Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 11, 2023

By Chris Rogers and Michael Zdinak

The back-to-school shopping season is looking softer this year but still earns a "passing" grade in our forecast, as strong wage growth and easing inflation are enough to keep real income gains positive and retail sales growing.

The slowdown in spending follows three years of surging sales, but last year's inventory hangover and this year's softening demand have retailers less willing to raise prices in 2023. Combining our forecast of consumer spending and data on international shipping shows what that means for back-to-school sales.

One of two peak spending seasons

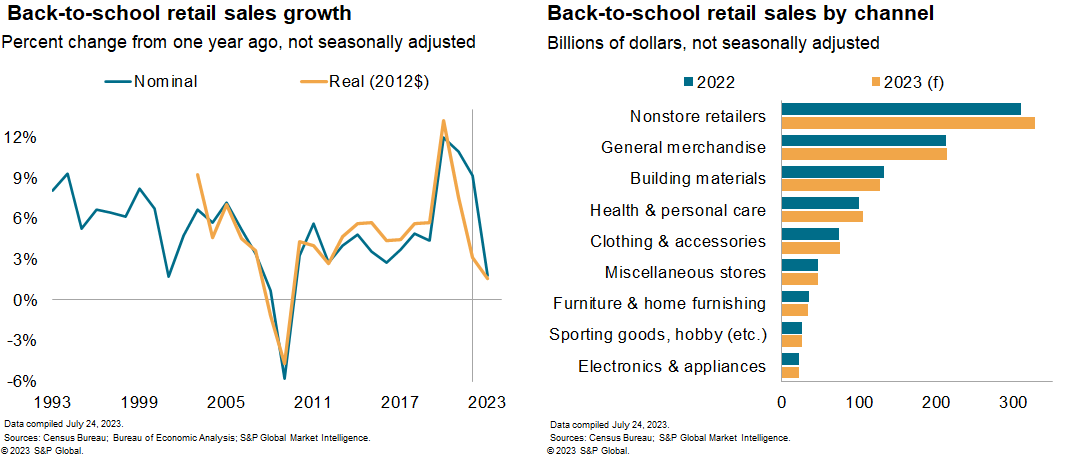

The back-to-school shopping season is the second-most-important time of year for many retailers, behind only the winter holidays. In 2022, retailers hauled in over $960 billion in sales ahead of the new school year (up 10.9% from 2021), dominated by spending on books, supplies, clothing, footwear, computers, software, smartphones, and tablets.

This year, thanks to renewed consumer confidence and rising incomes, back-to-school sales are forecasted to grow 1.8% to $978 billion. While far from the best year on record, real retail sales - current-dollar sales adjusted for the change in retail prices -- are expected to grow 1.5% in 2023, below trend yes, but better than the broad slowdown many were expecting. That's enough to earn a "passing" grade in our forecast.

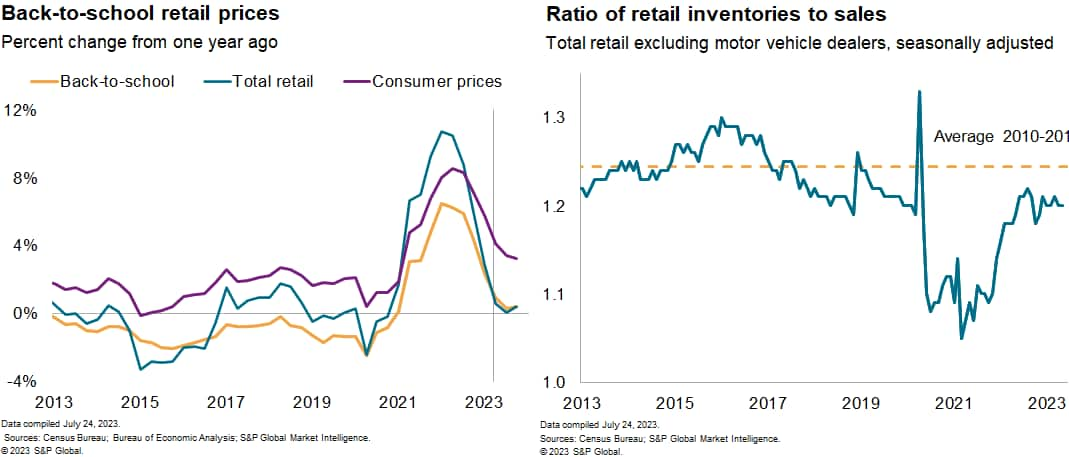

Part of the story is the dramatic decline in inflation on back-to-school retail sales, which we estimate will fall from a rate of 5.9% last year to just 0.3% in 2023, roughly in line with the decline in total retail inflation. Part of that decline reflects softer demand. Consumer prices broadly rose 8.0% in 2022 and are expected to rise 4.1% this year but are less driven by unmet demand for goods as they are the rising cost of rents and services.

The second part of the story this year is the normalization of retail inventories following the supply chain disruptions that contributed to inflation and characterized so much of consumer spending in 2022.

Last year saw inflation and inventories take off: first, as Russia's invasion of Ukraine sent food and energy costs soaring, and later, as supply-chain bottlenecks eased, and retailers rushed to re-build inventories. Set against solid consumer fundamentals but deteriorating consumer sentiment, the result saw current-dollar back-to-school sales rise 9.2%, retail inflation at an uncomfortable 5.9%, and real sales just 3.1% higher than the year before.

This year, retail inflation has cooled, and continued consumer demand for goods has allowed retailers to manage last year's excess and bring inventories back to a level more in line with sales expectations. This means that what retailers are ordering now, and how much, tells us a lot about their expectations for sales this year.

Peak shopping seasons require peak shipping seasons.

According to the National Retail Federation, 55% of households had started back-to-school shopping in July, and that requires goods to be delivered in June and July to be on shelves. In their survey, spending on electronics was expected to lead the way, followed by clothing, and school supplies.

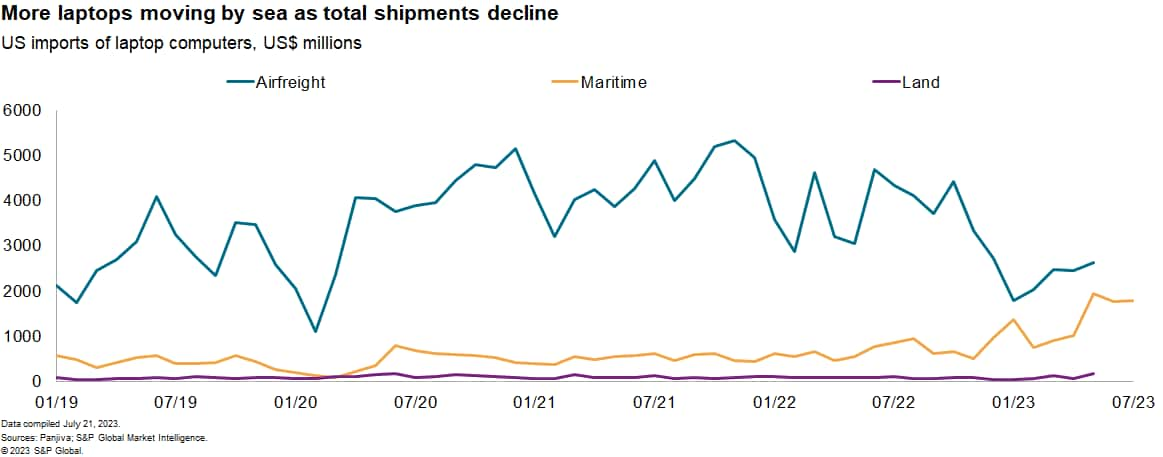

Floating operations: Laptop computer shipments lower, more by sea

Recently there's evidence of a sharp change in the choice of transportation for laptop computers. Total imports, measured in dollars, in the three months to May 31, 2023, fell by 8% year over year, Market Intelligence data shows. On closer inspection, imports by sea have jumped 132% while those by air fell 30%.

This year, US consumers are expected to spend more than $90 billion on computers, spread out across a variety of retail channels, from 'big box' retailers to smaller electronic and appliance stores. Comparatively soft, but better-than-expected demand for laptops and personal computers has raised our forecast of back-to-school sales in 2023.

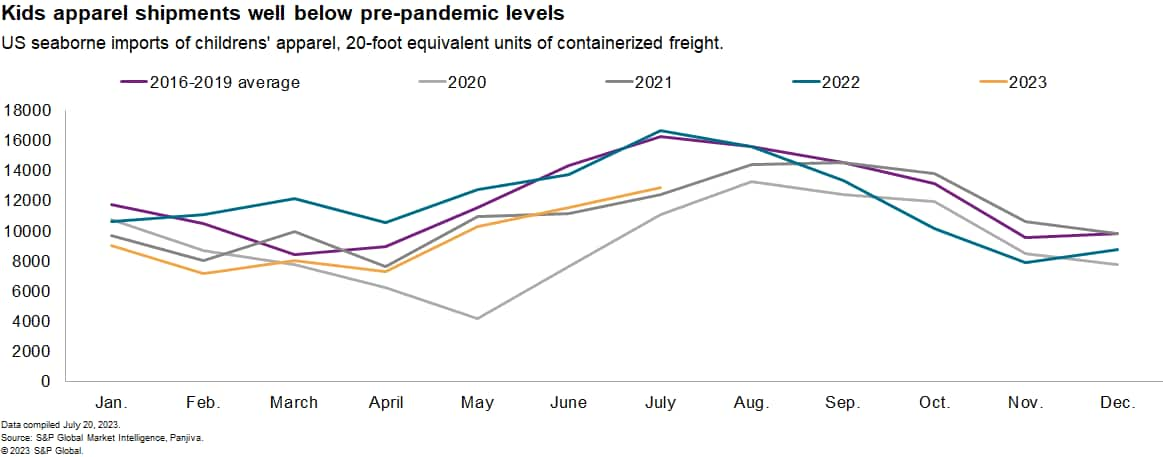

Empty wardrobes: Kids' apparel shipments down

Kids' clothing, like most apparel, is labor intensive and of a low value per volume. As a result, shipments mostly come to the US by sea from Asia.

Recently, the apparel industry has had to balance a period of falling demand with an ongoing imperative of having adequate inventory levels.

US seaborne imports of children's apparel fell by 16% year over year in June, Panjiva data show, and are down 21% overall for Q2'23. On net, the decline has brought shipments back to 2021 levels, but those were well below their pre-pandemic average. Finally, there's continued evidence of reshoring as manufacturers look for lower-cost supplies.

This year consumers will spend nearly $500 billion on clothing, accessories, and footwear. But with retailers expecting below-average demand, and the ratio of inventories to sales close to pre-pandemic levels, there's little reason to be surprised by the drop in imports.

In our forecast, the expectation of softer demand encourages additional discounting, which results in below-average back-to-school sales of clothing this year.

Packing lighter: School supplies supply-chain activity slows

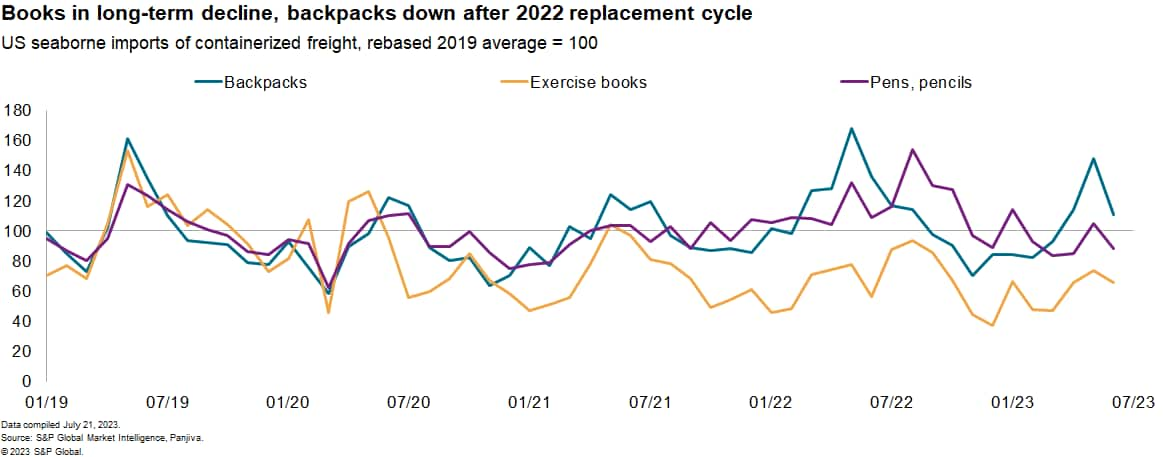

Traditional school supplies, including stationery and backpacks, underwent significant upheaval during the pandemic. A slump in demand during 2020 and 2021 linked to lockdowns and schooling-from-home, was followed by a surge in supplies in 2022.

This year, US seaborne imports of backpacks fell by 18% year over year in the three months to July 31, 2023, while shipments of pens and pencils fell by 20% and exercise books dipped 4% lower, Panjiva's data show.

After surging last year, sales of office supplies are headed back down to earth in 2023. But without Census data on inventories, we're less informed of how retailers are responding to recent trends. Here Panjiva's data fill in a gap in the "official" data and help inform our expectations for sales this fall.

In our forecast, the decline in imports of books, backpacks, and pens lowers our expectations for sales growth this fall, but higher prices at office supply stores raise current-dollar sales.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.