Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Apr, 2025

By Sheikh Rishad and Ronamil Portes

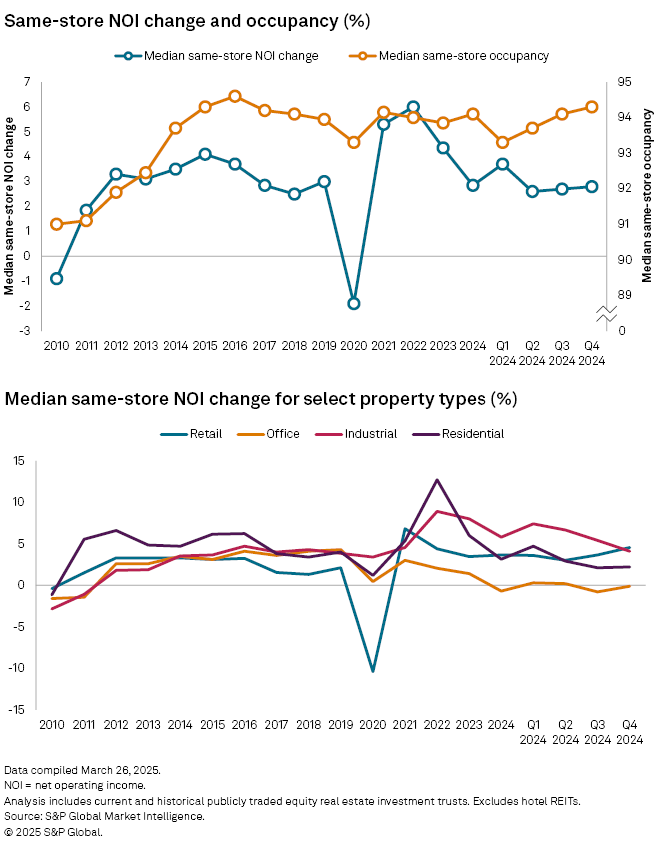

US equity real estate investment trusts reported weaker gains in same-store net operating income (NOI) for 2024, with a median growth of 2.9%, down from 4.4% in 2023.

During the fourth quarter of 2024, median same-store NOI grew 2.8% year over year across the entire REIT industry, while median same-store occupancy stood at 94.3%, according to an S&P Global Market Intelligence analysis. The median same-store occupancy was 94.1% in 2024, up from 93.9% in 2023.

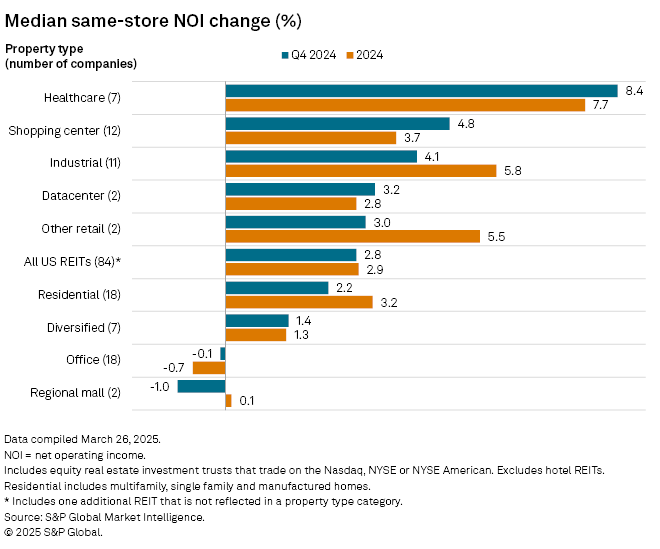

Among major property types, retail was the only segment to see continued improvement in median same-store NOI growth, rising 3.7% in 2024 after a 3.5% increase in 2023. Office sector REITs saw a 0.7% decline in same-store NOI in 2024. Industrial sector REITs grew their same-store NOI by 5.8%, slower than the 8.0% growth in 2023. Residential sector REITs recorded 3.2% growth, weaker than the 6.0% increase in 2023.

S&P Global Market Intelligence prefers to use cash-based same-store net operating income, if available. However, a noncash-based NOI will be used if not.

While earnings trends within the portfolio of publicly traded REITs might not match all privately owned properties, during a time when commercial real estate is being scrutinized, the data reported by public REITs can provide valuable insight into potential earnings trends for commercial real estate as a whole.

Healthcare records largest gain

In the fourth quarter of 2024, the healthcare segment posted the largest year-over-year gain in same-store NOI, with a median increase of 8.4%. The healthcare segment also led the 2024 chart for same-store NOI, with an annual growth of 7.7%.

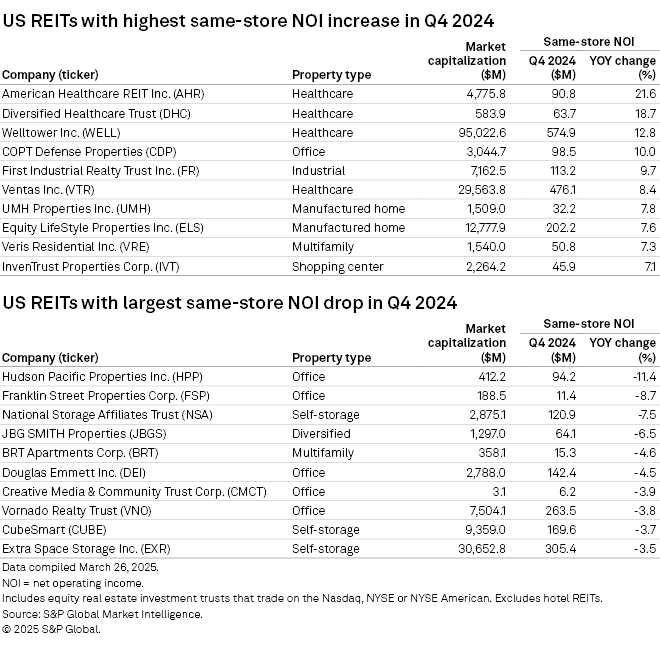

Four healthcare REITs ranked among the top 10 US REITs with the highest same-store NOI growth in the final quarter of 2024. American Healthcare REIT Inc. posted growth of 21.6% during the period, the largest increase among US REITs.

During a March 3 earnings call, American Healthcare REIT CEO Danny Prosky said the outlook is optimistic despite historically slow growth in the healthcare REIT sector. He noted that organic growth is driving earnings primarily through increased occupancy and revenue per occupied room, which is outpacing expenses per occupied room.

Prosky anticipates strong earnings growth in the coming years, supported by improved revenue and a favorable cost of capital. He also expects continued solid NOI margin expansion.

|

– Visit the CRE Zone for a curated compilation of S&P Global Market Intelligence's commercial real estate news and insights. – Download a template on real estate investment trust same-store comparison. – Listen to the latest Street Talk podcast: How threatened are US banks by the wave of commercial real estate maturities. |

Diversified Healthcare Trust ranked second with its same-store NOI growing 18.7% year over year during the fourth quarter of 2024. On a Feb. 26 conference call, Diversified Healthcare Trust CFO Matthew Brown said the REIT expects NOI to range from $120 million to $135 million in its senior housing operating portfolio segment and between $104 million and $112 million in its medical office and life sciences segment in 2025.

In relation to the senior housing operating portfolio guidance for the fourth quarter of 2024, Diversified Healthcare Trust experienced occupancy growth during the period, achieving an occupancy rate of 80% for the first time in several years, Brown added.

The two other healthcare REITs on the list are Welltower Inc. and Ventas Inc., which had same-store NOI gains of 12.8% and 8.4%, respectively.

During the fourth quarter of 2024, the shopping center segment posted the second-highest median gain of 4.8% in same-store NOI. For full year 2024, the sector achieved a median gain of 3.7%. InvenTrust Properties Corp. was the only shopping center REIT among the top 10 gainers through the fourth quarter, recording growth of 7.1% in same-store NOI.

The industrial sector recorded the third-largest year-over-year median gain of 4.1% in same-store NOI in the fourth quarter. The sector posted annual growth of 5.8% in median same-store NOI, the second-highest among all segments in 2024. First Industrial Realty Trust Inc. was the only industrial REIT among the top 10 US REITs with the largest same-store NOI gains in the fourth quarter.

The other four REITs among that top 10 were office-focused COPT Defense Properties at 10.0%, manufactured home REITs UMH Properties Inc. at 7.8%, Equity LifeStyle Properties Inc. at 7.6%, and multifamily-focused Veris Residential Inc. at 7.3%.

Office segment posts decline

The office segment registered a 0.1% decrease in same-store NOI in the fourth quarter and a 0.7% decline in 2024.

Office REIT Hudson Pacific Properties Inc. reported a decline of 11.4% in same-store NOI for the fourth quarter, posting the largest year-over-year drop among REITs. Franklin Street Properties Corp. booked the second-largest decrease at 8.7%.

Three other office REITs — Douglas Emmett Inc., Creative Media & Community Trust Corp. and Vornado Realty Trust. — ranked among the 10 REITs with the largest year-over-year declines in same-store NOI in the fourth quarter.

The same-store NOI of self-storage REIT National Storage Affiliates Trust declined 7.5% in the fourth quarter. "While we believe our year-over-year same-store performance has bottomed, the near-term negative NOI growth, along with the first quarter being seasonally the weakest, will put additional pressure on leverage for the next couple of quarters," said National Storage Affiliates Trust CFO Brandon Togashi at a Feb. 27 earnings conference.

Togashi expects the temporary pressure to ease as the company's organic growth turns positive in the latter half of the year and anticipates potential near-term asset sales to partially offset this pressure.