Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Jun, 2023

By Thomas Mason and Yizhu Wang

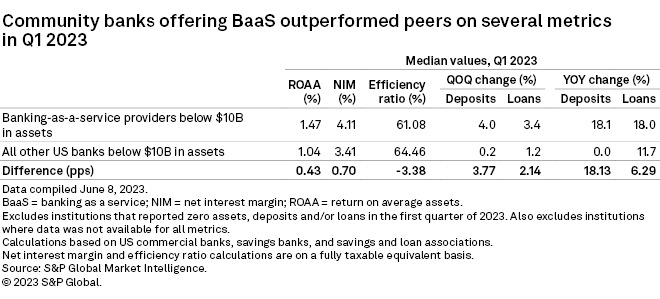

A group of 42 community banks focused on banking-as-a-service outperformed peers across some key metrics in the first quarter and showed signs of deposit growth resiliency.

The group's median net interest margin was 4.11%, compared to 3.41% for all US banks with under $10 billion in total assets, according to data compiled by S&P Global Market Intelligence. During the first quarter, banks focused on banking as a service (BaaS) recorded median deposit growth of 4.0% and median loan growth of 3.4% sequentially, while all community banks posted median deposit growth of 0.2% and median loan growth of 1.2%.

Overall, the US banking industry experienced accelerated deposit outflows with a 3.4% quarter-over-quarter decline, but analysts said the BaaS banks are unlikely to face deposit outflows similar to what caused the failures of Silicon Valley Bank, Signature Bank and First Republic Bank.

"Our research shows that BaaS banks are growing deposits generally through this industry turmoil," Michael Perito, an analyst at Keefe Bruyette & Woods Inc., wrote in an email.

Deposits of high quality

In addition to the outgrowth, the non-brokered deposits sourced from financial technology company partnerships can be stickier and more cost-efficient, analysts said.

BaaS providers that specialize in payments, such as Pathward Financial Inc. and The Bancorp Inc., typically set up highly transactional accounts that store smaller balances for payment purposes, said Frank Schiraldi, an analyst at Piper Sandler. This makes the majority of their deposits qualified to be insured by the Federal Deposit Insurance Corp.

"I would double down on that notion that they really have little- to no-run dynamics. Because the end users are not really trying to get a return, they're just looking for payment solutions," Schiraldi said in an interview.

The deposit base of Pathward primarily consists of accounts with an average balance of less than $1,000, the bank has disclosed. At The Bancorp, the bank had $6.70 billion in total deposits as of March 31, and an estimated $643.9 million of it, or less than 10%, were not insured by the FDIC, according to a Form 10-Q filed in May.

The Bancorp's deposit base represents about 50 fintech programs, including those with PayPal Holdings Inc. and Chime Financial Inc., said President and CEO Damian Kozlowski. The deposit base is relatively small, but it can drive a high volume of transactions, Kozlowski said.

"There's a lot of throughput through all [our] programs. It's not like the deposits are all parked here," Kozlowski said in an interview.

Keefe Bruyette & Woods' Perito also noted that the cost of those deposits are under contractual rates that both parties have agreed to. While other banks are racing to win customers with high yields, BaaS providers are less impacted by competitive market forces, even with stiffer competition for deposits.

"They've got pretty good negotiating power with the partners just because there are such limited banks that really do this," Schiraldi said.

Stride Bank NA, Lead Bank, MVB Bank Inc. and Column NA were the BaaS providers who grew deposits by over 20% sequentially in the first quarter, according to Market Intelligence data.

A unique focus on fee income

Potential new regulatory rules requiring banks to strengthen their capital positions should not be a concern to many BaaS providers, Piper Sandler's Schiraldi said. BaaS providers often have excess capital that they do not want to use to significantly grow the balance sheet because they are incentivized to stay under $10 billion in total assets, to be exempted from the Durbin amendment, which limits interchange fees.

"I don't think they'll be impacted to the degree of others," Schiraldi said. "Their business model in general would make them less susceptible to concerns over capital."

Unlike the traditional banking model that focuses on asset and deposit growth to boost net interest margin, BaaS providers like Rogersville, Tenn.-based Thread Bank deploy more resources to pursue noninterest income to drive returns on equity, said John Bearden, chief banking officer at Thread Bank. By processing payments for fintech partners, Thread Bank earns interchange fees that are not necessarily correlated to the size of its balance sheet.

Thread Bank operates a digital bank primarily for small businesses and also supports fintechs by setting up depository accounts and offering loans for small businesses. Over time, its goal is to have about 50% of its revenue coming from noninterest income, whereas a traditional bank typically has 75% to 80% of its revenue generated from interest income, Bearden said.

During the first quarter, the banking industry posted $85.96 billion in total noninterest income, versus $176.69 billion in total net interest income.

The fee income can also add a layer of stability to the banks' income streams. The Bancorp typically charges fintech partners an implementation fee upfront, and even if fintechs have small payment volumes at the beginning, there is usually a minimum obligation that they have to fulfill, Kozlowski said. Once the program gets to a certain size, the cost for fintechs would be a lot lower because there are few incremental costs after the program is up and running, he explained.

Weathering the storm

Just like other participants in the banking industry, BaaS providers are studying how to better control concentration risk and interest-rate risk in the wake of the recent bank failures. They have also taken action to increase the portion of FDIC-insured deposits through sweep programs.

Thread Bank is intentionally building a diversified customer portfolio of companies in uncorrelated industries and across different stages of funding cycles, Thread's Bearden said. The median of its fintech partners are those who have raised $10 million to $20 million in funding, he noted.

"From a risk standpoint, we ultimately think we'll see distribution across the bell curve," Bearden said. "We look at what the ramifications would be if any one of these companies doesn't make it."

Bearden was part of the new management team that began leading Thread Bank in 2021 after a recapitalization of former Civis Bank by an investor group. The bank's current largest voting member is private equity firm Patriot Financial Partners LP, Bearden said. Limited partners of FINTOP Capital also invested in Thread individually, and Thread's chairman Joe Maxwell is the managing partner at FINTOP.

David Hayes contributed to this report.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.