Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Nov, 2023

On the backdrop of the Paris Agreement (2015) and the acknowledgment for urgent action needed to mitigate climate change, Governments and Corporates alike, have committed to reducing carbon emissions and overall carbon footprint. Paramount to their success in achieving those targets is dependent upon the acceleration of energy transition and the ability to decarbonize “hard-to-abate” sectors. Energy transition refers to the global energy sector's shift from fossil-based systems of energy production and consumption to renewable energy sources and is a long and challenging endeavor.

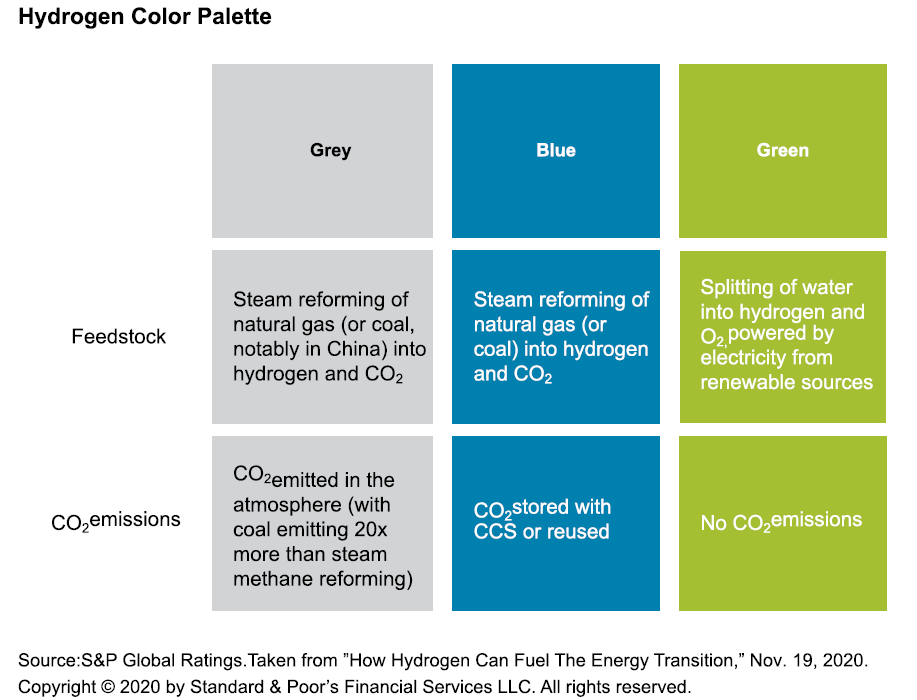

The presence of hydrogen is far from new, but “green hydrogen” is viewed as an important component to the energy mix and expected to have a key role in energy transition in the future, albeit hydrocarbons, will continue to play a critical role at the energy mix over the next decades. There are various hydrogen products that are based on the feedstock in question, shown in figure 1. “Grey hydrogen” is reliant on fossil fuel feedstock, it is carbon-intense and currently has the highest carbon presence among all hydrogen products. “Blue hydrogen” uses natural gas or coal and requires carbon capture and storage but has advantages in terms of cost as it utilizes many features of the oil and gas blueprint. “Green hydrogen” is produced via electrolysis from renewables and has no CO2 emissions, its growth is very much anchored around the substantial growth in renewables and decrease in electrolysis costs. Currently, only 1% of total hydrogen production is green hydrogen while the remaining majority is grey or blue, with blue and green hydrogen clearly ranking better in respect to CO2 Emissions. There are other colors of hydrogen, such as “pink” (nuclear) and “turquoise” (methane) also adding to the variance, however, green hydrogen is the one that seems to be driving most of the conversions within the energy transition space.

Figure 1: Hydrogen Color Palette

Source: S&P Global Ratings. Taken from “How Hydrogen Can Fuel the Energy Transition”, November 19 2020.

Value of Green Hydrogen in Decarbonization

Across the spectrum, green hydrogen provides a pivotal movement towards energy transition as it facilitates the decarbonization of heavy industries such as steel, chemicals

, and heavy transportation such as shipping and aviation.

Green hydrogen provides a route (via green ammonia) to the fertilizer industry to reduce its carbon emissions, especially in regions where irradiation and wind resources are in abundance and lessen its dependency on natural gas. Furthermore, green ammonia is an effective mean to transport hydrogen for the benefit of heavy transportation and other industries . In this spirit the industry has seen pilot projects across regions, as structures to support these transactions begin to emerge and pave the way for more scalable hydrogen transactions in the future.

Steel is another notoriously difficult sector to decarbonize. Green hydrogen is a suitable candidate in the process toward steel decarbonization, however affordability, due to slim margins and high costs, is making the adoption of green hydrogen slower than in other industries

. Regardless of these obstacles, there are notable efforts from major players in running pilots and testing the technology.

Funding and Assessing Credit Risks within Green Hydrogen

Currently there are more questions than answers when looking into the future of green hydrogen. How quickly the sector will grow is dependent upon many and often “moving” parts. At this initial stage a supportive regulatory environment is needed - looking back at the early days of renewables we can appreciate the value it can bring at an early stage - this will need to be complemented by a decline in costs deriving from renewables themselves, technologies involved (at the scale needed and interlinked to technological advancement) and associated infrastructure to allow transportation. All stakeholders across the value chain will need to come together to enable progress in the sector.

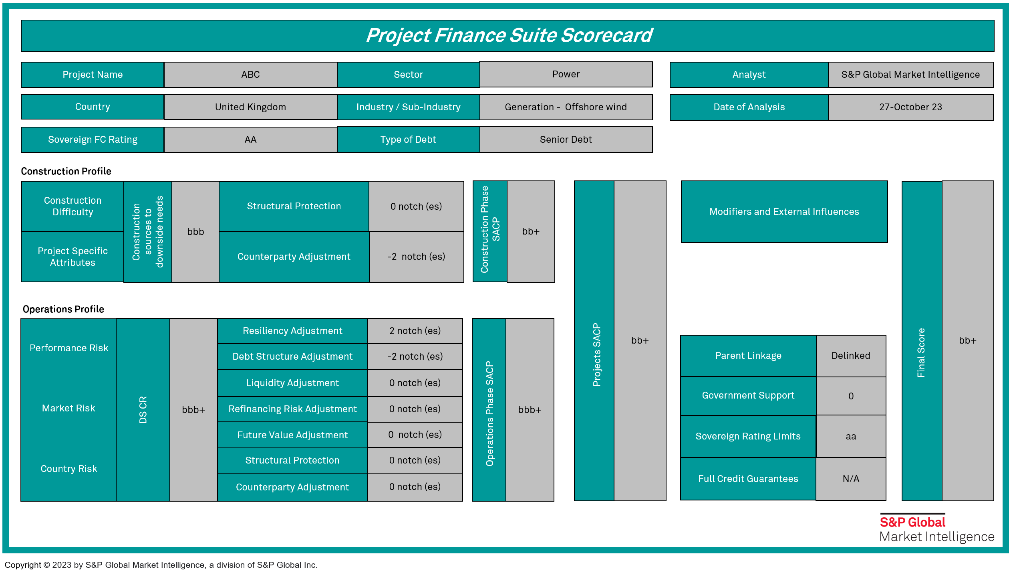

Funding and bankability of hydrogen projects is of equal importance. Hydrogen projects are Capex intense

, making their financing requirements comparable to project finance structures. Given the piloting stage of these transactions, it is critical for the financing participants to understand project specific risks and de-risk via necessary mitigants. The general principles and main building blocks of a typical project finance credit risk assessment during construction and operation phase, see figure 2, always apply. Nonetheless, there are project-specific features that may place a higher emphasis on risks

, for example technology risk (scaling up of technology) and offtake risk. Offtake risk and as an extension the ability of the project to sustain cashflows and debt serviceability are critical as in most regions PPAs are not available while currently there is no spot market. The ability to address these risks is key to the bankability of these transactions.

Figure 2: Sample of Project Finance Probability of Default (PD) Scorecard

Source: Project Finance Credit Assessment Scorecards, S&P Global Market Intelligence. As of: November 15, 2023.

Government and political support are seen by market participants as an important factor in the financing of hydrogen projects. The presence of support or lack of it can be captured under market risk (carbon pricing/taxing) as well as external support that maybe impacting the project beyond its standalone creditworthiness.

An added consideration for financing participants will be sustainability consideration s, regardless of the green credentials of hydrogen the environmental impact needs to be evaluated and reflected within the assessment.

As the sector evolves and more tangible changes and advances occur, S&P Global Market Intelligence will be monitoring and following up on the funding structures that emerge to support and drive growth.

S&P Global Market Intelligence has designed tools that bring together statistically validated Probability of Default (PD) and Loss Given Default (LGD) methodologies. Please click here to learn more about the Project Finance PD Credit Assessment Scorecard and the Project Finance LGD Scorecard.

This article is written and published by S&P Global Market Intelligence, a division independent from S&P Global Ratings. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit scores from the credit ratings issued by S&P Global Ratings.