Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 06, 2023

By Chris Rogers

Supply chain managers are emerging from a period of upheaval driven by the pandemic and now have to make decisions about their long-term supply chain structures in the face of a weak economy and high interest rates.

Back to the old pattern

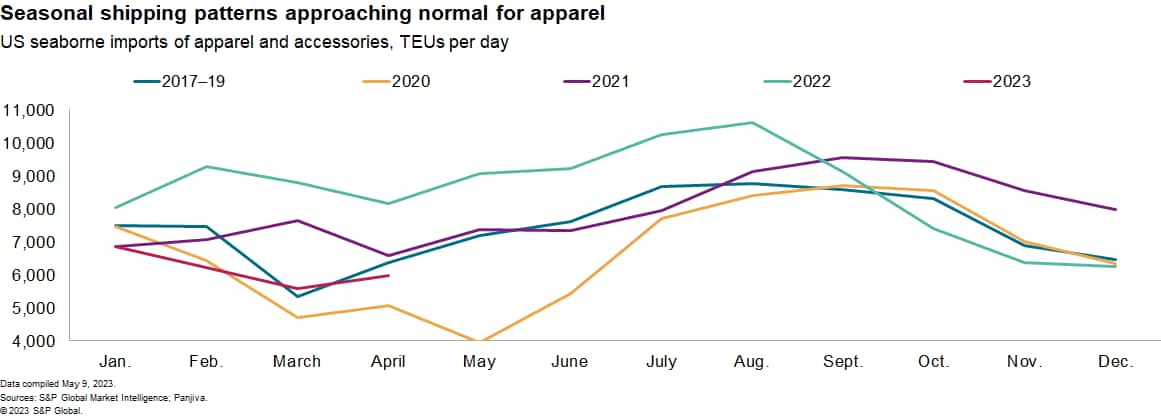

Supply chain conditions are continuing to normalize during the second quarter of 2023 after the logistics and manufacturing disruptions of 2021 and 2022. Seasonal businesses, such as apparel, are particularly exposed to delays and other network failures.

Winterwear shipments into the US peak in August through October, S&P Global Market Intelligence trade data shows, while swimwear peaks in January through March. Underwear shipments, meanwhile, peak in August and September, likely connected to holiday season gift giving. Formalwear peaks in February or March and in June through August, the latter linked to back-to-school shopping.

Activity patterns may be normalizing in early 2023. US seaborne imports of apparel fell by 27% year over year in April 2023, Panjiva data shows, and were also 8% below the same period of 2019. Shipments in February and March 2023 were down sequentially with a small rebound in April.

The reduced demand and improved fluidity of logistics networks has reduced the need for more expensive modes of transportation, namely airfreight. Historically airfreight accounted for 15% of US imports. There was a peak of 20% in November 2021, while in the first quarter of 2023 it fell to 13%.

Resilience is expensive

As supply chain conditions normalize, is there a need to adapt sourcing models in the wake of three years of disruptions? The needs of agility and resilience can be counterproductive for costs and profitability.

Inventory levels across the apparel industry may be close to back to normal. US retail inventories as a proportion of sales for all retailers reached 79% on average in first quarter 2023, according to US Census Bureau data. That compared with a trough of 60% in third quarter 2021 and was close to the long-run average of 77% on a seasonally adjusted basis.

That would suggest on the average across the industry that a move away from historic inventory management strategies — for example, to a more conservative just-in-case approach with higher inventories — in the aggregate has not yet occurred.

The return to lower-inventory levels may reflect the higher costs associated with keeping cash locked up in warehoused stock. The elevated level of interest rates will increase such costs.

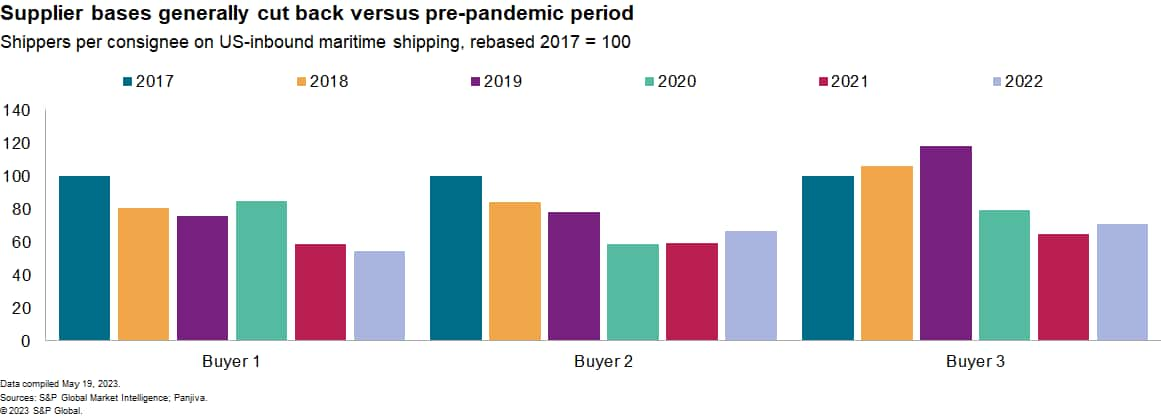

The trade-off between agility and resilience can also be seen in supplier numbers as well as location and contract terms. A higher number of suppliers provides more options for sourcing, flexibility of skills and risk diversification. However, smaller order numbers per supplier reduces economies of scale and can increase cost-per-unit.

Pressure from shareholders to cut costs and raise profits may lead to a smaller supplier base. Panjiva data for three major buyers of apparel show the number of suppliers fell by 29% to 45% in 2022 versus 2017.

It's not easy being green

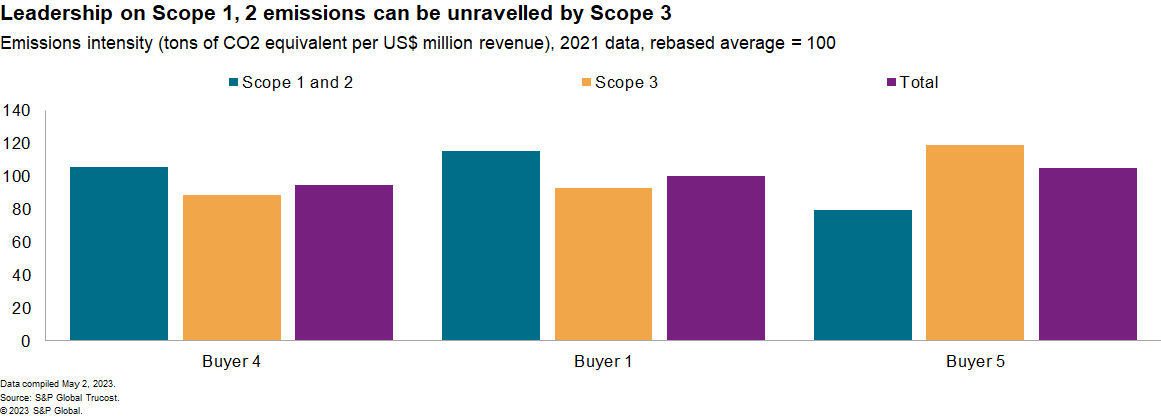

There are also increasing environmental costs, particularly with regard to expanding carbon emissions trading schemes in the EU. Indeed, many supply chain managers now have the dual task of managing sustainability.

Analysis of the greenhouse gas emissions of three major fast-fashion firms, based on S&P Trucost data, shows Scope 1 and Scope 2 emissions of 19.6 tons per million dollars of revenues in 2021. That covers their own corporate emissions as well as the power and heat used in running their operations.

However, Scope 3 emissions, covering their supply chains, are 3.7x the Scope 1 and 2 emissions combined. As carbon costs rise, that can make effective environmental supply chain management a competitive advantage.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.