Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 6 Jul, 2022

By Zoe Roth and Rich Karpinski

Introduction

Understanding citizen or consumer interest in so-called "smart city" initiatives can be critical for city governments looking to achieve a return on investment for their technology deployments. With smart cities enabled by new digital technologies dedicated to enhancing the quality of life by providing new services, citizen opinion offers valuable insight into the deployment calculus. Although some smart-city initiatives aim to provide insight or management on a citywide operations level, the goal of all smart-city efforts is ultimately to enhance efficiency and improve the quality of life for individual citizens.

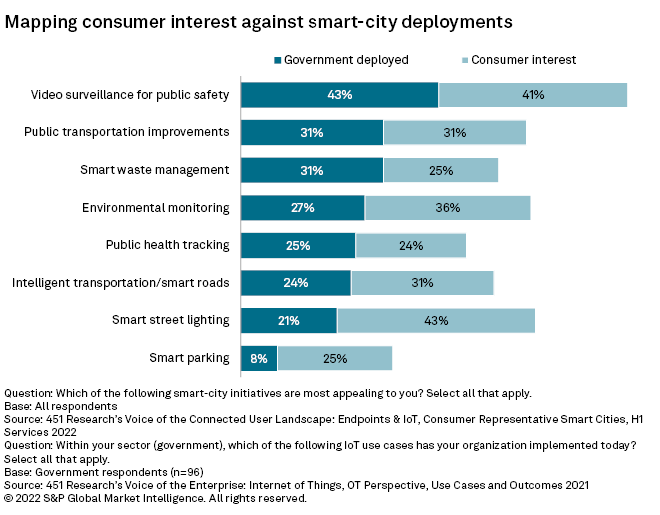

Here we compare data on the smart-city deployments reported from government respondents in 451 Research's Voice of the Enterprise: Internet of Things, The OT Perspective, Use Cases & Outcomes 2021 survey with consumer interest data collected from our Voice of the Connected User Landscape: Endpoints & IoT, Smart Cities, Services 2022 survey. The survey responses show that smart street lighting, intelligent transportation (roads and parking) and environmental initiatives have the greatest citizen demand but lag in current city deployments.

While cities vary widely in their geography and access to the funding needed to deploy smart-city technology initiatives, citizens' perspectives offer valuable insight into the appeal of various use cases. Prioritizing deployments that generate widespread interest, no matter the size and scope, could help cities better manage resources and provide citizen-focused services. While some current smart-city deployment priorities reflect significant consumer interest, other use cases generated outsized interest from respondents, presenting an opportunity for cities and technology vendors to target these areas and generate critical deployment wins.

Areas in which consumers express interest that essentially outstrips current deployment levels represent a sweet spot that can inform cities or technology vendors looking for valuable initiatives to pursue. Use cases with high levels of citizen interest but relatively low levels of deployment include:

Smart street lighting.

Smart parking.

Intelligent transportation/smart roads.

Environmental efforts and sustainability.

The single-use case where deployment outstripped interest in our survey data was smart waste management. While optimizing trash pickup and minimizing truck rolls is a valuable cost-saving measure for cities — 31% of surveyed city governments have deployed technology for smart waste management — citizens expressed slightly less interest in the initiative, with just one in four finding it appealing. Use cases that optimize city operations, like open access to citywide data or timely removal of waste, are often deployed at a higher rate than consumers are necessarily interested in, despite playing a valuable role in city operations.

Equilibrium: Where citizen interest/city plans match

Consumer interest and current municipal deployments roughly "matched" for three use cases: video surveillance, public transport management and public health tracking. While these use cases varied in the appeal they generated, reported deployment mirrored interest.

Video surveillance.

Public transport management.

Public health tracking.

451 Research's quarterly U.S. consumer population representative survey polls consumers about connectivity-related devices, services, digital media and applications. The Smart Cities 2022 survey was fielded from April 4-25, 2022, among approximately 5,000 respondents. 451 Research's Voice of the Enterprise: Internet of Things: Operational Technologies Perspective Use Cases and Outcomes survey focuses on OT insights into IoT use-case deployments and their impact on business outcomes. This survey was fielded from July 7-22, 2021, among 600 OT professionals, including 96 government respondents.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is part of S&P Global Market Intelligence. For more about 451 Research, please contact 451ClientServices@spglobal.com.