Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Jan, 2021

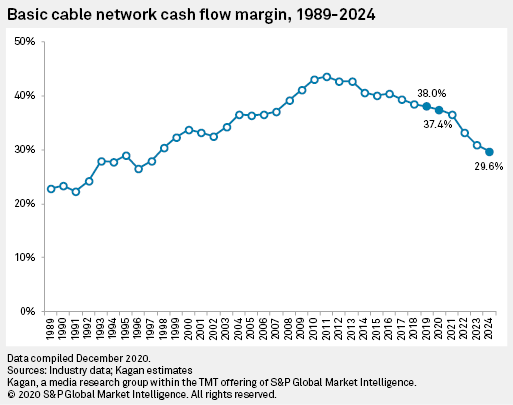

Cash flow margins for cable networks are not expected to contract significantly — to 37.4% in 2020 from 38.0% in 2019 — in large part because contracting ad revenue and flat-to-shrinking affiliate fees have been offset by reductions in selling, general and administrative as well as programming costs.

SG&A costs have been reduced partly due to layoffs and reductions in travel costs, and they could be reduced in future years by even more layoffs and reductions in overhead, such as rent, as companies shift more workers permanently to a work-at-home status.

There is only so much that can be cut, however, and by 2024, we estimate that the average cash flow margin for basic cable networks will shrink below 30% for the first time since the industry broke through that barrier in 1998.

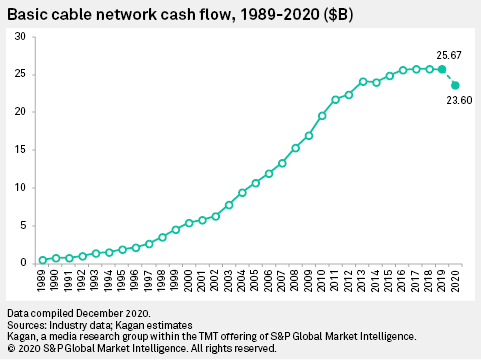

Still, the industry will suffer from a significant decline in cash flow despite all the cost-cutting efforts, with total industry cash flow estimated to be down 8.1% in 2020, corresponding to a loss of $2.07 billion.

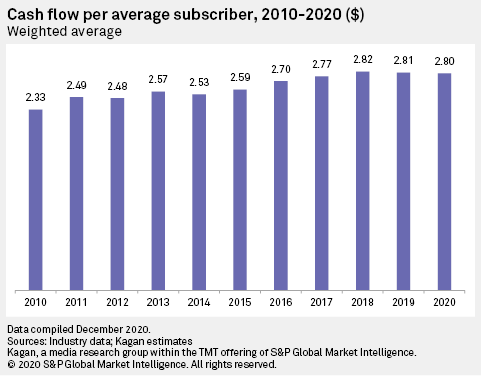

Not helping is the slide in multichannel, and even virtual platforms, which is causing revenue growth to slump, and cash flow on a per-subscriber basis is decreasing for some channels. As the graphic below shows, after rising for several years, this metric has declined slightly, from $2.82 in 2018 to $2.81 in 2019 to $2.80 in 2020.

Looking at the top networks, ESPN (US) is expected to grow in this metric from $28.50 in 2019 to $32.45 in 2020. However, cash flow per subscriber at the network has slid at a CAGR of 1.3% from seven years ago when it was generating $36.50. In the No. 2 spot is FOX News Channel (US) at $22.84 in 2020, followed by TNT (US) at $13.81 and USA Network Inc. at $13.74.

No other networks that we analyzed came in at over $10 per sub. The average of the top 20 is $9.21/sub, which is more than three times the industry weighted-average of $2.80/sub.

Looking at the bottom 20, there are a number of networks generating negative cash flow and quite a few generating between 0 and 14 cents per sub, which is only 5% of the industry average. We believe many of these channels will go dark over the next several years as the trend of cord cutting and cord shaving continues. In fact, El Rey has announced Dec. 8 it would go dark Dec. 31.