Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 23 Feb, 2023

By Zain Tariq and Nathan Sovall

Banks' deposit costs rose at a rapid clip in the fourth quarter, but a few institutions avoided the pressure by opting to let funds walk out the door in search of higher rates.

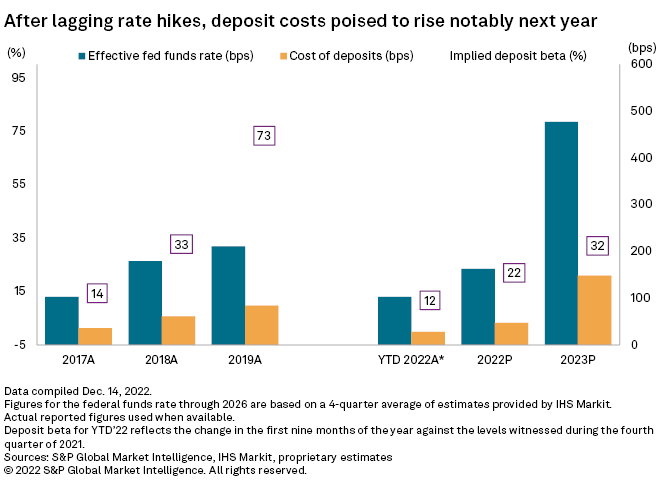

Deposit costs climbed modestly through the first nine months of 2022 but rose much more quickly in the fourth quarter as liquidity pressures emerged and banks defended their deposits with higher rates, while many others bolstered their balance sheets with more expensive wholesale funding and certificates of deposits.

Banks with low betas let hot money walk down the street

The banking industry recorded a quarter-over-quarter, interest-bearing deposit beta — the percentage of change in fed funds passed on to depositors holding interest-bearing accounts — of 44.6% in the fourth quarter, up from 32.8% in the third quarter and 17.7% in the second quarter.

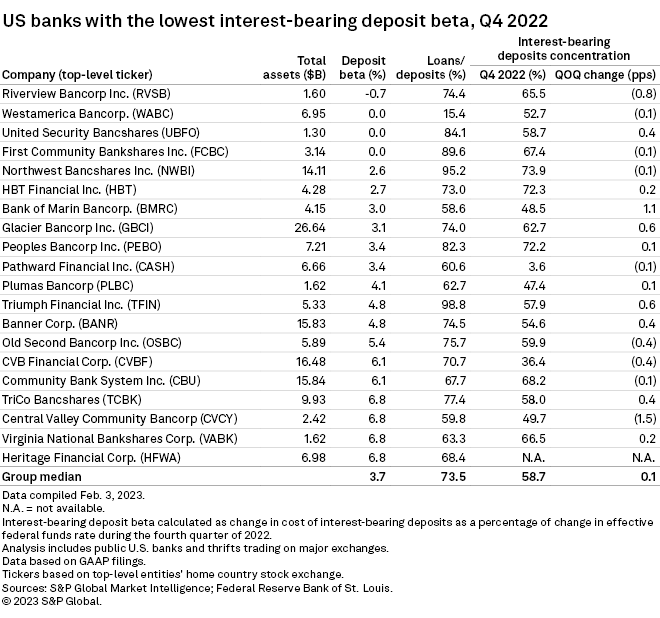

Some institutions' deposit bases were far less sensitive to changes in rates, and a few even saw virtually no change in their deposit rates in the fourth quarter, allowing them to enjoy substantial expansion in their net interest margins in the period. At least 27 publicly traded banks recorded interest-bearing deposit betas below 10% in the fourth quarter and 13 of those institutions reported betas below 5%. The median, linked-quarter margin expansion reported by the top 20 banks with the lowest interest-bearing deposit betas in the fourth quarter was 34 basis points, compared to 9 basis points across all publicly traded banks.

The banks in that top 20 group were willing and able to let funds seeking higher rates leave their respective institutions in the fourth quarter as they all reported deposit outflows in the period. Seven of the top 20 — Riverview Bancorp Inc.; United Security Bancshares; Bank of Marin Bancorp.; Glacier Bancorp Inc.; Triumph Financial Inc.; CVB Financial Corp. and Virginia National Bankshares Corp. — reported deposit outflows in excess of 5% in the fourth quarter, compared to a 0.8% linked-quarter, median decline reported by publicly traded banks in the period.

Higher beta banks have ties to crypto, pay up to support growth

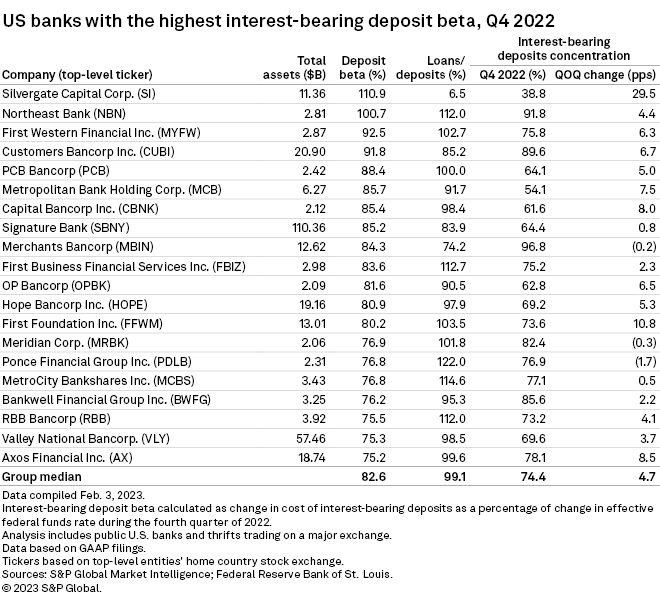

The 20 banks with the highest deposit betas in the fourth quarter recorded a median beta of 82.6% — nearly 50 percentage points above the median among publicly traded banks.

The higher-beta group had a significantly higher median loan-to-deposit ratio at 99.1% in the fourth quarter, or more than 30 percentage points above the industry aggregate.

Three of the institutions in the higher beta group — Silvergate Capital Corp., Metropolitan Bank Holding Corp. and Signature Bank — had cryptocurrency-related deposits. Silvergate easily reported the highest beta in the period and the company experienced billions in deposit outflows in the wake of the collapse of cryptocurrency exchange FTX.

Four of the 10 banks with the highest beta in the fourth quarter — First Western Financial Inc., Customers Bancorp Inc., PCB Bancorp and Capital Bancorp Inc. — grew CDs considerably in the period to fund loan growth. Northeast Bank recorded the second-highest beta in the period, and a large portion of its loan portfolio is purchased in the open market.

Funding future loan growth will come with a cost

We expect more banks to increase their reliance on higher-cost CDs and borrowings from the Federal Home Loan Banks for funding. Loan-to-deposit rates remain well below pre-pandemic levels at most institutions, but the current interest rate cycle has different forces at play that have likely pushed bank managers to take action to bolster their funding.

For instance, loan growth has remained strong, even in the face of significantly higher interest rates. Meanwhile, the spike in rates has left the majority of bank bond portfolios deeply underwater, and most institutions do not want to sell those positions at a loss to meet their liquidity needs. That dynamic leaves bank managers with one less liquidity lever to pull, and effectively lowers how high they will be willing to let their loan-to-deposit ratios rise.

As institutions come closer to their own internal ceilings for their loan-to-deposit ratios, they will become increasingly hungry for new funding and many will turn to CDs, borrowings and brokered deposits to satisfy their appetite, leading to higher deposit betas.

The industry recorded a beta on all deposits, including noninterest-bearing funds, of 21.8%, virtually in line with the 22% projected in our outlook in mid-December. For full year 2023, we projected betas to reach 32%.

As betas rise, the benefits of higher interest rates on net interest margins will wane for the vast majority of institutions. Some banks will remain standouts, however, having proven through nine months of rate hikes — which marked the swiftest pace of tightening by the Federal Reserve in 30 years — that their deposit relationships are not driven by rate.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.