.4% year-to-date as inflation fears drove investors to diversify portfolios. The COMEX gold price lost ground to end May at $1,848 per ounce, despite being up year-to-date on gold's safe-haven status. Consensus price forecasts are split, with upgrades over 2022-24 and downgrades in 2025 and 2026, for an overall average annual decrease of 0.3%.

Silver prices remained firmly above $20/oz in May, despite a dip to an eight-month low May 13, just after the U.S. dollar TWI reached a 20-year high. Like gold's price, the silver price came under pressure from the strengthening currency on the back of the year's second interest rate hike earlier in the month. With more U.S. interest rate increases slated, consensus price forecasts for silver have been downgraded an average of 1.1% annually — the second-largest downgrade after uranium — over the forecast horizon.

Platinum and palladium prices again took diverging paths in May, although their directions were reversed compared with their April trends. Between end-April and end-May, platinum was the only commodity surveyed to post a gain, up 3%, while palladium dropped the most, losing 14% to close the month below $2,000/oz. In early May, the U.K. announced a 35% increase in tariffs on certain Russian products, including platinum and palladium, in a new package of sanctions, causing prices of the two metals to briefly spike. Automakers have been increasing their use of platinum over palladium, driven by both supply concerns and tighter emissions regulations, and the World Platinum Investment Council is expecting auto sector demand for platinum to increase year over year in 2022 despite the prevailing macroeconomic headwinds. Consensus price forecasts for platinum have been upgraded an average of 0.2% annually and are broadly unchanged for palladium through to 2026.

The London Metal Exchange three-month, or LME 3M, zinc price was on a downward trend in the first half of May, subdued by a strengthening U.S. dollar TWI and a lockdown-mired Chinese economy. Although high power prices in Europe, potentially exacerbated by the EU's ban on Russian oil, are constraining refined zinc production, global demand is subdued. With low supply countering low demand, consensus price forecasts for zinc are similarly somewhat neutral, with an average 0.1% upgrade annually across 2022 and 2026.

Copper prices were under pressure in May as a deterioration in the global economy weakened demand. The 50-basis-point interest rate hike in the U.S. to combat inflation drove the trade-weighted dollar index to a multidecade high and the LME 3M copper price to a 13-month low May 12. A broader metals-market selloff also helped draw the copper price down, while stalled manufacturing in China due to citywide lockdowns weighed on demand, although announced supportive measures and easing of lockdown restrictions in June should help alleviate demand concerns in the short term. On the mined supply side, companies in Chile have reported lower first-quarter production, and companies in Peru and Mexico are lowering full-year guidance, bolstering expectations that supply will lag demand in the medium term. Consensus price forecasts are mixed, with 0.1%-0.4% upgrades over 2022-24 and slightly larger downgrades for 2025-26.

The LME 3M nickel price was on a roller-coaster ride in May, first dropping to a low of $26,159 per tonne May 18, a level not seen since March 2, before rallying to $28,231/t the next day. Like copper, the risk-off tone led to a broad selloff in the nickel market in the early weeks of May. Investment funds' long positions have also been on a general downtrend since mid-March, hitting a near two-year low in the month and weighing on prices. On the other hand, Beijing's stimulus announcement was behind the overnight price rally. As the gloomy macroeconomic environment weighs on demand, Indonesia is expanding production of battery-grade nickel intermediate products, which should widen the global primary nickel market surplus in 2022. Consensus price forecasts are nevertheless positive, with annual upgrades through to 2026 averaging 2.8%.

Battery-grade cobalt demand was subdued in May because of reduced plug-in electric vehicle production and sales. Auto manufacturing has been strongly derailed by the COVID-related lockdowns in China and supply constraints in Europe, leading to long lead times despite lower sales. Global demand from battery applications in consumer electronics is also being suppressed as inflationary pressure limits consumer spending. The LME cobalt cash price dropped 11% in May, although it may correct on reduced downstream availability, as shipments from the Democratic Republic of Congo have been impacted by flooding in South Africa's main export hub, the Port of Durban. Pent-up demand as major Chinese industrial cities emerge from lockdowns in the short term, and the ongoing fleet electrification worldwide amid the broader green agenda in the long term, underpin the upgrades to consensus price forecasts across 2022-26 at an annual average of 3.5%. The 2026 estimate is up 9.6% — May's largest increase.

The citywide lockdowns in China weighed on iron ore demand in May, causing the IODEX 62% Fe iron ore price benchmark to drop to a four-month low of $127.35/t May 13. Halfway through the peak construction season, Chinese steel-mill profit margins turned negative on subdued demand from the weakened domestic property sector, while demand exclusive of China has been tempered by fallout from the Russia-Ukraine conflict and interest rate hikes to counter surging inflation in major economies. Reported first-quarter iron ore production was mixed for major companies, but the overall market remains tight, limiting the downside to prices. The outlook is positive nevertheless, with consensus iron ore prices upgraded an average of 3.7% annually — the largest upgrade — across 2022-26.

S&P Global Inc.'s economics group is separate from, but provides forecasts and other input to, S&P Global Ratings analysts.

S&P Global Platts is an offering of S&P Global Commodity Insights. S&P Global Commodity Insights is owned by S&P Global Inc.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.