Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 31 Aug, 2023

By David Hayes

Bankers have grown less optimistic on loan growth over the course of the last nine months, according to S&P Global Market Intelligence's latest 2023 US Bank Outlook Survey.

➤ Bankers' outlook for loan growth has soured over the last nine months, with just over half of bankers surveyed expecting total loans to increase at their organization over the next 12 months, while nearly one-quarter of respondents expect loans to decline.

➤ Forty-two percent of respondents expect credit quality to deteriorate in their commercial real estate loan portfolio over the next year.

➤ Two-thirds of respondents expect a recession by March 2024.

Loan growth optimism fades again

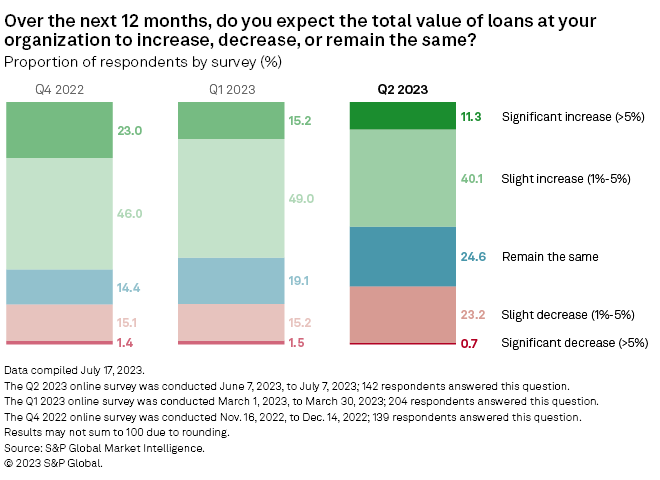

Between June 7 and July 7, S&P Global Market Intelligence surveyed US banking executives and found that just slightly over half of bankers, 51.4%, expect the total value of loans to increase over the next 12 months at their organization, down from 64.2% in the first-quarter survey and 69.0% in the fourth-quarter 2022 survey.

Meanwhile, the percentage of survey participants who expect loans to remain flat at their institution over the next year increased to 24.6%, up from 19.1% and 14.4% in the previous two surveys, respectively.

Similarly, 23.9% of participants expect loans to decline over the next 12 months, up from 16.7% and 16.5% in the previous surveys.

Banks have continued to grow loans through the first half of 2023, albeit at a relatively slow pace. US commercial banks and thrifts reported $12.299 trillion in loans and leases as of June 30, up 0.7% quarter over quarter and 4.5% year over year.

Over 40% expect commercial real estate credit quality to slide

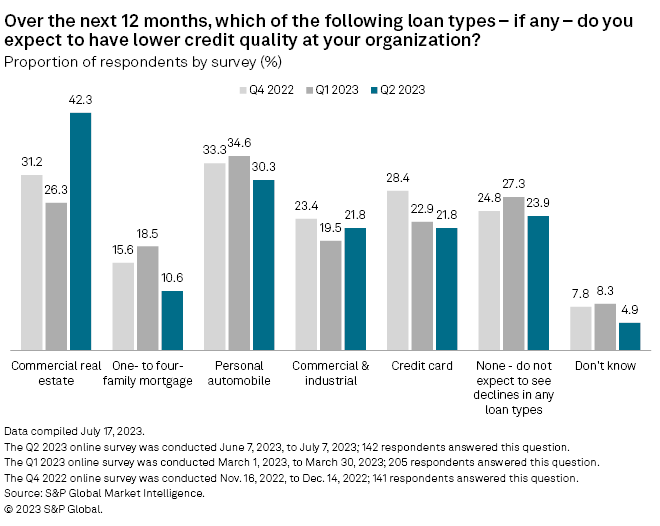

More than 40% of respondents expect commercial real estate credit quality to decline at their institution over the next 12 months, up notably from 26.3% in the first quarter and 31.2% in the fourth quarter of 2022. About 30% of respondents expect auto loan credit quality to decline over the next 12 months, down slightly from the previous two surveys, but within the margin of error of +/- 8 percentage points.

Credit quality on commercial real estate loans has slipped modestly thus far. At the end of the second quarter, 0.82% of commercial real estate loans — defined as construction and land development loans, multifamily loans, nonowner-occupied nonresidential property loans and commercial real estate loans secured by collateral other than real estate — at US banks and thrifts were 30-plus-days past due or in nonaccrual status, up from 0.77% at March 31 and 0.73% at the end of June 2022.

The delinquency rate on nonowner-occupied nonresidential property loans was higher as of June 30 at 1.16%, up 11 basis points quarter over quarter and 37 basis points year over year.

Two-thirds of respondents expect a recession by spring 2024

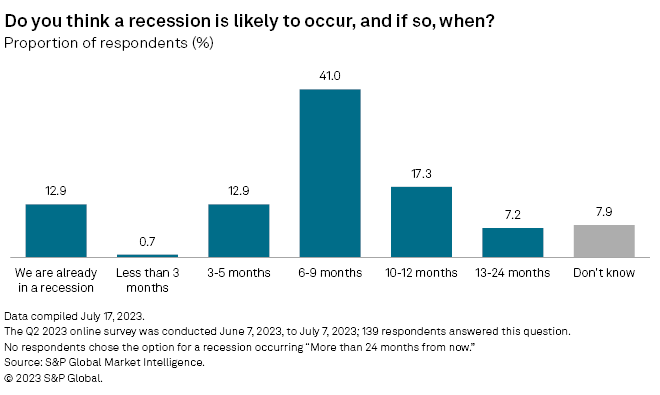

Most respondents were not optimistic about the near-term future of the economy. Almost 68% of survey participants expect a recession within the next nine months, including 12.9% of respondents who think the US is already in recession. The last time S&P Global Market Intelligence asked this question, in the fourth-quarter 2022 survey, about two-thirds of respondents expected a recession by summer 2023, which has not come to pass.

According to data from the US Bureau of Economic Analysis, real GDP in the US has increased in each of the last four quarters, including a 2.4% annualized gain in the second quarter. The latest estimates from the economics group of the Global Intelligence and Analytics team, a part of S&P Global Market Intelligence, show US GDP rising by 1.42% this year and 1.28% next year.

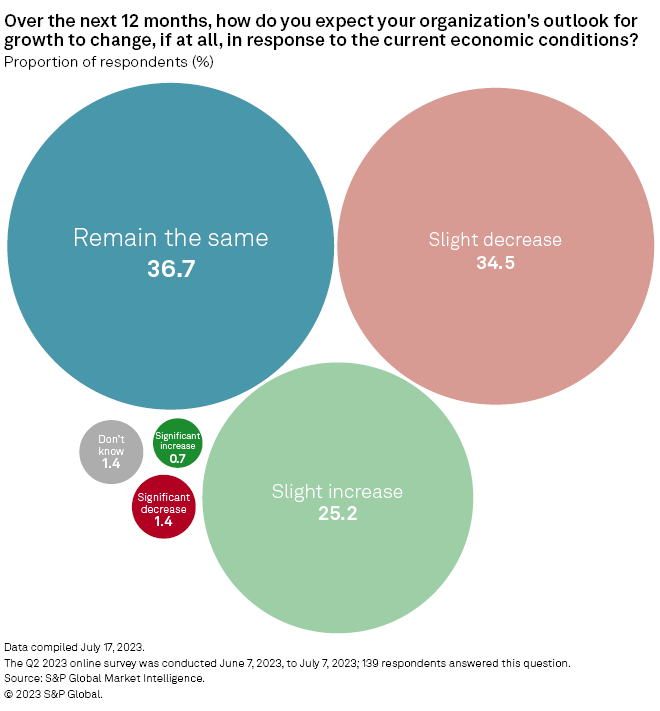

Perhaps not surprising given participants' anticipation of a looming recession, 35.9% of respondents expected their organization's growth outlook would decline over the next 12 months due to current economic conditions, compared to 25.9% that believe their company's outlook would improve.

About 36.7% of respondents expect their company's growth outlook would remain the same over the next 12 months.

Willing buyers, but still a hard sell

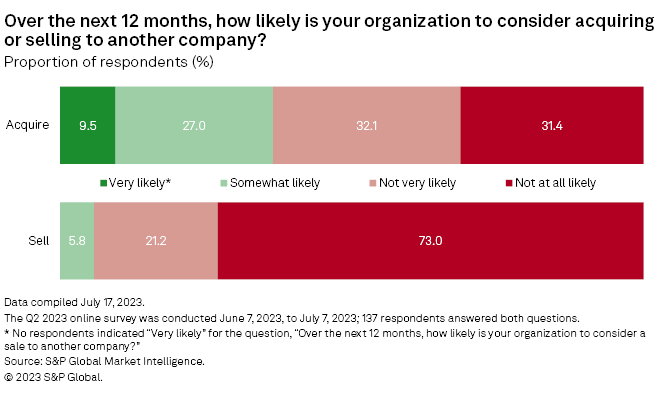

Appetite for M&A among both would-be buyers and sellers dropped in the most recent survey compared to when S&P Global Market Intelligence last asked about M&A in the fourth quarter of 2022 but was within the margin of error.

In the most recent survey, 36.5% of participants anticipated that their institution was "very likely" or "somewhat likely" to consider acquiring another company over the next 12 months, down from 43.2% in the fourth-quarter 2022 survey.

Meanwhile, 94.2% of respondents said their institutions were "not very likely" or "not at all likely" to consider a sale over the next 12 months, up from 89.3% in the earlier survey.

M&A activity has indeed been subdued so far this year with only 63 US whole-bank deals announced year to date through Aug. 22, down from 107 over the same time period in 2022 and 133 in 2021.

However, August has seen an uptick in deal announcements already, with nine deals announced so far this month, compared to 10 in August 2022. Also, the two largest deals of 2023 were announced on July 25: PacWest Bancorp's $1.06 billion merger with Banc of California Inc. and Atlantic Union Bankshares Corp.'s $443.7 million acquisition of American National Bankshares Inc.

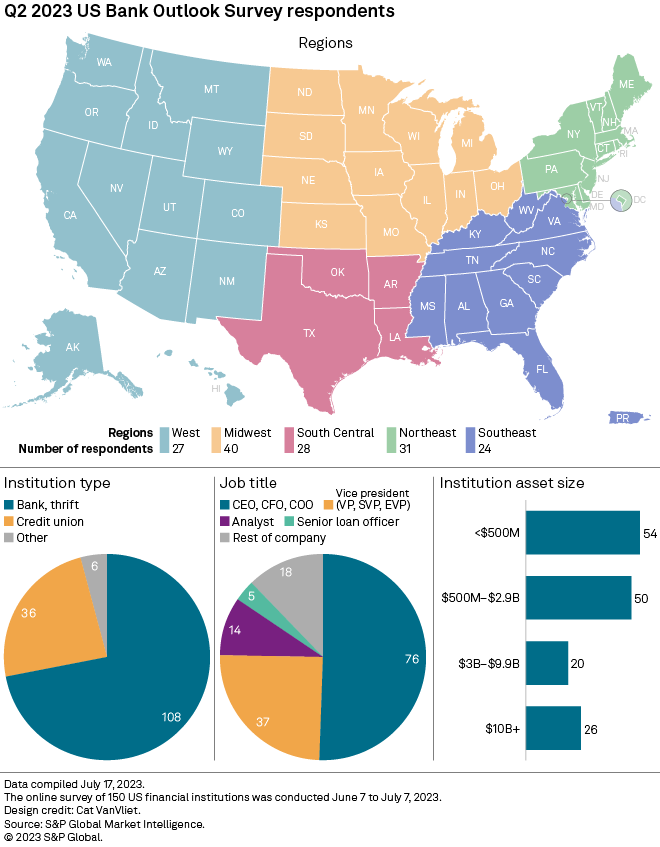

S&P Global Market Intelligence surveyed 150 US financial institution clients on various topics including expected loan and deposit growth, projected interest rates and liquidity trends. Of the 150 participants, 108 worked for commercial banks or thrifts, 36 for credit unions and six for other US institutions.

The online survey was conducted between June 7, 2023, and July 7, 2023. Access all results here.

The margin of error for topline statistics is +/- 8 percentage points at the 95% confidence level.

If you would like to participate in future US banking surveys, please contact david.hayes@spglobal.com.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.