Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 24 Aug, 2022

Highlights

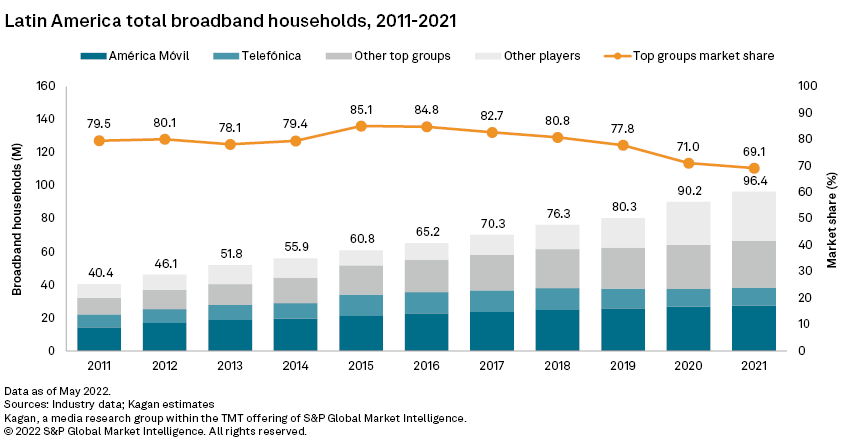

Fixed broadband services grew 6.8% to reach 96.4 million subscribers, or 48.2% of total Latin America and Caribbean households, by year-end 2021

The region's top 11 operator groups grew 4.0% to 66.6 million broadband households, losing market share to new market entrants.

Fiber network spinoffs allowed Latin America's top operators to turn small ISP competitors into customers.

Kagan estimates fixed broadband services grew 6.8% to reach 96.4 million subscribers, or 48.2% of total Latin America and Caribbean households, by year-end 2021. The COVID-19 pandemic continued to accelerate broadband adoption in the region, albeit at a slower rate than the previous year's 12.4% growth. The region's top 11 operator groups, however, grew only 4.0% to 66.6 million broadband households, losing market share to new market entrants.

The Take

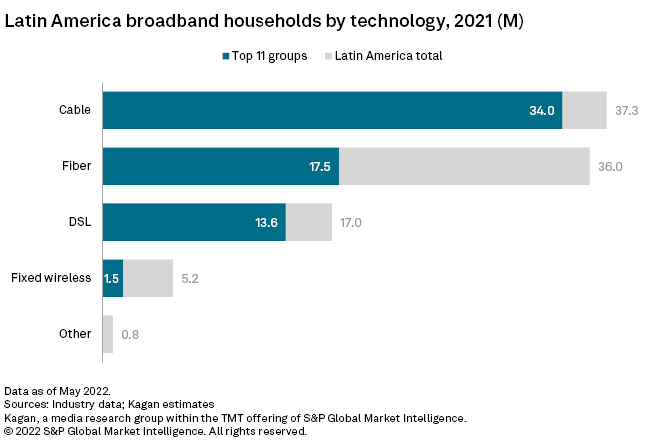

* Latin America's top 11 operator groups' fixed broadband market share fell below the 70% mark for the first time as they continue to shed subscribers in legacy technologies such as DSL and struggle to compete with small internet service providers' fiber offers.

* Large telcos did, however, recover ground in the Latin American fiber market in 2021. Their share of fiber-to-the-premises households grew from 44.2% to 48.5% as they pushed to migrate existing subscriber bases to new, high-speed networks.

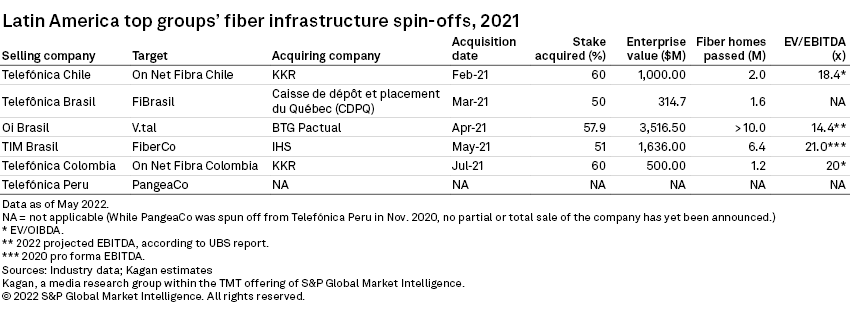

* Fiber network spinoffs also allowed Latin America's top operators to turn small ISP competitors into customers.

* Although cable still dominates the top groups' broadband offers, at 51.1% of total households, the platform is beginning to show signs of weakening in the face of competition, coupled with cord-cutting among cable multichannel subscribers.

Although América Móvil, and Telefónica continued to dominate the region's broadband market at a 39.8% market share, they led losses among the top groups, each dropping their share by 3.6 percentage points since 2019. This decline was largely due to disconnections in Brazil, where the two incumbents face increasing competition from small, regional ISPs, which have led fiber rollouts in the country.

Already a client? Check our Latin America regional forecast table here for total broadband market data, including projections, and our TMT Geography Knowledge Base here for country-level data.

The region's largest operator groups dominated legacy broadband technologies such as DSL and cable, with market shares of 79.8% and 91.2%, respectively, in 2021. Their slow deployment of fiber networks, however, has stunted leadership in this segment, where small ISPs overtook the top groups in 2018. A recent push in migrating existing DSL subscriber bases to fiber has improved results, with the top groups regaining fiber market share in 2021 by 4.3 percentage points to reach 48.5% of total fiber broadband households in Latin America.

Telefónica, which operates as the telco incumbent in many of its Latin American markets, largely led the shift in strategy, along with Brazilian telco Oi and América Móvil, whose largest subsidiary, Mexico incumbent Telmex, has ramped up fiber growth in the past two years. The companies added 4.2 million fiber households in Latin America during 2021, or 61.9% of the region's total fiber net adds. Comparatively, the three groups saw 3.1 million disconnections in DSL households during the year.

Cable decline

América Móvil, which dominated the Latin American cable broadband sector with a 34.5% market share in 2021, also started seeing disconnections in cable in the year, as the company faces competition from fiber operators in Brazil, its largest market with subsidiary Claro Brasil. This may indicate the beginning of a downward trend for cable broadband in the region as a growing number of households choose to cut the cord on triple-play bundles and migrate to fiber broadband and streaming. Cable multichannel subscriptions in Latin America have declined in the past three years, down by 1.1 million since 2018.

The top 11 groups controlled 74.9% of the region's cable TV households and 91.2% of cable broadband households as of 2021. Liberty Latin America, Millicom International Cellular, Grupo Televisa and Megacable were the most exposed, with over 80% of their broadband subscriber bases on cable, although fiber competition is still limited in most of the markets where the companies operate.

Besides América Móvil, Liberty Latin America was the only other company within the top groups to see cable broadband decline in 2021, largely due to subscriber losses its Chile subsidiary VTR suffered during the pandemic. The multiple system operator recently merged with América Móvil's Claro Chile, and Telefónica Chile overtook it as Chile's largest broadband provider, as the Spain telco's subsidiary successfully migrated almost its entire subscriber base from DSL to fiber in the past five years.

Despite growing fiber competition in Mexico from Telmex and Grupo Salinas' Total Play Telecomunicaciones, especially in the last two years, the two Mexican cableras, Televisa and Megacable, still benefit from the high penetration and affordability of their bundled services. Throughout the past 10 years, the two companies have maintained the lowest average revenues per user for broadband services among the top 11 Latin American operator groups.

Another group benefiting from cable's market dominance is Telecom Argentina, the incumbent telco in Argentina's Northern region. With 69.2% of its broadband subscriber base on cable, inherited from its merger with Cablevisión Argentina in 2017, the company has been slow to migrate its legacy DSL households in Argentina to fiber, given that most of its competitors are small, regional MSOs that only recently completed migration to digital cable. The country's only major fiber player is Telefónica de Argentina, which operates as the incumbent telco for Southern Argentina. This differs from Telecom's strategy in Paraguay, where subsidiary Núcleo. (Personal Paraguay) has become the market's second-largest ISP behind Millicom's cable operator Tigo Paraguay with its rapid fiber expansion.

Already a client? Access a complete database of Latin America's top operators' subscriber data, access the TMT Operator Knowledge Basehere.

Fiber network spinoffs

At 18.9%, Spanish group Telefónica leads fiber market share in the region, competing neck-and-neck with Mexico's América Móvil over the past five years. With fiber expected to overtake cable as the largest broadband platform in the region by year-end 2022 and projected to grow to 70.4 million households in 2030, Latin America's telco groups have doubled down on the technology. New fiber network deployments also provide expansion opportunities for the companies' mobile services, especially with the emergence of 5G.

To focus capital expenditure on these two core businesses, Latin America's top groups have been promoting several divestments, such as with mobile tower operations. In 2021, the region's top groups spun off six fiber networks into separate entities, looking to investment partners to expand their fiber deployment capabilities. The strategy also allows them to better monetize their networks by providing backbone services to their rapidly growing small ISP competitors while maintaining their original companies as anchor clients.

Of these six neutral fiber networks, four were subsidiaries of Telefónica, which has long been looking to divest its Hispam operations to focus on Brazil and Europe. So far, five fiber network spinoffs have already been partially sold, with plans to significantly accelerate coverage expansions in the coming years.

Revenues

Broadband revenues for the top 11 operator groups in Latin America grew 8.7% in 2021 to reach $16.42 billion. This was after dropping 4.1% in 2020 despite increased adoption following COVID-19-induced stay-at-home measures, largely affected by exchange rate pressures as Latin American economies struggled with the effects of the pandemic. The average revenue per user similarly suffered foreign exchange effects in 2020, although the growth in 2021 also partially reflects customer migration to fiber and higher speeds.

In 2021, broadband revenues have grown to represent 52.2% of total fixed service revenues for the top 11 Latin American groups, up from 24.5% in 2011. This is largely due to subscriber losses in fixed telephony and multichannel services, which also saw ARPUs reduce significantly over the years, as operators are offering promotional prices to hold on to triple-play households.

With operators increasingly focused on mobile and broadband services, in some cases divesting multichannel operations, connectivity is expected to continue growing its share of fixed revenues in coming years.

Research