Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 16, 2022

By Akshat Goel and Michael Zdinak

The end-of-year holidays are an important time to pause, reflect, and take stock of where we have been, where we are now, and where we are going.

In that spirit, we offer our outlook on retail sales this holiday season, through the lens of the ghosts of holidays past, present, and future.

COVID-19, the ghost of holidays past

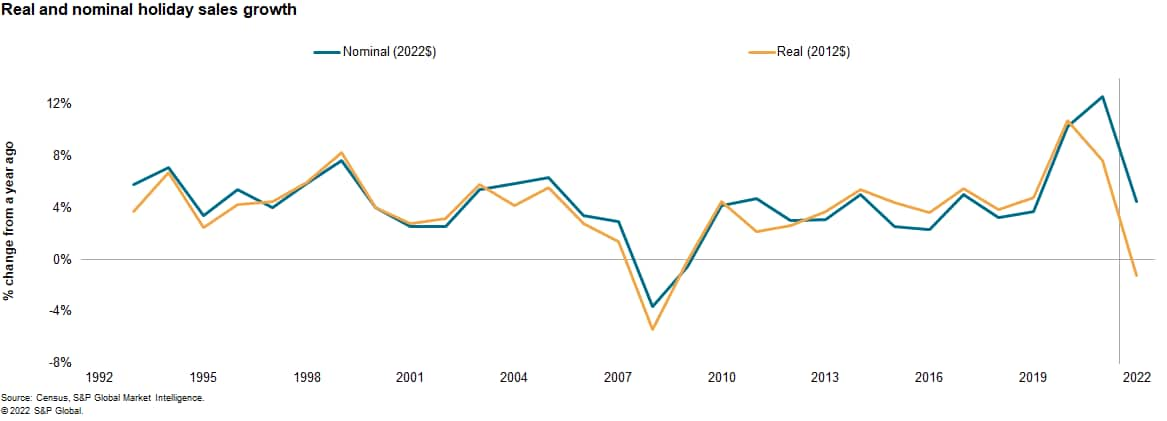

Before 2020, holiday sales growth had averaged 3.9%, and 1999 reigned as the best year on record at 7.6%.

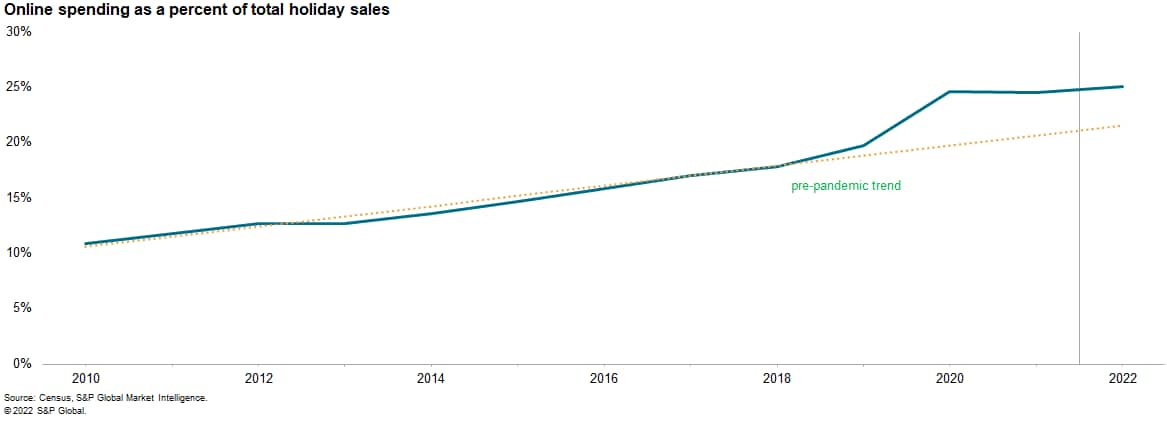

During the pandemic, consumers embraced online shopping and set a record for holiday spending growth on goods, which dominate retail sales. Holiday sales rose a blistering 10.3% in 2020. Prices ended the year down slightly, and real growth reached an all-time high of 10.8%.

The following year, found Americans vaccinated, flush with savings and stimulus cash, and ready to continue spending. 2021 boasted the largest increase in current-dollar holiday sales on record, with a 12.6% surge. Inflation started to tick up, but pandemic-related demand for goods remained strong through the summer.

Then fears of stock-outs as supply chains faltered pulled spending forward into October — so much so, that December 2021 saw a 1.7% decline in holiday sales, seasonally adjusted. Inflation also jumped and ended the year at 4.5%.

On balance, sales growth in 2021 outpaced prices and real holiday sales rose a robust 7.7% last year.

Inflation, the ghost of holidays present

Growth this year is not going to approach the levels seen the last two years. 2022 marks the first time in three decades that price increases are set to outpace the rise in current dollar holiday spending. The pandemic surge in demand for goods is over, and any post-pandemic pent-up demand for services appears to be largely exhausted.

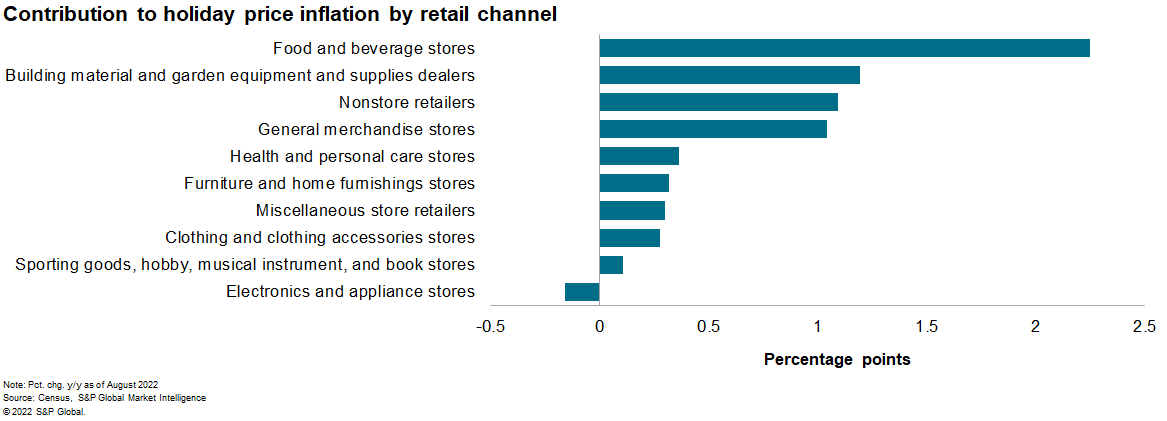

The year began with another surge in cases of COVID-19 and Russia's invasion of Ukraine. The conflict sent food and energy costs soaring. Prices are rising quite broadly now: The total retail sales price index has risen 5.7% at an annualized rate through September.

Real personal disposable income is down, in part a result of the end of stimulus support. Inflation is expected to continue to erode the real purchasing power of any additional income. So, in a very real sense, consumers are starting the holidays off with a bit less money in their pockets this year.

Spending has held up remarkably well even as consumer sentiment declined significantly. But will it last?

If not, retailers may find it hard to reduce inventories by cutting prices. Inventories at general merchandise stores climbed 17.9% in the first half as retailers hedged against fresh supply-chain disruptions and rising prices. Lackluster sales through September have pushed the ratio of inventories-to-sales to a 15-year high.

Retailers will have to pull out all the stops to get customers to open their wallets this year, rolling out holiday deals often and early. We expect brick-and-mortar retailers to capitalize on consumers' willingness to return to stores by offering steep discounts on overstocked items—one reason we expect durable goods prices to decline over the balance of the year.

Retailers should expect consumers to start shopping early, and for rising prices to force some households to intensify the hunt for a good deal. A rise in early shopping means more total shopping, so retail data in October and November will be closely watched for how strong the year will finish.

We expect:

Recession, the ghost of holidays future

Inflation remains stubbornly high, the Federal Reserve is tightening policy, and the trend in sales growth is slowing.

Given the strength of consumer fundamentals and the tightness of the labor market this year, households remain willing to use debt to boost spending. As a result, total consumer credit outstanding has surged.

The recent slowing in the growth of consumer spending more broadly owes to factors including weak real incomes, rising financing costs, a drop in household sector net worth, and less remaining pent-up demand. We project the Personal Consumption Expenditures (PCE) price index to rise 5.8% this year, restraining the growth of real disposable income.

The recent plunge in stock prices and weakening home prices means real household sector net worth is expected to fall more than 10% this year, albeit after an extraordinary rise the prior three years.

Recent data confirms the housing sector is already in recession, although the US economy as a whole has yet to tip into recession. We believe that will happen in the coming quarters.

The broader concept of consumer spending, real Personal Consumption Expenditures (PCE), grew at a 1.6% annual rate over the first three quarters of the year and, in our latest forecast, we expect another modest gain in the fourth quarter.

That's good news, because in a year where consumers find themselves battling unprecedented price increases, the simple fact that spending has kept pace with inflation underscores their resilience.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.