S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 14 Nov, 2024

By David Hayes, Xylex Mangulabnan, and Gaby Villaluz

An S&P Global Market Intelligence survey found that US bankers expect a second term for former President Donald Trump would be better for the US economy by a nearly 3:1 margin compared to Vice President Kamala Harris.

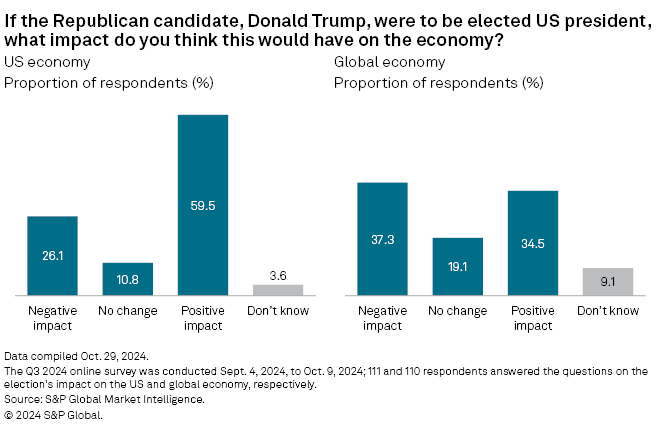

➤ Roughly 60% of respondents believe a Trump victory would positively impact the US economy.

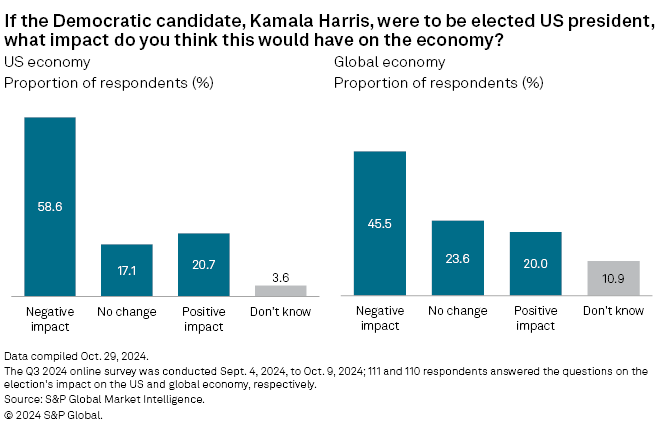

➤ An almost equal percentage felt that Harris winning would have a negative impact on the economy.

➤ Regulatory and compliance changes were top of mind for bankers regarding the outcome of the presidential race.

Majority of respondents believe Harris win would be negative for US economy

Market Intelligence surveyed US banking industry professionals between Sept. 5 and Oct. 9 and found that 59.5% of respondents believe a second Trump term would positively impact the US economy, compared to 20.7% that felt similarly about Harris. Meanwhile, 58.6% of respondents indicated that a Harris win would negatively impact the US economy compared to 26.1% for a Trump victory.

Even considering the +/- 9-percentage-point margin of error at the 95% confidence level, over 50% of respondents felt Trump's election would have a positive impact on the US economy, while less than 1 in 3 respondents indicated the same following a win for Harris.

A larger proportion of respondents, 37.3%, believed a second Trump presidency would have a negative impact on the global economy. However, 34.5% believe that Trump winning would have a positive impact on the global economy, compared to 20.0% for a Harris win.

Trump has recently floated the prospect of eliminating income taxes and making up for the budget shortfall by significantly increasing tariffs on imported goods.

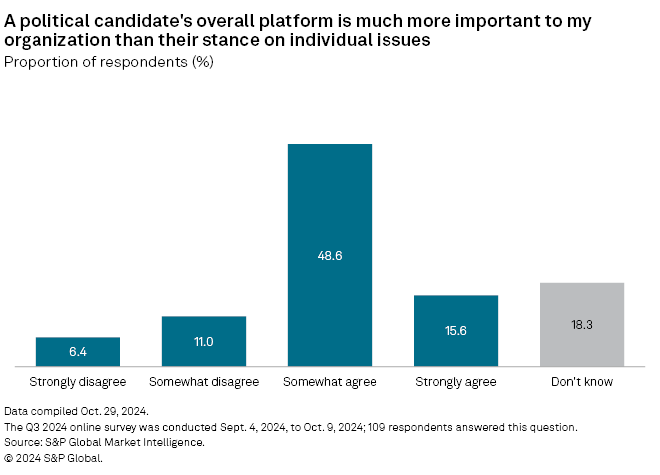

Bankers more concerned about overall platform than any one issue

Over 64% of survey participants indicated that a candidate's overall platform was more important to their company than any individual issue. Only 17.4% of respondents felt that individual issues were more important than a candidate's wider platform.

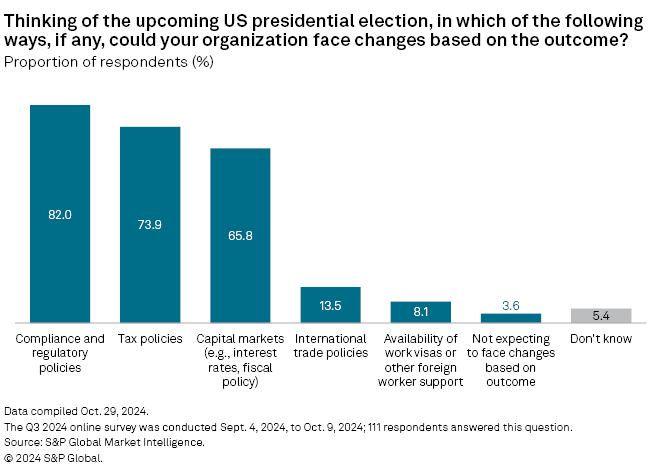

Majority of respondents expect election could have consequences for their organization

Eighty-two percent of respondents believe their company could be impacted by compliance and regulatory changes following the election, the most common concern among the five options. Meanwhile, almost 74% of respondents believe tax policy changes could affect their business depending on the election's results.

Less than 4% of survey takers believed their organization would not see changes based on the outcome of the election.

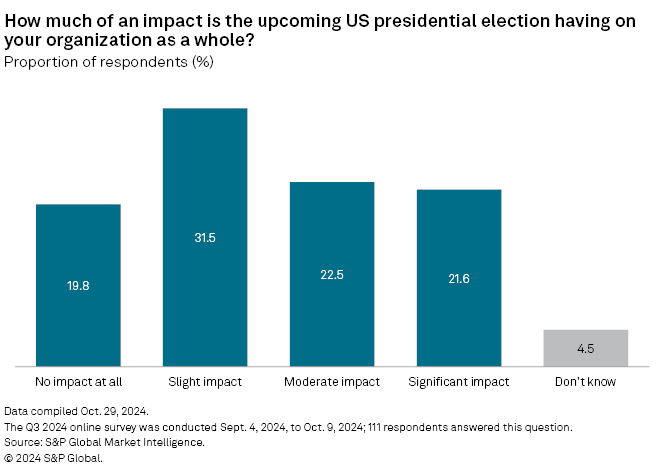

Roughly 3 in 4 participants indicated that the upcoming presidential election was having some impact on their organization, and 21.6% of respondents felt the election was having a "significant impact."

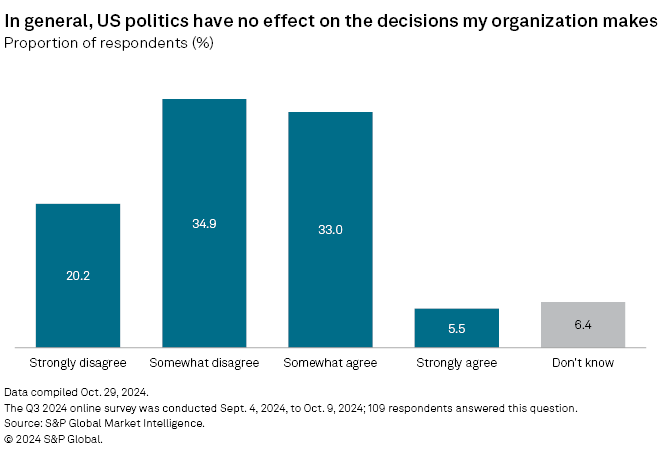

However, when asked about US politics in general, only 55.1% of respondents indicated that politics affect how their organization makes decisions.

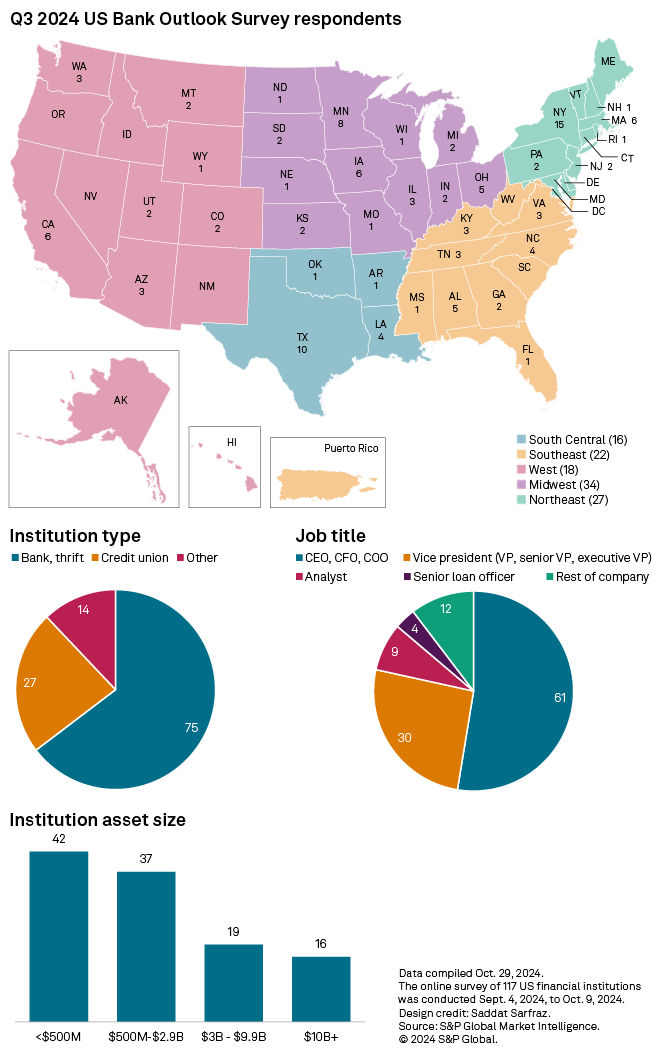

S&P Global Market Intelligence surveyed 117 US financial institution clients on various topics including expected loan and deposit growth, projected interest rates and general sentiment surrounding the upcoming US presidential election. Of the 117 participants, 75 worked for commercial banks or thrifts, 27 for credit unions, 14 for other US institutions and one chose not to answer the question.

The online survey was conducted between Sept. 4 and Oct. 9, 2024.

The margin of error for topline statistics is +/- 9 points at the 95% confidence level.

If you would like to participate in future US banking surveys, please contact xylex.mangulabnan@spglobal.com, gaby.villaluz@spglobal.com or david.hayes@spglobal.com.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Segment