Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 26 Jul, 2024

By Alice Yu and Anna Duquiatan

S&P Global Commodity Insights reports on investments and growth in global battery capacity. The article leverages the Battery Cell Manufacturer Database provided by the Global Clean Energy Technology service, which tracks known company announcements of battery capacities, including lithium-ion, alternative chemistries such as sodium-ion, and various flow batteries. The demand database includes rechargeable batteries used across the automotive, energy storage and portable electronics sectors.

➤ Global battery cell manufacturing capacity is forecast to reach 7.2 TWh in 2030, based on company announcements through the end of the March quarter. This is over three times the 2023 total and well above the projected demand of 4.0 TWh.

➤ New capacities are at risk of being delayed or canceled due to slowing demand and overcapacity, with emerging players most at risk.

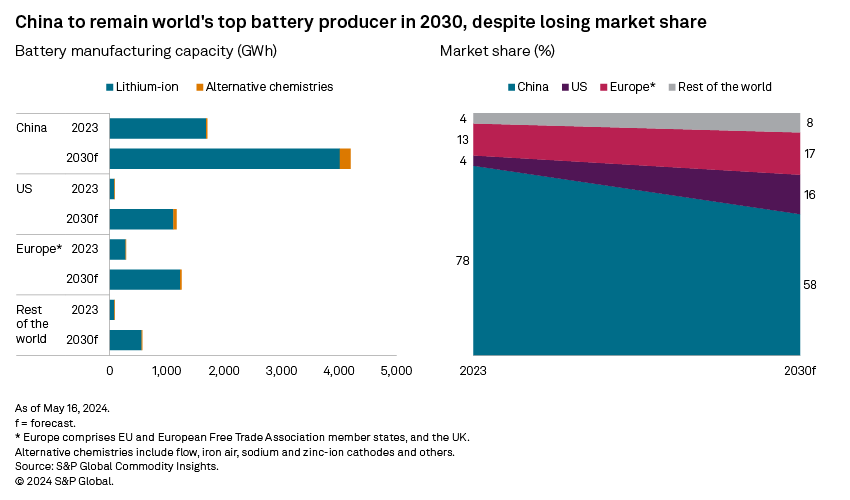

➤ China will remain the top battery-maker by 2030, but its market share is forecast to shrink.

➤ Battery capacities in the US and Europe will grow more rapidly, supported by rising incentives for establishing localized capacities.

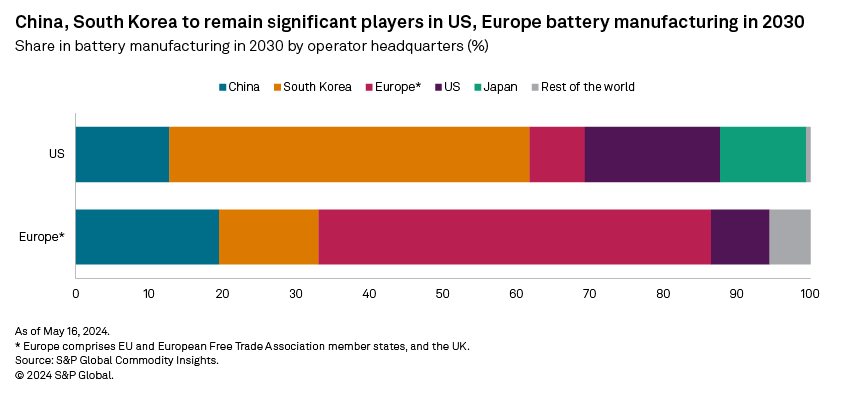

➤ China- and South Korea-headquartered battery-makers will remain indispensable partners in the capacity buildouts in the US and Europe, given their tier-1 expertise on scaling up capacity and as reliable partners to automakers.

➤ The share of vehicles utilizing lithium-iron phosphate (LFP) batteries will rise as EV markets transition from being premium to mass-market, bringing benefits in terms of cost, safety and greater supply security.

➤ A truly localized supply needs to solve key questions, including whether and how to gain technical know-how from current sector lead China, where to obtain cathode supply, and regarding the sourcing of cost-competitive, regionally made lithium, iron and phosphate inputs.

Batteries play a vital role in the global green transition, enabling the electrification of transportation and providing storage for intermittent renewable energy sources. Battery demand is expected to rise by a notable 18.9% compound annual growth rate (CAGR) between 2023 and 2030, led by growth in the already-dominant EV sector amid accelerating replacement of internal combustion engine cars. The automotive share of battery demand will rise to 91% from 83% within that same time frame, faster than growth in the battery use in energy storage, with its share of battery demand falling to 6% from 10%.

Battery capacity overhang to widen through to 2030, putting plans at risk

Battery cell manufacturing capacity growth is expected to outstrip demand over our forecast period, set to rise to 7.2 TWh in 2030, at a 16.1% CAGR from 2023, based on company announcements through the end of the March quarter. There is currently no shortage of battery capacity, and we expect the surplus to widen through to 2030 as governments increase funding to battery value chain projects, automakers scramble to secure battery capacity in line with EV production needs, and battery-makers vie for market share. We estimate the capacity overhang will nearly triple to 3.2 TWh by 2030 from 1.2 TWh in 2023. Overcapacity and a slowdown in EV uptake have delayed or lead to the cancellation of battery capacity plans this year across the entire industry, including the industry leaders. LG Energy Solution Ltd. said it will lower capital expenditure in the battery sector this year. China's SVOLT Energy Technology Co. Ltd. canceled a planned battery plant in Brandenburg, Germany, after a key customer dropped out.

US, Europe ramp up expansions; China market share to shrink

As a base of production, China's dominance in global battery capacity will weaken as manufacturers headquartered in the country are pivoting from exporting to establishing capacities abroad, especially those with deals to supply to end-users in Europe, and where possible, the US. We expect China's capacity share to decline to 58% in 2030 from 78% in 2023.

The US battery capacity pipeline is forecast to grow faster than in Europe based on greater financial commitments in the country since 2021, although we expect their respective capacities to add up to around 1.2 TWh each in 2030. The US and Europe will account for 16% and 17% battery capacity by 2030, respectively, up from 4% and 13% in 2023. The definition of Europe in this article includes EU member states, European Free Trade Association countries and the UK.

The Infrastructure Investment and Jobs Act of 2021 and the Inflation Reduction Act of 2022 have reshaped battery supply chain incentives in the US. According to the US Energy Department, the two pieces of legislation have attracted over $89.5 billion of announced investments in the battery supply chain, including extraction, processing and battery manufacturing. Key components include:

– Dedicated $6 billion federal funding for individual projects. The funding is in phase-two, with a total of $3.5 billion. Phase-one selection awarded $1.92 billion for 15 selected projects.

– Production tax credits for advanced manufacturing under Section 45X, including $35/kWh for battery manufacturing and 10% of production cost for critical minerals production.

– Investment tax credit under Section 48C for the expansion of advanced energy projects including manufacturing of clean energy technology and critical minerals. Producers need to choose between receiving the 48C or the 45X for the same product manufactured at a single facility.

– Buyer EV tax credits under Section 30D with rising annual requirement on the proportion of value-added created in the US, North America and other countries with free trade agreements (FTAs) with the US.

– Loan Programs Office administers the Advanced Technology Vehicles Manufacturing program, providing loan support for vehicles, batteries, battery components and critical minerals.

The EU lags the US, having only seriously committed support to boost an integrated raw material-to-battery supply chain until 2024 due to the success of largely organic growth in battery capacity.

– EU launched the RePowerEU initiative in 2022 to kickstart post-COVID-19 recovery, focused on green transition industries, with €1.7 billion for energy storage projects also shared with other decarbonizing sectors.

– In December 2023, the EU announced a €3 billion funding package to boost battery manufacturing in Europe.

– In January 2024, EIT InnoEnergy, a joint collaboration between the EU and a private equity firm, announced a €500 million funding dedicated to the development of battery raw material supply.

– The 2024 Critical Raw Materials Act entered into force in May 2024, and stimulated a further €4.1 billion of funding from member state governments and EU-funded bodies for the development of raw material extraction, processing and recycling. Governments are hoping public sector money will kickstart private sector funds to make up for the rest.

China, South Korea to remain major players in onshoring efforts in Europe, the US

Battery producers in China and South Korea will remain indispensable, even as Europe and the US expand their respective battery capacities. Early government support for EVs in South Korea and China gave a headstart to the traction battery industry, leading to the emergence of dominant producers, including South Korea's LG Energy Solutions, Samsung SDI Co. Ltd. and SK Innovation Co. Ltd., and China's Contemporary Amperex Technology Co. Ltd. (CATL) and BYD Co. Ltd. China's and South Korea's EV subsidy programs were launched in 2010 and 2011, respectively, paired with targets for sales volumes. These policies enabled widespread battery research and development, and commercial-scale production that led to cost efficiency. While the US and France started providing purchase incentives for EVs even earlier, the design of the subsidies was unfavorable to production ramp-ups. For example, the US initiated EV subsidies in 2010 but capped financial support at 200,000 vehicles for each automaker — weakening the incentive for rapid scale-up of EV production. In France, the subsidy program first launched in 2008 targeted CO2 reduction and lacked countrywide uptake targets. Finally, in Germany and Italy, subsidies were provided from 2016 and 2019 respectively, several years behind other countries.

South Korea-headquartered manufacturers are forecast to account for 49% of battery capacity in the US by 2030, homegrown US manufacturers for 18% and China-headquartered manufacturers for 13%. Uncertainty overhangs the future of these projects, however, due to heightened scrutiny reflected by Foreign Entity of Concern (FEOC) rules in the US. An entity is a FEOC if it is owned by, controlled by or subject to the jurisdiction of a government of a foreign country that is a covered nation — currently the list comprises China, North Korea, Russia and Iran. An EV becomes ineligible for the EV tax credit if a FEOC entity supplied any of the vehicle's battery components from 2024 and any of the applicable critical minerals from 2025. This means that the US EV tax credit will not be applicable to EVs that use the applicable inputs from China-based production, regardless of the location of the producing company's headquarters.

The subsidy will also not apply to EVs that use applicable inputs from China-headquartered companies that are controlled or owned by the Chinese government, regardless of the country of operation. There remains ambiguity over the classification of China-headquartered companies' operations abroad, including fully owned subsidiaries or joint-ventures, due to likely complexities in determining the extent of state involvement and ownership in these entities. This ambiguity risks delays in automaker timelines for launching more affordable, mass-market EVs in the US. To roll these out would require the widespread adoption of the more cost-effective LFP batteries, a technology in which China has a dominant share of both manufacturing and expertise. CATL had to scale down plans for a joint battery plant with Ford Motor Co., reducing it to a technical licensing partnership only. CATL and General Motors Co. are also discussing a similar arrangement. GM President Mark Reuss said in a recent interview that the automaker was now unsure which company it could partner with for less expensive LFP batteries. It will launch the next-generation version of its best-selling Chevy Bolt in 2025, powered by LFP batteries.

Homegrown battery-makers will dominate capacity in Europe, with a 53% share of the region's total by 2030. They will be led by the French company Automotive Cells Company SE with a planned total of 179 GWh capacity for five plants across Germany, France and Italy; followed by Sweden's Northvolt AB with a combined 160 GWh planned capacity for three plants in Sweden and Germany.

Automakers may still prefer to work with battery incumbents in China and South Korea for reliable battery supply, as small and mid-tier battery producers face scalability challenges. In June, BMW Group canceled a €2 billion contract for battery cells with Northvolt due to the latter's inability to scale up and deliver the contract on time, and is now turning to Samsung SDI instead. In reality, only some of the capacity announcements will come into fruition, with emerging players especially at risk of project delay and possible cancellation. In January 2023, Power by Britishvolt Ltd. — the UK battery start-up — went into administration as funding ran out before the company could complete gigafactory construction and begin production.

In Europe, battery-makers headquartered in China are forecast to be the second-largest category of operators by 2030, accounting for 20% of the regional battery capacity, spearheaded by CATL; they are followed by South Korea-headquartered producers, with a 14% share, led by LG Energy Solution.

China's international capacity buildout is concentrated in Europe, as the continent has remained largely open to investment from the country. CATL's planned capacity outside of China will rise eightfold to 24% from 3% of its total capacity between 2023 and 2030, led by a 100-GWh battery facility in Debrecen, Hungary, targeting production start in 2025. In contrast, the US has heightened scrutiny on all forms of involvement by China-based and headquartered companies in the EV supply chain. The designation of companies as FEOCs appears to be specifically targeted at China's involvement, as the other three covered nations — Russia, Iran and North Korea — are negligible players in the US EV supply chain today.

China-headquartered battery-makers are taking a multitargeted approach and setting their footprints in countries that could provide both a growth market in themselves and also a potential backdoor into the US market through having an FTA in place. Morocco has thus emerged as a midstream supplier. Located near the growing European market, Morocco can leverage Africa's role as a rising supplier of lithium and an established provider of cobalt, manganese and graphite. As a US FTA partner, Morocco's critical minerals value-add from refining can count toward the sourcing requirements under the US EV tax credit. Zhejiang Huayou Cobalt Co. Ltd. and LG Energy Solutions are planning a lithium refining facility and an LFP cathode plant in Morocco. Furthermore, Gotion High-tech Co.Ltd. is also planning a 20-GWh battery plant, expected to begin production in 2026. Volkswagen AG's China subsidiary — Volkswagen (China) Investment Co. Ltd. — is the largest shareholder of Gotion, with an equity share of just under 25% as of March 31.

Nickel-manganese-cobalt batteries to decline in share on more rapid growth in LFPs

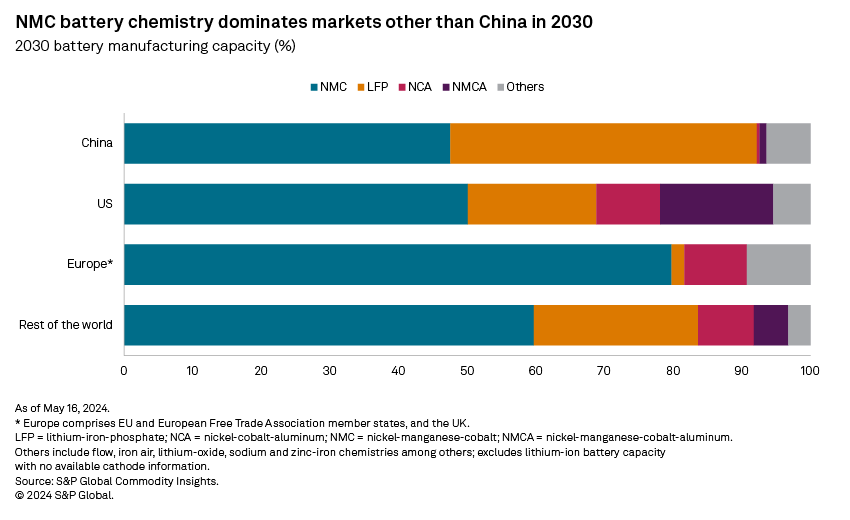

Lithium-ion batteries (LIBs) will still account for 96% of capacity by 2030, while the share of alternative chemistries will edge up to 4%, helped by the commercialization of sodium-ion batteries in China, France and Sweden.

Among LIBs, nickel-manganese-cobalt (NMC) batteries will remain dominant through to 2030, but their share will fall to 44% as the LFP battery share rises to 24%, from 20% in 2023. Markets outside of China are increasingly embracing LFPs, as EV availability moves into the mass-market segment and the expiration in 2022 of the main LFP patents in ex-China markets have removed licensing costs. The elements used in LFP cathodes — lithium, iron and phosphate — are relatively abundant, making on- and near-shore production more feasible and easier to diversify production away from China. In comparison, NMC batteries contain cobalt and nickel; mined production of these two metals is concentrated in countries with both elevated ESG concern and significant China investments.

In Europe, homegrown battery producer ACC has temporarily paused the construction of new capacities in Germany and Italy since June. The company is considering options to shift to the cheaper LFP batteries from the NMC batteries currently planned.

South Korea-headquartered battery producers are also starting to embrace LFP and other iron-based chemistries, which paves a possible pathway to commercializing LFP batteries in North America. Up until recently, South Korea-headquartered producers have focused on high-nickel-based battery chemistries. They are trying to quickly acquire existing LFP knowledge from China-headquartered partners and avoid reinventing the wheel. For example, Samsung SDI is planning its first LFP battery plant in Ulsan, South Korea, and may use China-made equipment.

Indeed, South Korea-produced batteries will not qualify for the EV tax credit in the US. The legislation stipulates that the batteries need to be made in North America to count toward the local sourcing eligibility requirements, and the additional FEOC regulation further limits China's involvement. China also dominates battery cathode production. Therefore, the buildout of battery capacities in North America also needs to be concurrent with local expansions in cathode capacities. LG Energy Solutions is concurrently building US-based cathode-and-battery capacities predominantly for nickel-based chemistries, while also collaborating with China-headquartered partners for LFP supply and capacities for batteries destined for markets in Europe and China for use in energy storage and EV applications.

The question also remains where to source the cathode and raw material inputs for LFP production outside of China. LFP production requires iron units. In China, these come from relatively low-cost titanium dioxide by-products and scraps generated during iron and steel production, which are not readily available and may not be replicable in other countries due to environmental, social and governance (ESG) requirements. There will also need to be investment in purified phosphoric acid capacities. While the US is a big producer of phosphoric acid, the purified form is typically used as the phosphate source for LFP production. Canada has recently added high-purity phosphate to its list of critical minerals given its use in batteries and food security.

S&P Global Mobility forecasts the share of combined iron-based batteries — including LFP and lithium-iron-manganese-phosphate — of light-duty EV production will only reach 15% in the US by 2030, behind China's 65% and Europe's 30%, due to enhanced challenges in building out battery supply chains that exclude China.

What's next?

The LIB-dominated rechargeable battery industry has benefited from government interest and public and private investments worldwide. There is a strong battery capacity pipeline to meet automotive and broader energy transition demands. The industry has shown dynamism, in shifting battery chemistry choices to drive the transition to mass-market EVs, and adaptability, in addressing supply-security concerns of governments around the world. More countries will become battery producers, and more players will also emerge.

Competition among battery manufacturers remains fierce, however, given the current slowdown in EV demand and the expectation of a widening overcapacity. Capacity utilization fell for CATL — the world's largest battery producer — for two consecutive years, to 70.5% in 2023 from 95.0% in 2021, weighing on profitability and margins. The nascent LFP industry outside of China needs to overcome technical and supply chain hurdles to deliver the batteries that are essential for cheaper EVs.

Further upstream, Europe and the US also need to build more battery metals extraction and refining capacities to meet net new demand for EVs and batteries. It will be extremely difficult to shift existing trade flows and supply relationships due to inherent stickiness. This means Europe and the US need to overcome reserve limitations, long permitting times and address local resident concerns. For minerals used in battery cathodes, including cobalt and nickel, a large share of mine supply currently originates from operations with significant ownership by China-headquartered companies, making diversification extremely difficult. In the midstream refining stage, China-based production currently dominates production. An option could be to build refining capacities in North America and FTA partners, especially for minerals with limited local reserve availability, such as cobalt and nickel. The viability of this approach would still depend on the definition of FEOCs for the origin of the raw materials supplying to the refineries.

Battery capacity regionalization and supply chain diversification brings many questions — and also opportunities — for those players who can address the key bottlenecks while leveraging current policy support to the maximum.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Campaign