S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 16 Jan, 2023

By Neil Barbour and Milan Ringol

In the clearest sign yet that streaming media devices are no longer the strategic focus of the online video universe, both Roku Inc. and Xperi Inc.'s TiVo took definitive turns toward smart TVs during CES 2023, which was held in Las Vegas from Jan. 5-8.

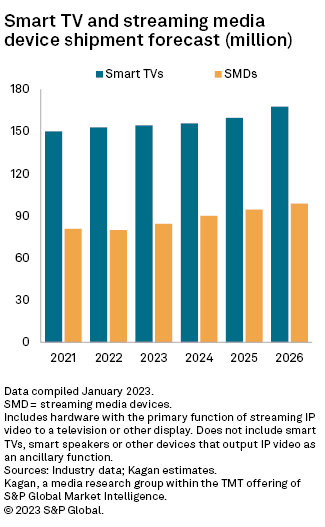

However, our research indicates that the streaming media devices, or SMDs, market is far from finished. We anticipate the streaming players and sticks that comprise SMDs will compose 35.3% of combined global SMD and smart TV shipments in 2023, up a percentage point from its market share in 2022.

Connected TV companies are locked in a tight race as deep pockets compete for what's left of an increasingly saturated market. A year ago at CES, smart TV vendors were showing off an array of new features, such as fitness and cloud gaming. At CES 2023, the tone changed from iterative functionality to rethinking the underlying business model.

The persistence of dongles as a conduit to streaming video is partially due to the quick emergence of new streaming services over the past two years. Consumers turn to SMDs to equip an older TV quickly and cheaply with more robust streaming capabilities or to fill gaps in a smart TV's app universe.

Inflation and declining consumer confidence also favor the SMD market because a new SMD can be had for as little as $15, compared to hundreds of dollars for a new TV.

But streaming media devices are often low margin, built to last only a few years and prone to creating friction for users by introducing new remotes and setup issues. Having a streaming OS installed directly onto a TV is a way for streaming OS operators to take more control of the user experience and potentially keep users inside their ecosystems for longer periods.

The way that has worked in the past is that a streaming OS vendor would partner with a TV manufacturer, which led to Roku OS being installed on TCL Electronics Holdings Ltd. and Hisense Visual Technology Co. Ltd. TVs or Alphabet Inc.'s Android being installed on Sony Group Corp. TVs. Alternatively, a smart TV manufacturer could also develop its own streaming OS, which is how it worked for Samsung Electronics Co. Ltd.'s Tizen and LG Electronics Inc.'s WebOS.

But now Roku is taking what was an existing streaming OS business and using it to design, make and sell its own TVs. And that puts it into direct competition with its OEM partners that carry the Roku OS on their TVs.

Why is it doing this? Representatives at the show suggested that being in charge of the chips that go into the TVs could facilitate Roku's push into smart homes. Smooth connectivity to smart lights and doorbell cameras might not be an important factor to most of Roku's smart TV partners, but it is for Roku now that it has partnered with Wyze Labs Inc. to make and sell those devices.

Samsung is already developing a smart home play to tie into its TVs, and the company has said its newer displays will support the Matter smart home interoperability standard.

Underpinning Roku's argument around controlling the hardware that composes a smart TV is the ongoing concern that some of its TV manufacturing partners do not fully recognize the need to install the kind of chipsets that might make for a truly robust streaming experience.

For years, underpowered hardware has dogged mid-range and low-end smart TVs. This is primarily because lower power equals lower cost and vendors are looking to maximize their margin on each set sold. But it is also because many vendors making mid-range and low-end smart TVs do not share much, if any, of the ad revenue that a streaming OS provides. That revenue goes to the provider of the streaming OS. If smart TV vendors are not making money from consumers staying on the platform, they are not incentivized to build a hardware stack capable of powering a streaming platform for more than 2-3 years.

To mitigate the concern that Roku is now competing with its partners, the new Roku line of TVs will not focus on picture quality that would please home theater enthusiasts or hardcore gamers. But Roku will be competitive on price, with sets ranging from $119 for a 24" TV to $999 for a 75" model.

TV vendors that feel threatened by Roku's move into the space have other options to power their smart functionality, such as Android TV or Amazon.com Inc.'s Fire TV, or they could license something from a competing TV vendor, such as Tizen, WebOS or Hisense's VIDAA. These are road-tested operating systems with established app stores that already have buy-in from consumers worldwide.

Click here for our quarterly streaming OS tracker.

Xperi is hoping to make that decision a little harder with its Linux-based TiVo OS. The new TiVo interface has an array of search and sorting functions to make finding content easier, particularly content to which a consumer already subscribes. It also comes with voice search as a standard feature, which has been something of a soft spot for Roku in the past.

But what makes the OS more inviting for smart TV vendors is that Xperi promises to let the TV vendor keep more of its branding inside of the interface and, more importantly, harvest more of the ad revenue flowing through that platform.

The TiVo OS will launch on Vestel Elektronik Sanayi ve Ticaret Anonim Sirketi-made TVs later in 2023, and it is not the same OS that is powering the Android-based TiVo Stream 4K.

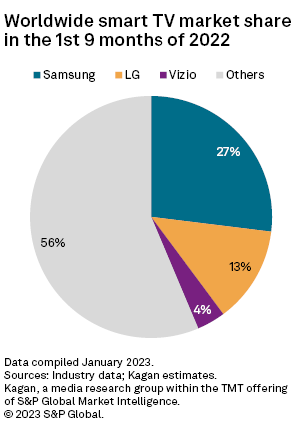

Samsung, LG and VIZIO Holding Corp. only use their owned-and-operated streaming operating systems on TVs they ship, and they composed 43.6% of the 96.3 million smart TVs shipped in the first nine months of 2022. That means that any new streaming OS has slightly more than half of the smart TV market to sell into.

Soon that opportunity may be much smaller depending on how successful Roku is at securing distribution and retail partnerships. Xperi's move to give the smart TV vendors more leverage in this space strikes us as a concession that the market is tightening, and rising players will have to be creative if they want to be successful.

Technology is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.