Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Aug 21, 2023

By Carla Selman and Paula Diosquez-Rice

Results from Argentina's presidential primaries indicate weaker traditional parties and increasing likelihood of currency policy change.

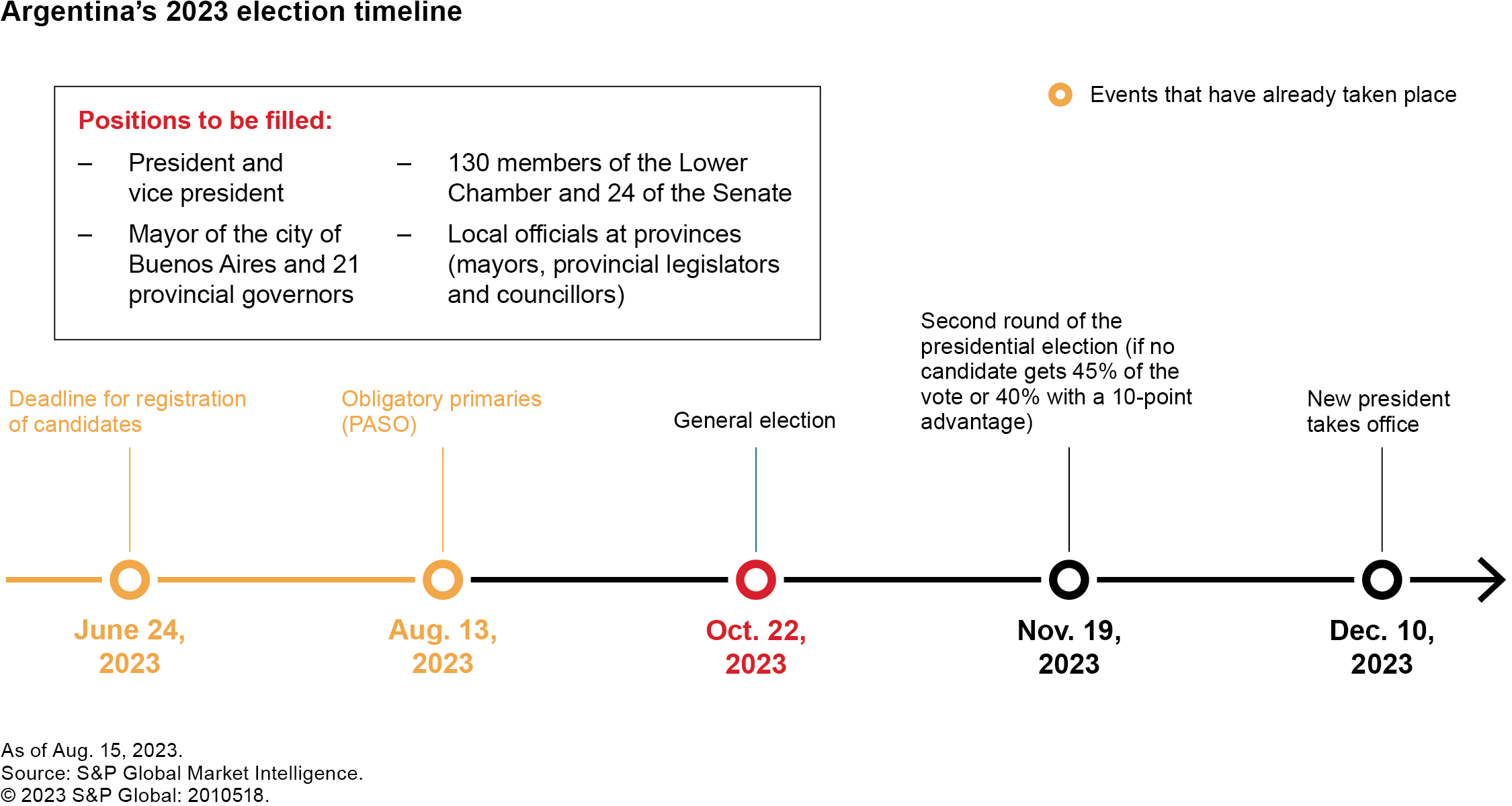

In the Aug. 13 primaries (Primarias Abiertas Simultáneas y Obligatorias: PASO), Libertarian candidate Javier Milei from Advance Freedom (La Libertad Avanza: LLA) came first with 30% of the vote. Former security minister Patricia Bullrich won the nomination for the opposition Together for Change (Juntos por el Cambio: JxC), which obtained 28%, and Minister of Economy Sergio Massa was nominated for the ruling Union for the Motherland (Unión por la Patria: UP), with 27%.

Milei's win is the first time that a candidate from outside the two main coalitions has led voting with a seemingly genuine prospect of becoming president. Milei's strong support is likely to reflect the adverse economic situation, with inflation above 100%, and his strong discourse against corruption and the political class.

If no candidate obtains 45% of the vote or 40% with a 10-point advantage in the Oct. 22 vote, a run-off will take place on Nov. 19. If the results of the primaries, which also included legislators, are replicated in the election, the next government will face a divided Congress with no coalition holding a majority, forcing negotiation with the opposition and diluting or delaying proposals. Bullrich's JxC would become the largest coalition in the lower chamber with 105 of 257 seats, followed by Massa's UP with 95 and Milei's LLA, with 41. In the Senate, the UP would have the most seats, 35 out of 72, while the JxC would hold 27 and the LLA, 8.

Milei's priorities

Milei prioritizes dollarization and privatizations and would be relatively likely to gain support from the JxC. If elected, Milei would promptly submit a bill to dollarize the economy and end with the central bank to avoid hyperinflation. He proposes allowing people to exchange pesos for dollars at their own pace, enforcing redenomination only after two-thirds of the money stock has been converted. Milei's team estimates that dollarization would take 9 to 24 months to be fully implemented after passage of appropriate legislation. In practice, many transactions are already being made in dollars, including those for real estate, automobiles and trade involving international businesses.

Milei also supports lifting capital controls after reducing central bank liabilities to a manageable level. He would drastically cut government spending, planning measures to close ministries, cut subsidies and transfers to provinces and privatize state-owned companies, including airline Aerolíneas Argentinas and oil company YPF. He would be likely to seek to renegotiate the International Monetary Fund (IMF) Extended Fund Facility (EFF), which he criticizes for generating high borrowing levels, while proposing deeper fiscal austerity than current IMF targets.

If elected, the LLA's likely modest representation in Congress and the absence of provincial governors from his party would hinder his efforts to pass and implement policy. However, S&P Market Intelligence sources in Argentina assess that he is likely to reach an agreement with the JxC, brokered by former president Mauricio Macri, with whom he has good relations, increasing the likelihood of obtaining JxC support in Congress.

The strong showing of Bullrich and Milei indicate an increasing likelihood of Argentina having a right-wing government from December, with both sharing views on issues such as a tough stance to combat crime, which has become a main concern for the population. Instead of dollarization, Bullrich advocates unifying the multiple exchange rates and is likely to propose using the US dollar alongside the Argentine peso. Like Milei, she would seek deep fiscal austerity. During the electoral campaign, Bullrich faces the challenge of retaining support from Rodríguez Larreta's voters — and preventing them switching to Massa — without moderating her proposals to the point she loses other supporters to Milei.

Inflation as an issue

The UP coalition's third place indicates weakening of Massa's electoral position. This is likely due to Massa's inability to deliver on his main pledge as economy minister to reduce inflation. With the primaries behind, Massa is likely to accelerate meeting IMF demands to obtain disbursements in August and November.

On Aug. 14, the government devalued the official peso by 22% and modified the foreign exchange system to a temporary fixed rate (350 Argentine pesos/ US$1) until the election. The government also introduced new capital controls, including a weekly limit of US$40,000 for financial operations using the alternative exchange rate for trading financial instruments (Dolar bolsa: MEP).

Further measures are probable, including fuel price increases and raising gas and electricity tariffs to match inflation. Such moves, notably higher utility costs, would be unpopular, damaging Massa's likely electoral prospects. These are already being threatened by worsening inflation post-devaluation; we forecast the consumer price index to rise by nearly 11% month over month in August 2023 and a further 12% in September 2023 as retailers face increased restocking prices.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.