Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 17 Feb, 2022

By Kym Nator

Highlights

Asia-Pacific continues to be an attractive region for streaming services looking to reach greater subscriber scale.

Streaming platforms that shut down cited rising content costs as a key driver for their decision to exit the increasingly competitive OTT landscape in the region.

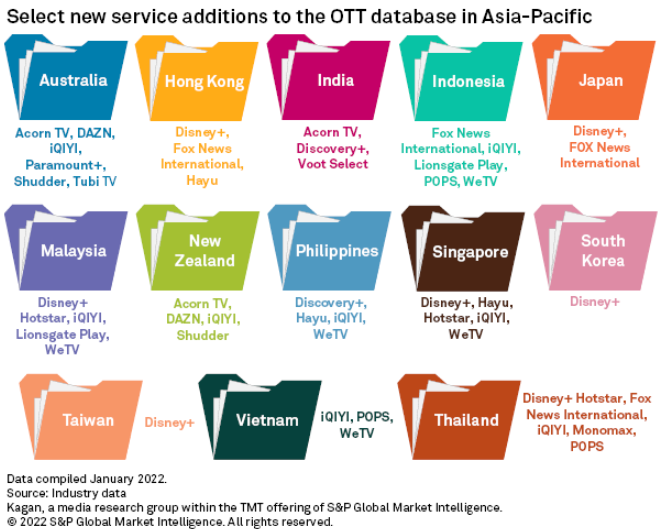

Kagan has added more than 40 new entities in various markets across Asia-Pacific to our OTT Services & Devices database.

While a handful of local over-the-top video platforms have decided to fold in recent years, viewers in Asia-Pacific still find an abundance of streaming options as new services land in the region.

Kagan has added more than 40 new entities in various markets across Asia-Pacific to our OTT Services & Devices database. Our proprietary database offers data on nearly 2,000 OTT services worldwide across a variety of operating models and regions.

Disney continued to make strong inroads with its streaming expansion in the region in 2021, rolling out Disney+ in Singapore, Hong Kong, South Korea and Taiwan, as well as Disney+ Hotstar in Malaysia and Thailand. Disney+ is also available in Australia, New Zealand and Japan while Disney+ Hotstar operates in India and Indonesia. Some key markets in the region still without access to Disney's OTT services include the Philippines and Vietnam, but the company has not announced concrete plans on when the streaming platforms will launch in both markets.

Baidu Inc. and Tencent Holdings Ltd. have also looked beyond mainland China, launching international versions of iQIYI and WeTV, respectively, in Southeast Asia between 2019-2020 to capture a wider audience base. Both Chinese streaming platforms adopted the freemium business model and embraced premium Asian content as a core selling point. Southeast Asia is currently one of the few regions where the likes of iQIYI and WeTV directly compete for viewers against other global streaming players like Netflix, Amazon Prime Video and HBO Go that are not allowed to operate in mainland China.

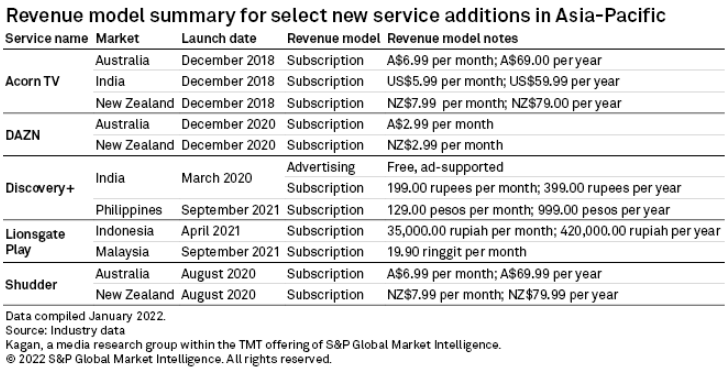

Other U.S.-based OTT streamers that are also gradually expanding their footprint across Asia-Pacific include Lionsgate's Lionsgate Play, Discovery's discovery+ and AMC's niche streaming services Acorn TV and Shudder. Most of these OTT services entered the region with a subscription video-on-demand model and are compatible with a wide range of devices such as smartphones, tablets, computers and connected TVs.

Streaming services were widely credited as some of the biggest beneficiaries of COVID-19 lockdowns across much of the region since 2020. That said, a few local and regional OTT platforms still went dark as bigger global players stepped up investments for their various localization initiatives, which further intensified competition in key markets. The acceleration of operating expenses driven by rising content costs has been a common thread cited by services that decided to pull the plug.

Some of the notable closures in Asia-Pacific during the past two years include Singtel-backed HOOQ in the Philippines, India, Thailand, Indonesia and Singapore; Viu in India; and local platforms such as SVOD service dimsum in Malaysia and AVOD service Line TV in Thailand.

Economics of Internet is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

Article

Location