Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 5 Jan, 2023

The streaming revolution in the U.S. media sector started with a few quiet splashes — the debut of YouTube LLC in 2005 and Netflix Inc.'s launch of streaming films and TV shows in 2007 — that would swell into a tidal wave of streaming revenues projected to top $100 billion by 2026. The streaming wave is still rippling across the media sector and forcing pay TV operators, network owners and the film industry to face the dilemma of maximizing traditional revenue streams while also capitalizing on new streaming opportunities.

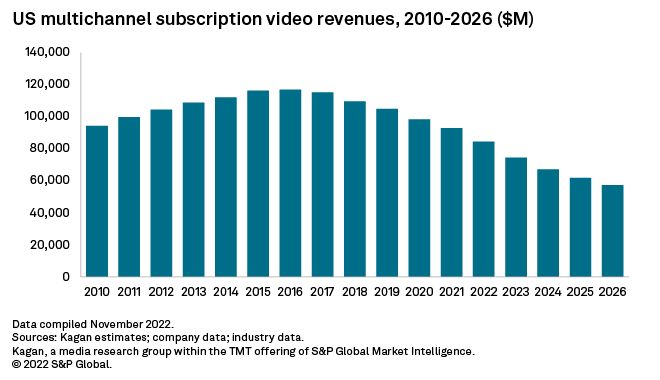

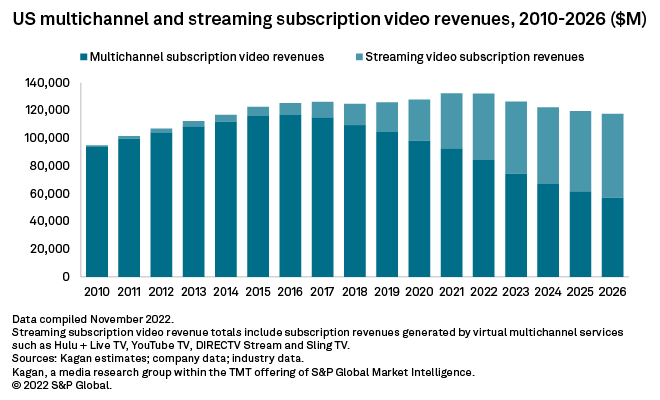

* Traditional multichannel video operators offering pay TV packages via cable, satellite and telco delivery were the first to feel the sting of cord cutting as streaming video services enabled some households to finally ditch their pay TV services. U.S. multichannel revenue peaked at nearly $117 billion in 2016 and has declined each year since. However, gains in higher-margin businesses such as broadband have eased the pain, and some operators including Comcast Corp. and DIRECTV LLC have launched their own streaming video services.

* TV network owners and TV station owners face similar challenges from cord cutting. Steadily shrinking linear TV audiences have cut into advertising revenues, although increases in CPMs and booming political ad spending have helped mitigate some of the pain. Affiliate fees charged by TV networks and retrans fees collected by TV station owners are also under pressure, with rate increases struggling to offset a contracting traditional TV viewing audience.

* The film industry has been less impacted by the rise of streaming than some other traditional media sectors, insulated to some extent by the unique experience of watching movies in a theater. Exhibitor and distributor revenues have slowly recovered from pandemic lows and most studios have returned to theatrical debuts for most new films, although exclusive theatrical windows have shortened as Walt Disney Co., Paramount Global, Warner Bros. Discovery Inc. and NBCUniversal LLC look to quickly shift new movies to their respective streaming platforms.

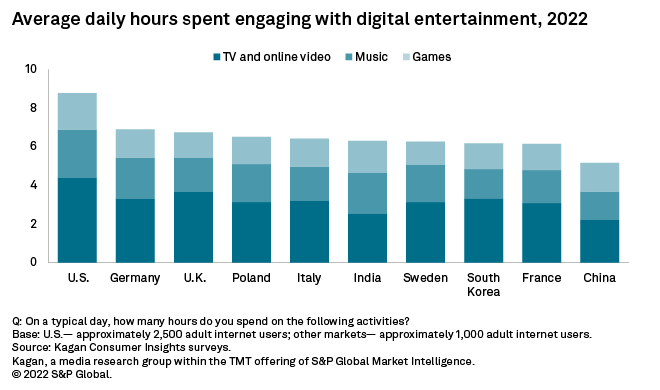

The U.S. proved to be the perfect petri dish to test whether the streaming delivery of entertainment content could crack the hammerlock that a handful of big media firms and multichannel operators held throughout the '80s, '90s and '00s. Americans have comparatively ample amounts of discretionary income to spend on video entertainment and engage far more often with digital entertainment than consumers in many other markets, watching well over four hours of TV and online video each day in 2022. Free-to-air, or FTA, TV programming is also more limited in the U.S. versus many other markets, which was a factor in pay TV penetration rates that neared 90% of U.S. occupied households in 2009 when only a few FTA channels were available.

Access selected data discussed below here in Excel format.

The arrival of streaming services such as YouTube, Netflix and Hulu LLC in 2005-2007 came at a critical juncture in America's love affair with television — especially for some households chafing at the idea of paying for hundreds of channels they never watched. Streaming services were initially more a novelty than a serious threat to traditional TV stalwarts such as Disney, HBO, Comcast and Charter but that rapidly changed as viewers flocked by the millions to streaming platforms.

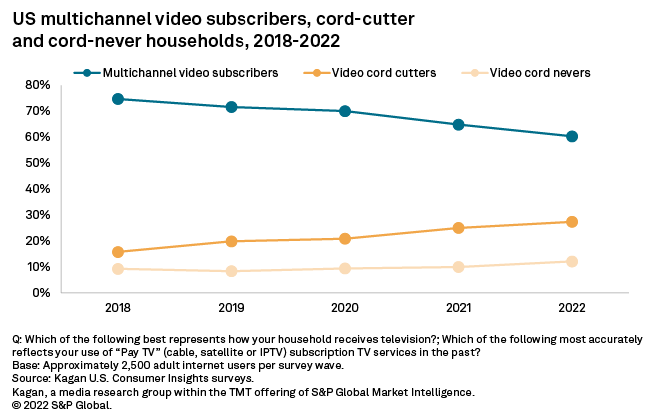

A trickle of cord-cutting households has grown to a flood, boosted in recent years by most of the media old guard embracing the inevitable and prioritizing their direct-to-consumer streaming platforms. Cord-never households that have never had a pay TV subscription have also slowly ticked up in the U.S., driven in part by younger generations growing up in a world where YouTube, TikTok and Twitch may be more familiar than networks like ABC, NBC, CBS and FOX.

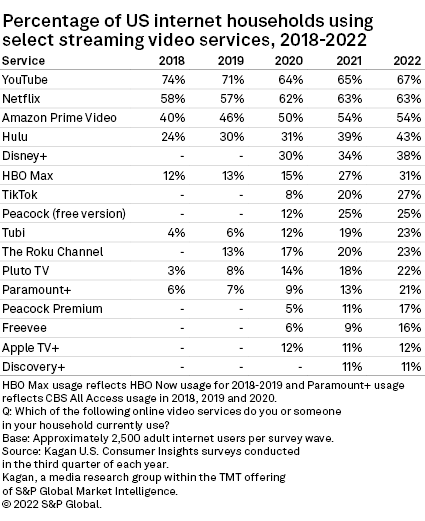

Kagan's Consumer Insights surveys of U.S. online adults showed just five streaming services — YouTube, Netflix, Amazon.com Inc.'s Prime Video, Hulu and HBO Now — used by 10% or more of households in 2018, with that number more than tripling to 16 services by 2022.

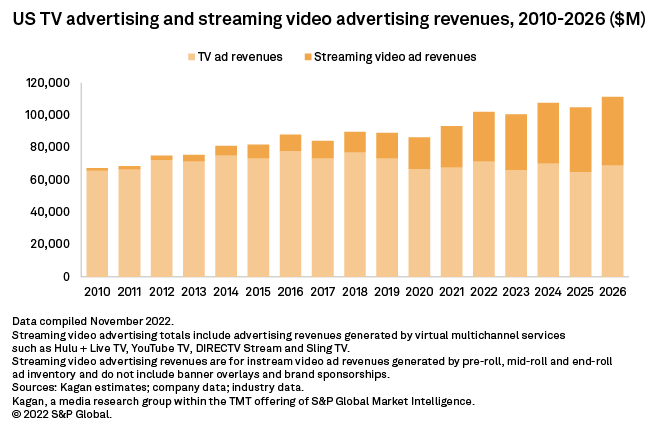

Streaming video subscription and video advertising revenues have raced higher as a result, rising from just over $2 billion in combined revenues in 2010 to likely surpassing the $100 billion mark by 2026. While some of streaming's headlong growth has come at the expense of traditional multichannel, TV network and film revenue streams, impacts have varied widely. Media giants including Disney, Comcast/NBCU, Paramount and Fox Corp. have also leaned heavily into the streaming model, aiming to offset declining traditional TV revenues with digital dollars.

Multichannel video

The digital transition must come at the expense of something, with the traditional cable bundle in the crosshairs as consumers switch to streaming. The good news for operators is that video business margins are very slim, so they are losing what are in many cases break-even businesses. Some smaller operators have thrown in the towel on traditional TV and opted to be a dumb, but profitable, pipe to enable customers to cobble together à la carte streaming services. The success of larger cable operator mobile virtual network operators in the last few years (e.g., Comcast's Xfinity Mobile and Charter's Spectrum Mobile) have also helped allay some investor fears and keep overall churn low.

Additional good news for operators is that their wired broadband businesses, including co-ax and fiber, offer double-digit profit margins and are also more difficult, if not impossible, to replace in many areas. Closing the digital divide for broadband could become more of a focus for operators in the medium term than video. The U.S. government has whetted operator appetites by setting aside $62.85 billion in funds to remove U.S. broadband deserts including both the Broadband Equity, Access and Deployment program and the Rural Digital Opportunity Fund.

Comcast's content business includes streaming options like Peacock and Hulu, so as eyeballs switch from traditional to streaming, on a consolidated level viewers remain with the same company. In April, Charter and Comcast partnered to lean into the digital shift with an upcoming nationwide streaming service/set-top box offering (similar to Flex), which will be available outside of each operator's homes passed footprint.

But in terms of revenue, the traditional video forecast is grim as consumers continue to cut the video cord. The traditional video subscription market — including cable, telco and satellite video services — peaked at $116.94 billion in revenue in 2016 but is forecast to drop to $84.38 billion in 2022 with no reversal in sight over the forecast period.

Stacking traditional multichannel revenues and streaming video subscription revenues highlights the dynamic nature of the shift to streaming as well as the impact of consumers shifting to à la carte video consumption. Streaming subscription video revenues could top $60 billion and eclipse multichannel revenues by 2026, although total combined revenues for the two formats may peak at about $132 billion in 2021 and 2022 before declining slightly each year through 2026. Despite recent price increases for most major streaming subscription video services in the U.S., the combined cost of subscribing to even five or more services remains well below the price of a typical pay TV package. The softness in outer year top-line revenue growth from subscription services might be eased with the launch of additional free, ad-supported TV options.

TV networks, TV stations

The once-booming TV network business is now under pressure from cord cutting and increased programming expenses, causing profit margins to shrink and executives to shift strategies. Viewing of original programming has migrated to on-demand streaming services, leaving news and sports as the dominant genres on linear TV. The lines are becoming increasingly blurred, with networks sharing programming across their linear channels and streaming video services. Some networks such as TNT and TBS have gotten out of the original programming business as executives at Warner Bros. Discovery have signaled a tightening in spending. Comcast has also pulled back on original scripted programming, opting to increase its investment in sports.

With consumers looking for more convenient ways to view content, media companies have shifted focus from linear TV to direct-to-consumer and on-demand platforms by launching streaming channels and platforms. In 2022, we saw the launch of Fenway Sports Group Inc.'s NESN 360, Sinclair Broadcast Group Inc.'s Bally Sports+ and National Football League Inc.'s NFL+.

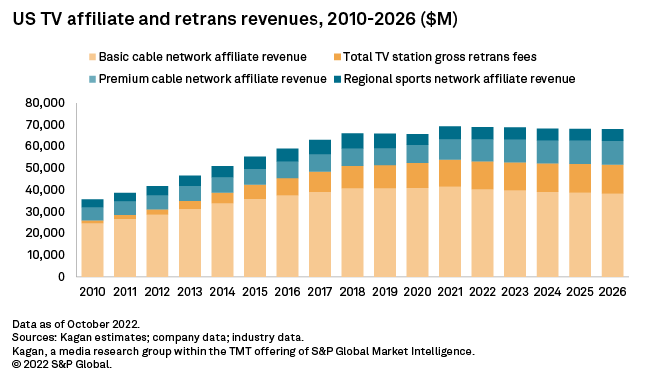

Affiliate fees, retrans

Affiliate revenues have been the dominant revenue stream for basic cable networks since 2002 and have been more stable than advertising as carriage deals are locked in and include annual rate hikes. Total industry affiliate revenue enjoyed double-digit annual growth from 1990 through 2010 as the cable network industry added new networks and expanded into more households. While the affiliate revenue stream has consistently grown on a year-over-year basis since we started tracking it in 1989, we estimate that it could decline in 2022. Cable network affiliate fees are under pressure from a decline in pay TV subscribers, with industrywide affiliate revenue declining in the future as license fee increases fail to offset subscriber erosion. Note that the regional sports and premium networks started seeing affiliate revenue declines in 2019 as they experienced sharper subscriber declines.

TV station owners have continued to be successful in securing higher retrans fees in each renewal period, although with some major disruptions, including TEGNA Inc. and DISH Network Corp., which was resolved prior to the Super Bowl and Winter Olympics broadcasts in February. In October, we saw Nexstar Media Inc. and Verizon Communications Inc. Fios and Mission, White Knight, and DIRECTV retrans disputes lead to signal blackouts for subscribers.

On the virtual side, distribution and carriage rates are being set by the networks, with the stations typically receiving less on a net basis than on the legacy side of the multichannel video universe. However, reverse retrans payments back to the networks are expected to rise over the projection period, putting downward pressure on those net margins for traditional subs. Based on Kagan's outlook for net retrans margins, they will only compress slightly from a basis of 50% over the five-year projection period as the consumer shift away from traditional multichannel to streaming platforms accelerates.

U.S. TV station traditional sub gross retrans fee revenue is projected to reach $12.76 billion in 2022, up 2% from $12.50 billion estimated in 2021 as rate increases in renewals and step-ups in station deals outpaced traditional sub churn. Over the projection period, we see growth rates slowing to just 1% or less, with gross retrans fee revenue reaching $13.31 billion by 2026, driven by continued rate hikes in renewals.

Big Four networks still rely on their affiliate stations to deliver prime-time and live sports programming to a nationwide audience as well as local programming, which is still in high demand and differentiates the networks from streaming alternatives. In addition, over-the-air TV households are on the rise with the nationwide rollout of NextGen TV potentially accelerating that trend. That is a potential downside risk for retrans but also an opportunity for broadcasters to reach new audiences that do not subscribe to any video packages.

TV advertising

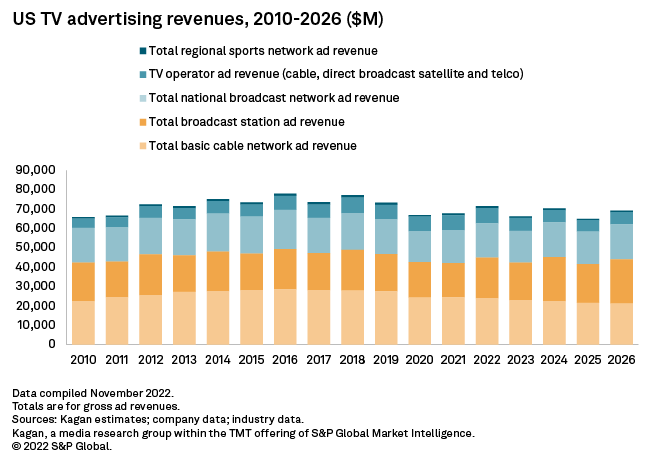

Cable networks in the U.S. have been under pressure from declining subscribers in the past decade, which has resulted in a drop in ratings and ultimately lower advertising revenue. Network advertising revenue will be also challenged by the emergence of ad-supported Netflix and Disney+ tiers joining discovery+ and HBO Max, which launched ad-supported versions in 2021. We anticipate that cable network gross advertising revenue will fall 2.3% in 2022 to an estimated $23.88 billion and will likely decline every year through 2026.

Sports programming remains a key driver for ad revenues across basic cable networks, regional sports networks and broadcast networks. The return of regularly scheduled sports content in 2021 following the pandemic provided a much-needed boost to help TV ad revenues recover from 2020 lows. National broadcast networks continue to attract large audiences with marquee sporting events and original programming. However, networks are increasingly diminishing the exclusivity of their content by airing shows on streaming services the day after the live premiere. We estimate that gross advertising revenue for the broadcast networks peaked in 2016 at $20.30 billion.

For TV stations, our outlook shows core spot ad revenues, excluding digital and political, growing 5.4% in 2022 to $17.59 billion with local core outpacing national. We expect local ad revenues to rise 6.0% to $12.04 billion versus a 4.0% increase in national ad revenue to $5.56 billion. Sports gambling, healthcare, professional services, telecom, banking and home improvement ad categories will likely continue to be stronger than the auto, retail and travel categories.

Adding in $3.49 billion in political ad revenue in what is anticipated to be a record-breaking midterm election year, Kagan's total TV station ad revenue forecast of $24.15 billion in 2022 would be just below the all-time high-water mark of $24.16 billion recorded back in 2006. Digital is the fastest-growing category in our TV station ad revenue outlook, increasing from $3.07 billion in 2022 to $3.68 billion by 2032, boosted by the nationwide rollout of NextGen TV.

We estimate that the total US TV industry — spanning basic cable, national broadcast, and regional sports networks, as well as broadcast stations and local ads run by multichannel operators — will generate $71.47 billion in gross advertising revenue in 2022, an increase of 5.4% compared to 2021 thanks to an influx of political ad spend. Political advertising delivers a surge of cash flow across the TV ecosystem during election years, with record fundraising numbers reported so far in 2022. Traditional TV will continue to receive the lion's share of political ad spending in coming years, but we expect some political ad spend to migrate to streaming services where advanced targeting capabilities are particularly attractive to campaigns and PACs.

Stacking traditional TV ad revenues and streaming video ad revenues reveals a much different impact compared to what has developed in the subscription video marketplace. While the rise of streaming has contributed to shrinking pay TV viewing audiences — which in turn has crimped cable network and TV operator ad revenues — streaming video ad revenue gains will likely keep the combined total growing briskly and on pace to surpass $111 billion in total combined revenues by 2026.

Motion pictures and streaming

The motion picture business has a long and storied history of embracing new technologies and exploiting them to drive revenue growth for the industry. As network television became popular, studios began licensing their films for broadcast. When VHS become the dominant home video format, they developed a robust windowing system that led to the rise of companies like Blockbuster and Hollywood Video while allowing cinephiles to build their own VHS libraries.

As cable television blossomed, studios created more release windows and licensed their films to both pay networks (HBO, Showtime, etc.) and cable networks (TNT, USA, etc.). When DVD hit the market, studios wholly embraced the format, skirted the traditional video rental window and released their films on DVD straight to sell-through to put momentum behind its adoption. Consumers embraced the DVD like never before and spent billions renting and buying movies and TV series.

Then came high-speed internet and a plethora of connected devices. Subscription streaming services were launched and have forever changed how consumers interact with home entertainment. Early on, studios struck lucrative deals with streamers that wanted to use Hollywood content to drive subscriber growth. Eventually, streaming services like Netflix moved away from licensing deals in favor of creating original content. This led to most major film studios launching their own streaming services — Disney+, HBO Max, Paramount+ and Peacock — where their films will land after theatrical release.

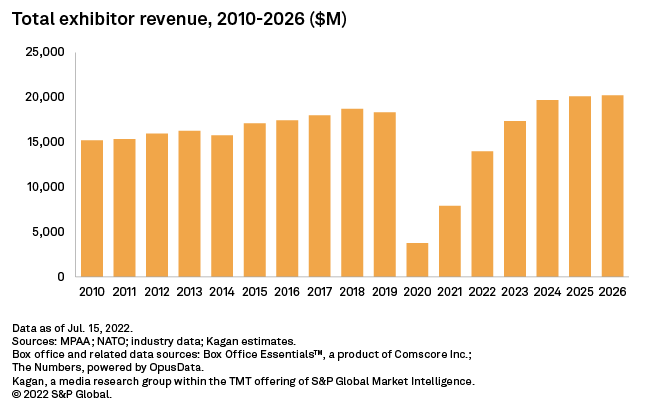

The theatrical exhibition market has been remarkably resilient to weathering the launch of new technologies. The industry, while mature, has trended in an upward trajectory primarily due to increased ticket costs and upgrading concessions beyond just popcorn, candy and soda. In 2010, total exhibitor revenue was $15.22 billion and had grown to $18.32 billion in 2019. The COVID-19 pandemic caused revenue to plummet to $3.77 billion in 2020. The market has slowly been recovering as studios have begun releasing films that had been put on hold while theaters were closed, and audiences have gotten comfortable with returning to theaters. We estimate the exhibition recovery will continue through 2023 before returning to normal by 2024 and growing to $20.23 billion in 2026.

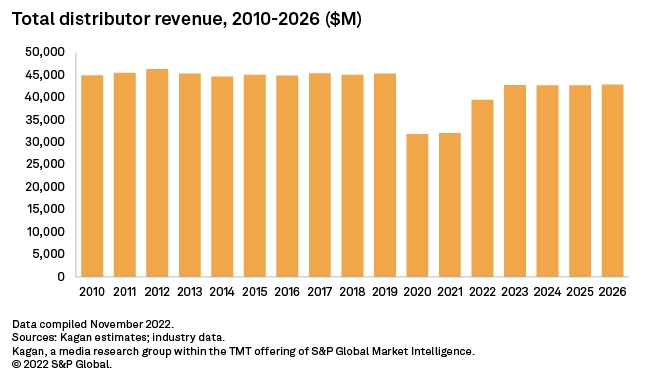

Motion picture distributor revenue has also been rather steady through the emergence of digital distribution with total revenues in the range of $45 billion from 2010 through 2019. The pandemic also hit this part of the market with revenues dropping to $32 billion in 2020 and 2021. We estimate that the distributor portion of revenues will not rise to the heights they once enjoyed due to the shift in release strategies by studios.

Film studios negotiated a shorter exclusive theatrical release window, and based on public filings, it appears they have conceded a larger portion of box office receipts to exhibitors than they had in the past. Also, many studios are releasing major films — soon after theatrical release — onto their streaming platforms before they are available to buy/rent digitally or on optical disc in what seems to be a way to reduce streaming service subscriber churn. We expect this strategy will lead to lower license fees for films when they are released on TV. We estimate total distributor revenue will be $42.81 billion in 2026.

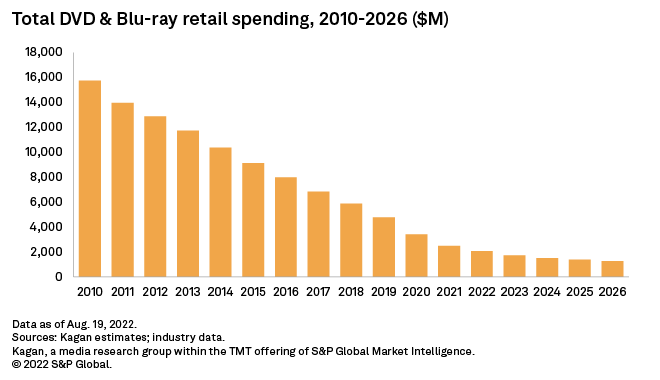

The segment hit hardest by the meteoric rise of streaming video has been the DVD and Blu-ray retail market. There was a time, at the height of the DVD, when consumers were spending over $20 billion a year to buy and rent movies and TV series on disc. The market began to decline in 2007, dropping by $1+ billion a year for 11 straight years to $6.85 billion in 2017. By 2021, consumers spent just $2.50 billion on DVD and Blu-ray. There is no sign of the decline stopping as the optical disc becomes an outdated format for most consumers. We estimate that by 2026, only $1.28 billion will have been spent renting and buying DVD and Blu-ray discs.

Economics of Internet is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.