Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 14 Aug, 2024

By Setch Chang

Highlights

International Sustainability Standards Board (ISSB) aligned climate risk disclosures, including Scope 1 and 2 Greenhouse Gas (GHG) emissions, will be mandatory for all listed issuers to report and file in Hong Kong from FY2025.

Climate risk disclosures in the sustainability disclosure standard for Mainland China (“China Standard”) reference the ISSB but also consider the local context and preparedness of the Chinese companies in sustainability reporting. In addition, the China Standard requires companies to consider material ESG topics through financial materiality and impact materiality.

To help companies start their reporting journey, S&P Global Sustainable1 has developed an ISSB foundation Pack. It is a dedicated solution to help companies identify reporting gaps, conduct climate risk scenario analysis, measure Scope 1 and Scope 2 GHG footprint and set a climate transition target.

On 19 April 2024, the Hong Kong Stock Exchange (HKEX) published conclusions on climate-related disclosure requirements [1]. The new climate standard aligns closely with International Financial Reporting Standards (IFRS) S2 [4], and will be effective in phases from the 2025 reporting year [1].

Earlier on 12 April 2024, three stock exchanges in Mainland China, Beijing, Shanghai, and Shenzhen, finalized the Sustainability Report (Trial) (referred to as Guidelines) [2], establishing a framework for sustainability disclosure for listed companies, aligning with international requirements for enhanced climate-related disclosure. The Guidelines will be effective from May 1, 2024 [2]. The disclosing entity required by the Guidelines shall publish its 2025 Sustainability Report before April 30, 2026 [2].

Mandatory Reporting for GHG Emissions

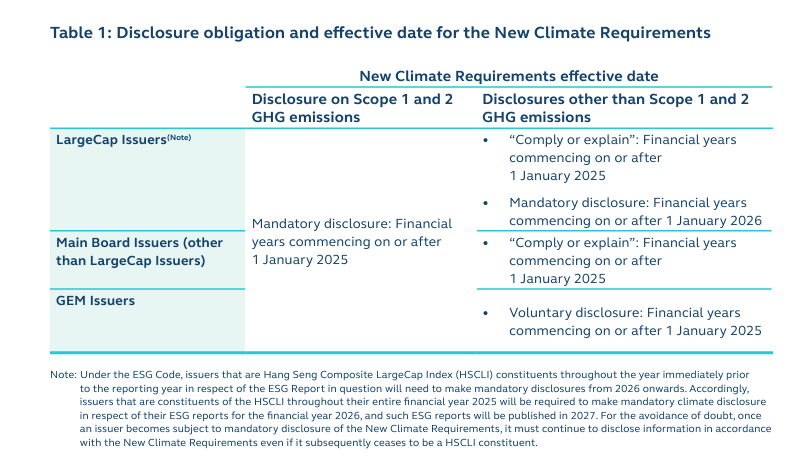

The HKEX requires all listed issuers to report Scope 1 and 2 GHG emissions starting from FY2025 [1].

For Scope 3 GHG emissions and other disclosures other than Scope 1 and 2, there is a one-year interim transition time for large cap issuers, from a comply or explain basis in 2025 to mandatory disclosure in FY2026 [1]. Main board issuers other than large caps follow a comply or explain basis commencing on or after FY 2025, whereas disclosure is voluntary for Growth Enterprize Market (GEM) issuers [1].

Source: Implementation Guidance for Climate Disclosures under HKEX ESG reporting framework

In Mainland China, Scope 1 and 2 GHG emissions disclosures are mandatory for targeted issuers, which comprise of constituents in the Shanghai Stock Exchange (SSE) 180 Index, the Science and Technology Innovation Board 50 Index, the Shenzhen Stock Exchange (SZSE) 100 Index, the ChiNext Index sample companies, and companies listed both domestically and abroad. Scope 3 GHG emissions disclosures are encouraged [2].

Climate Risks Reporting

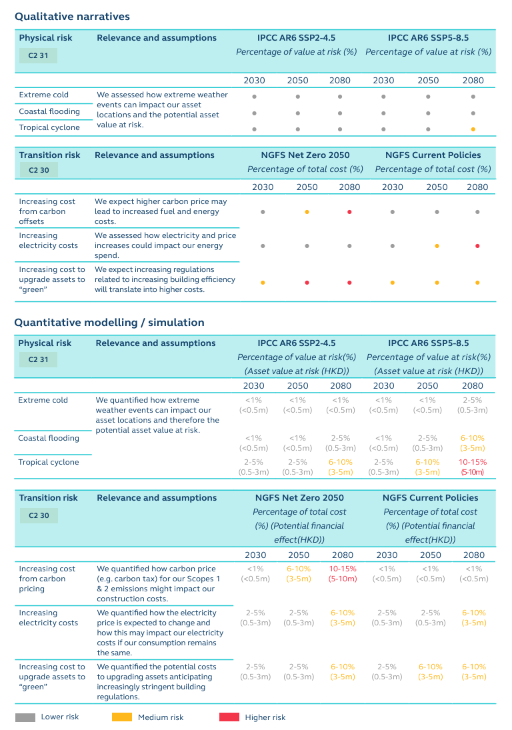

As a critical element of IFRS S2, climate-related risk disclosure is mandatory under HKEX’s climate disclosure requirements. The exchange’s guidance uses an example of a real estate company to illustrate how issuers should perform transition and physical risk scenario analysis by qualitative narratives and quantitative modeling.

Source: Implementation Guidance for Climate Disclosures under HKEX ESG reporting framework

Mainland China’s sustainability disclosure guidance, however, is yet to include mandatory requirements for climate scenario analysis [2]. That said, the Guidelines do require companies to report climate-related issues under the four-pillar “Governance, Strategy, Risk Management and Target and Metrics” framework. In addition, under the “Climate Change” section, the Guidelines focus on climate transition and quantifies climate impact on current-year financial performance, cash flow and financial position. It also encourages capable companies to explore scenario analysis for future years’ financial impact assessment [2].

Materiality Assessment

The Guidelines in Mainland China require companies to assess both financial and impact materiality for sustainability topics. The Guidelines require that Companies need to identify whether each topic is expected to have a major impact on its business model, operations, development strategy, financial position, operating results, cash flow, and financing methods and costs over the short, medium, and long term (“financial materiality”) [2]. It should also include whether its performance in that topical area has a material impact on the economy, society, and environment (“impact materiality”), and explain how that materiality analysis is conducted. Financial material topics should be disclosed in accordance with four key aspects: 1) Governance; 2) Strategy; 3) Impacts, Risks, and Opportunities Management; 4) Indicators and Targets.

Hong Kong’s Adoption of the ISSB

The new climate-related disclosures form part of Hong Kong’s wider roadmap for the local adoption of the ISSB standards with a phased approach and implementation relief to support listed companies to meet the new requirements. It is also the Hong Kong government’s vision, set out by the Financial Services and the Treasury Bureau in March 2024 [3], that the city be among the first jurisdictions to align the local sustainability disclosure requirements with the ISSB standards.

S&P Global Market Intelligence Solutions to support you wherever you are in your ISSB reporting journey

The ISSB foundation Pack is a four-module solution, designed to support companies on their ISSB reporting journey.

Starting with an ISSB Disclosure Benchmark & Gap Analysis, we identify the extent to which the company’s public reporting is aligned with ISSB (IFRS S2) recommendations. We review publicly available climate disclosures in Sustainability Reports as well as the company’s latest CDP Climate Change Questionnaire and up to three of their peers. From this analysis, S&P Global Market Intelligence provides an overview of the disclosure coverage , which can help companies better understand their overall alignment against the ISSB framework.

The S&P Global Market Intelligence Climate Risk Analytics module includes a detailed Transition Risk Assessment on Policy and Market Risks through the lens of carbon pricing based on three future carbon price scenarios. This is followed by a Physical Risk assessment under two climate scenarios—Shared Socio-Economic Pathways 5 and 2 (SSP5 and SSP2)—for eight climate hazards (Water Stress, Temperature Extremes, Coastal Flooding, Drought, Wildfire, Tropical Cyclone, Fluvial and Pluvial flooding). The output is a Climate Risk Assessment Report, which captures forward-looking carbon pricing risk and physical risk impact metrics.

Carbon Footprint Analytics helps the company to measure their Scope 1, 2 and 3 emissions using a quantitative approach aligned with the GHG Protocol.

Finally, the Science-Based Target Setting module supports the company in identifying the appropriate target-setting approach and emissions reduction trajectories aligning with different temperature scenarios to set science-based emissions reduction targets.

Find out more here: ISSB Reporting | S&P Global (spglobal.com)

Get ready for ISSB. Request more information about how our sustainability specialists can provide an end-to-end solution to meet your ISSB reporting needs.

[1] Exchange Publishes Conclusions on Climate Disclosure Requirements. (2024 April 19). HKEX. Retrieved from https://www.hkex.com.hk/News/Regulatory-Announcements/2024/240419news?sc_lang=en

[2]Notice on Releasing Guidelines No. 14 of Shanghai Stock Exchange for Self-Regulation of Listed Companies—Sustainability Report (Trial). (2024 April 12). SSE. Retrieved from https://english.sse.com.cn/news/newsrelease/c/c_20240412_10753174.shtml

[3]Government issues vision statement on developing sustainability disclosure ecosystem in Hong Kong (2024, March 25). Hong Kong SAR. Retrieved from https://www.info.gov.hk/gia/general/202403/25/P2024032500391.htm?fontSize=3

[4] IFRS S2 Climate-related Disclosures. IFRS. https://www.ifrs.org/issued-standards/ifrs-sustainability-standards-navigator/ifrs-s2-climate-related-disclosures/

BLOG