Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan 30, 2025

China has declared an export ban and imposed restrictions on several minerals and metals to the US. On Dec. 3, 2024, a day after the US expanded its technology restrictions on China, the latter government's Commerce Ministry said that exports of antimony, gallium, germanium and superhard materials to the US would cease. Additionally, graphite products destined for the US would come under stricter review regarding their intended end use.

China has enacted an export ban on antimony, gallium, germanium and superhard materials intended for the US, effective Dec. 3, 2024, citing national security concerns in reaction to the US' latest technology restrictions imposed on China. Additionally, graphite exports to the US will undergo more stringent reviews based on their intended use. China accounted for about half of the antimony and natural graphite imports to the US over the past two years. This move by China is also part of a larger strategy to manage the flow of critical minerals and follows a newly updated framework for regulating dual-use products that came into effect Dec. 1, 2024. Given the shifting policy landscape in the US, we anticipate China may continue to implement restrictive policies in attempts to maintain control over various critical minerals.

National security concerns — response to US restrictions

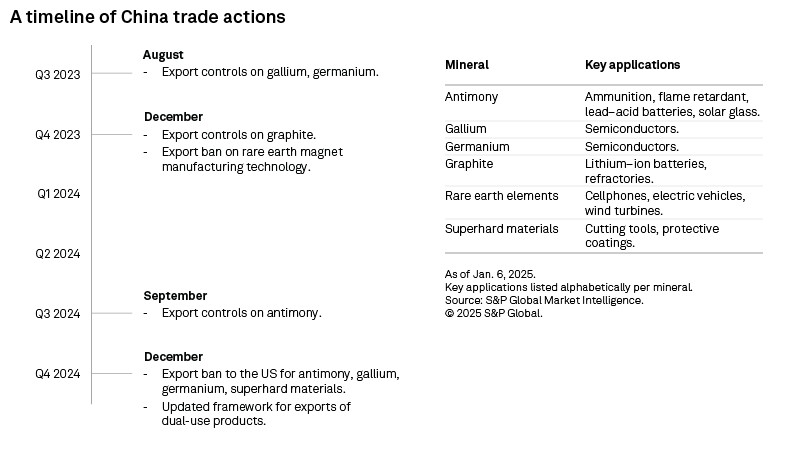

Citing national security concerns, China made the declaration a day after Washington's recent tightening of advanced equipment and technology regulations against Beijing's semiconductor sector. The new US restrictions focus particularly on tools used in semiconductor manufacturing and that of certain high bandwidth memory products and include the addition of 140 China-directed entities to its export control list. China's announcement is the latest in a series of actions aimed at controlling the flow of critical minerals. In 2023, export restrictions were enforced on gallium, germanium and graphite from August to December, and an export ban on rare earth magnet manufacturing technology was also instituted in December of that year. Trade controls on antimony took effect in September 2024. In late November 2024, China introduced a revised framework for regulating the export of dual-use products that have civilian and military applications, which came into effect Dec. 1, 2024. This framework consolidates earlier announcements and features an updated classification system, along with a streamlined licensing process.

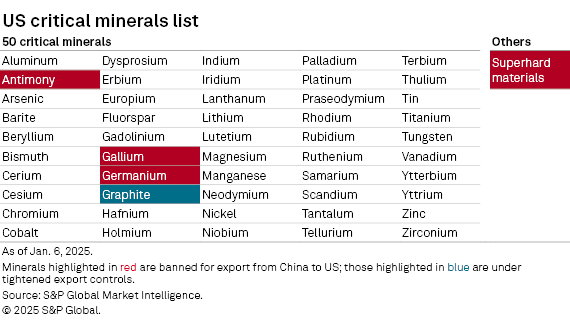

Antimony, gallium, germanium and graphite are included in the list of 50 critical minerals compiled by the US government. Antimony is predominantly used in the making of flame retardants, solar glass, lead-acid batteries and ammunition; gallium and germanium are used in the production of semiconductors; and graphite is used extensively in lithium-ion battery anodes and refractories.

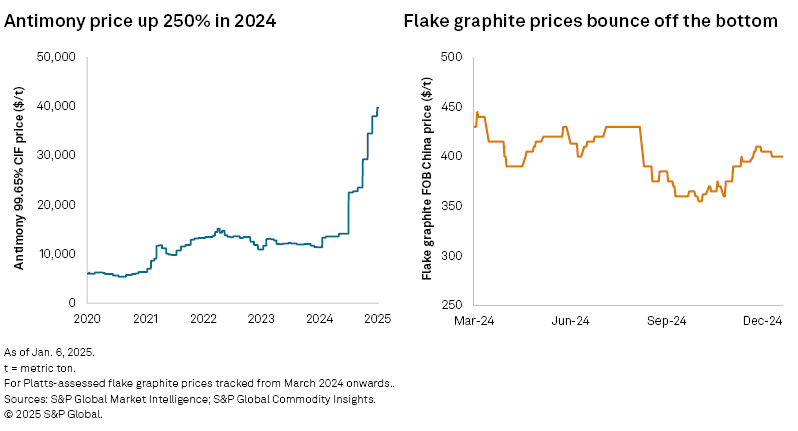

Mixed impact on prices

Despite China's export controls on graphite — first enacted in December 2023 — prices have remained low due to persistent oversupply, particularly from inexpensive synthetic materials produced in China, coupled with recent weakness in electric vehicle sales in the US and Europe. That said, prices have shown a modest recovery from November on the back of near-term supply disruptions. The Platts-assessed price for 94%-95% C flake graphite FOB China was $410 per metric ton on Dec. 12, 2024, compared with $430/t on March 18, 2024. In contrast, antimony prices jumped to almost $40,000/t in December 2024 from around $11,300/t in the first week of 2024.

China accounts for about half of antimony, graphite US imports

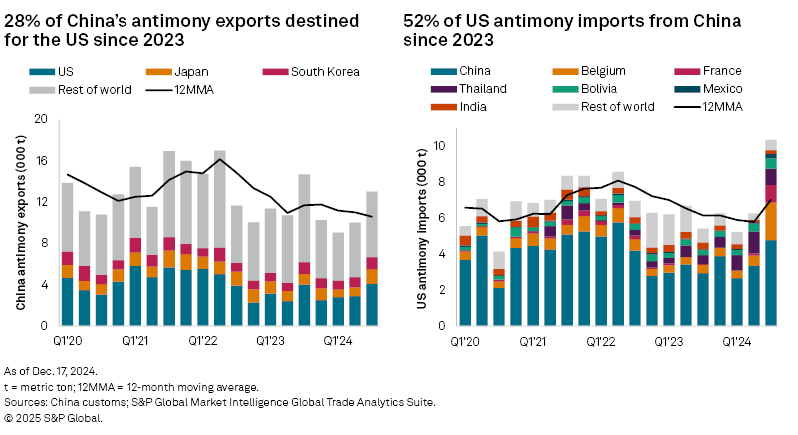

China's antimony exports have been on a downward trend since peaking in the June quarter of 2022. Exports in 2024 are projected to reach their lowest levels in recent years, with only 42 metric tons shipped in October due to export controls, in contrast to the monthly average of approximately 3,500 metric tons recorded from January to September.

Since the September quarter of 2022, US imports of antimony have been on a downward trajectory; however, they surged in the September quarter of 2024 as producers in China increased shipments in anticipation of export controls, alongside robust deliveries from Belgium and France. Shipments from China accounted for about 52% of US antimony imports, while the US received 28% of China's antimony exports since the start of 2023.

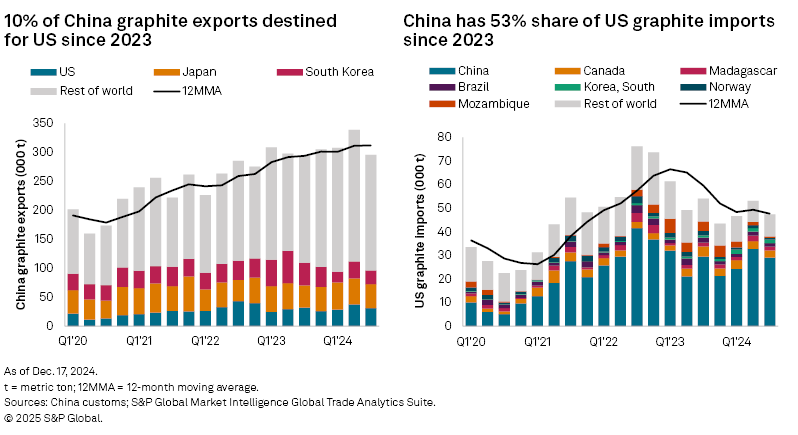

China's graphite exports have shown a general upward trend over the past five years, reaching a near-term peak of 339,000 metric tons in the June quarter of 2024. Year-to-date data indicates that annualized shipments are around 1,256,000 metric tons, compared to an average yearly export of approximately 997,000 metric tons from 2000 to 2023. US graphite imports have generally decreased since the recent peak in the September quarter of 2022, but China is a significant source, being responsible for about 53% of shipments since the start of 2023.

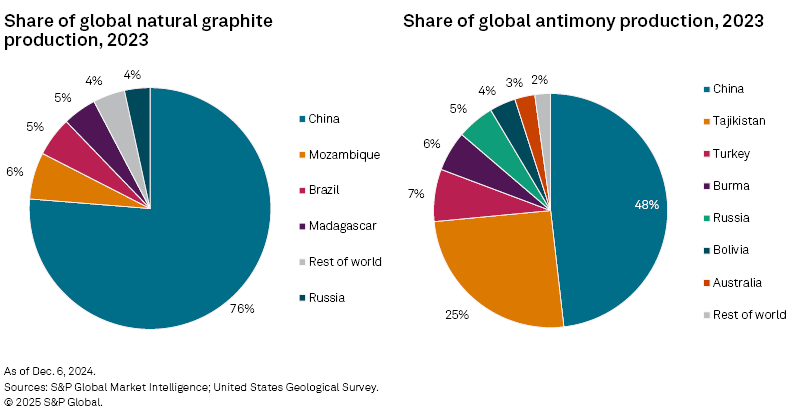

China — the dominant producer

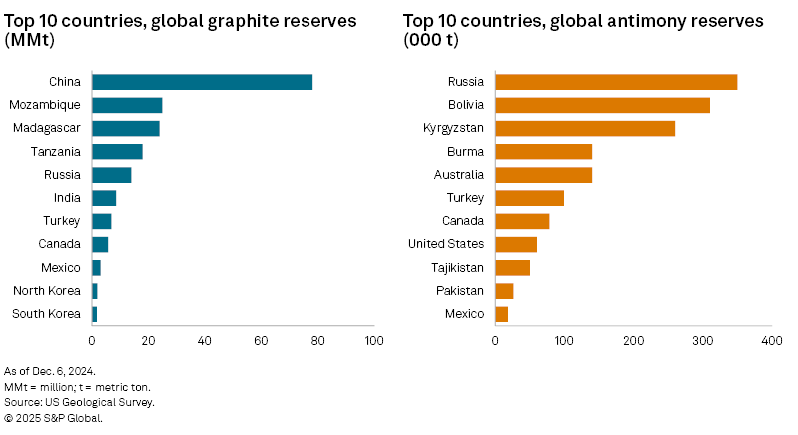

Although China's antimony mine supply has decreased 77% from its peak in 2008, the country continues to hold a significant 48% share of global production, as reported by the US Geological Survey (USGS). Additionally, in 2023, China remained the leading producer of natural graphite, contributing 76% to the global supply. China was also the dominant producer of gallium, with an estimated production share exceeding 90%, according to the USGS. The country is also considered to be the primary supplier of germanium, but global production data is scarce. Although the geographical distribution of reserves is more varied, China remains the largest holder of graphite and antimony, with USGS estimates of 28% and 32%, respectively.

Considering China's recent trade actions, the US has a number of options in Africa, North America and South America to diversify its supply of mined graphite. However, the intricacies lie in the details, as lithium-ion battery anode materials necessitate specialized products such as uncoated and coated spherical graphite, with China being the sole large-scale producer of these products at present. Antimony also presents a challenge for the US due to the limited number of US-friendly countries among the current leading producers. The reserves outlook appears more positive, as Australia, Canada and the US possess antimony deposits.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro..

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.