- The "IRA economy" — in which the tax code is used to accelerate cleantech deployment — has been firing on all cylinders since the new law kicked off the "deployment decade" in August 2022. But it will be tested in the coming months as the US Federal Reserve maintains higher interest rates to fight inflation.

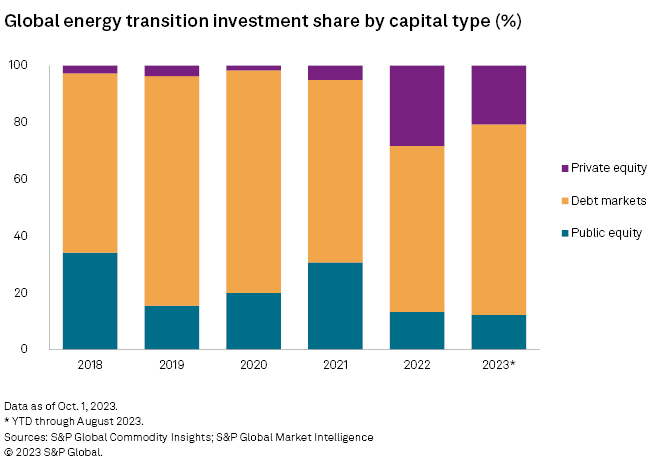

- Clean energy companies will test debt market capacity over the next six to 12 months as they look to start construction on announced and often equity-backed projects predicated on receiving Inflation Reduction Act (IRA) funds. As much as $340 billion of US energy transition projects could be under review as debt discussions unfold.

- Private debt and private loan funds have been able to take on a high proportion of energy transition project finance debt in recent months. But they are often charging interest higher than 12%, making them either unworkable or unappealing for projects that require billions of dollars in capital and years of construction activity before seeing their first dollar of IRA tax incentives.

- For the largest projects expecting to qualify for IRA tax credits, however, there is no viable path forward without bank debt project financing. Much of the new debt issuance for energy transition project finance in 2023 has been sourced from European and Asia-Pacific banks, some of them taking a leading role on US project finance rosters for the first time.

- Much of the road ahead for the largest US energy transition projects is dependent on the appetite of large asset managers for the debt and securitized loan products that banks originate in their deals with project developers then sell to other buyers.

- Asset managers will need to believe in the potential for a viable market for these projects' energy output and commodity fuels, have confidence in the construction and deployment timelines and budgets, and perhaps most importantly, trust in the viability and durability of the IRA tax credits — whether via direct pay or in the transfer market.

Investing in Energy, a group within S&P Global Commodity Insights, produces content for Connect by S&P Global.

Select content from Investing in Energy is featured on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.