Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Apr, 2023

By Milan Ringol and Neil Barbour

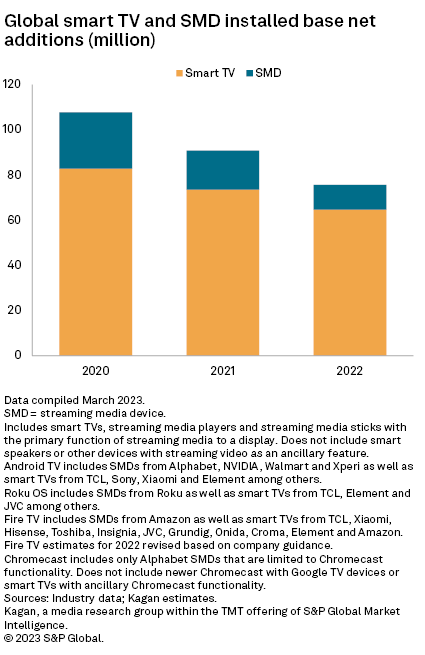

Kagan estimates the combined global installed base for smart TVs and streaming media devices, or SMDs, grew 7.5% year over year as of the end of 2022, but the market has slowed considerably since the pandemic began. Particularly, the net additions to the SMD installed base in 2022 were less than half that of 2020.

The connected TV universe faced multiple challenges in 2022, including macroeconomic headwinds tied to inflation, fading demand related to the pandemic and increasing market saturation. Many vendors used the downdraft as an opportunity to pivot.

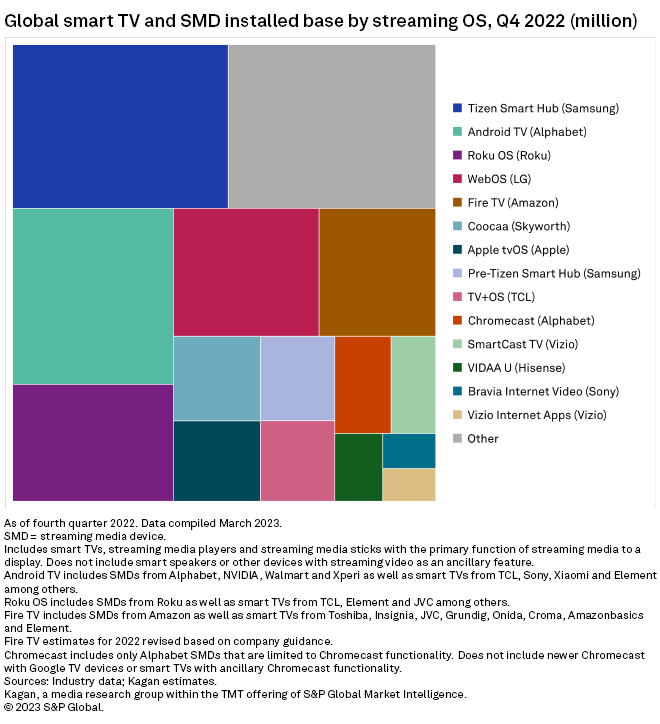

Alphabet has, for instance, abandoned its Chromecast SMDs in favor of Android TV-based streamers. Consequently, and with the help of smart TV partners, Alphabet was able achieve grow at a pace faster than Tizen, narrowing the gap between them.

Meanwhile, Amazon has made smart TVs a priority: the estimated installed base of Fire TV smart TVs as of fourth quarter 2022 grew 47% year over year, largely driven by its own Omni and 4-series smart TV lineups launched in late 2021.

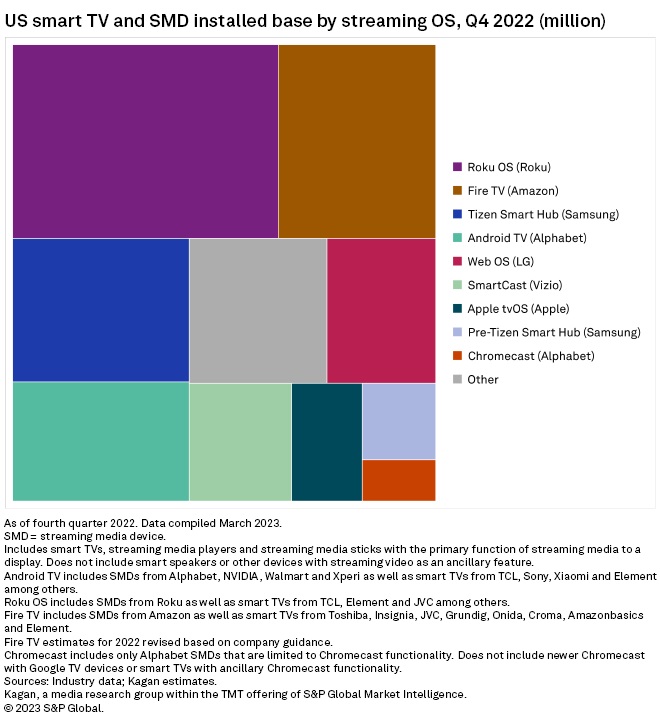

In the US, falling SMD shipments after the pandemic uptick, on top of the shifting product mix by key vendor partner TCL, dragged Roku's year-over-year growth. Amazon suffered the same SMD declines but offset this with renewed efforts around smart TVs, allowing it to grow at a slightly faster rate than Roku.

Android TV was the fastest-growing streaming OS in the US in 2022 due to Alphabet's pivot toward the platform for its latest SMDs while its own Chromecast was the fastest-declining platform.

Vizio's SmartCast was the second-fastest growing streaming OS in the US in 2022. Its strong position at brick-and-mortar retailers helped insulate it from increased competition from the likes of Amazon and Roku in their price range.

The data points in this analysis are Kagan estimates based on research into the smart TV and streaming media device, or SMD, markets, which we track on a quarterly basis with proprietary market share models that incorporate company-reported data, estimates based on business line revenues and other market research. Streaming-capable soundbars, smart displays, game consoles and other hardware with an ancillary video streaming feature are not included in this analysis.

Research

Research