Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Apr, 2025

By Robert Clark and Xylex Mangulabnan

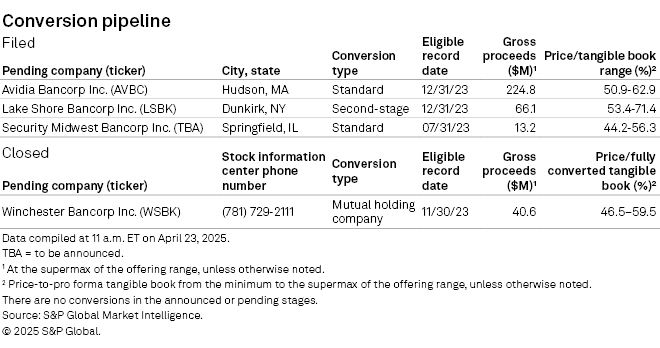

This feature has the latest news from the mutual bank conversion sector. As of April 23, four conversions were in the pipeline.

The new shares of Wausau, Wisconsin-based Marathon Bancorp Inc. began trading April 22, closing down 0.5% from the $10 offering price. The company sold 1,693,411 shares, which was between the midpoint and the maximum of the offering range, in its second-stage conversion.

Winchester, Massachusetts-based Winchester Bancorp Inc. has closed the community offering for its mutual holding company conversion.

On March 14, Avidia Bancorp Inc., the proposed holding company for Hudson, Massachusetts-based Avidia Bank, filed a registration statement for a standard mutual bank conversion. Gross proceeds at the supermax of the offering are expected to be $224.8 million, which would represent the fourth-largest standard conversion offering completed in the last 10 years.

In the filing, the company disclosed that at the end of 2024, the bank's loan portfolio was dominated by four major categories: one-to four-family residential (23.3%), commercial and industrial (C&I) not related to condominium associations (22.8%), condominium associations (22.5%) and commercial real estate (22.1%).

The bank initiated condominium association lending in 2014. Of the $494.9 million in condominium association loans at year-end 2024, 48.7% were in Massachusetts, 15.9% were in Florida and 9.3% were in New York. The largest loan in the category was on a complex in Miami Beach, Florida, with a $19.4 million outstanding balance.

Within the other C&I loan category, the company listed dental practice loans of $190.5 million and solar plant loans of $76.9 million. Those lending lines began in 2010 and 2015, respectively.

"To sharpen its business focus and to increase efficiency and profitability, in 2024, Avidia Bank exited the banking of cannabis businesses and sold its credit card portfolio," the company said in the filing.

Robert Cozzone joined Avidia Bank in March 2023 as president and CEO. He was previously the COO at Rockland, Massachusetts-based Independent Bank Corp. Other recent hires include CFO Jonathan Nelson in October 2024 and Chief Administrative Officer Barry Jensen in May 2024, both of whom formerly worked at Independent Bank.

The purchase limitation in the offering is $400,000 for individuals and $600,000 for groups. Cozzone, Nelson and Jensen each plan to buy $400,000 worth of stock. The aggregate proposed outlay for directors and executive officers is $6.9 million, or 3.1% of the gross proceeds at the supermax.

Also on March 14, Dunkirk, New York-based Lake Shore Bancorp Inc. filed a registration statement for a second-stage conversion. The purchase limitation for both individuals and groups is $1.5 million. The exchange ratio for the newly issued shares is between 1.1632 at the minimum of the offering range and 1.8098 at the supermax.

On March 11, Lake Shore Bancorp suspended cash dividend payments pending the completion of the second-stage transaction. The company paid an 18-cent-per-share dividend for the past four quarters. It will pay dividends after the conversion, but the amount has not yet been determined.

On March 4, the Federal Reserve terminated its enforcement action against Lake Shore Bancorp and parent company Lake Shore MHC. In December 2024, Lake Shore Savings Bank, the federal savings bank subsidiary in the corporate structure, announced the termination of an enforcement action by the Office of the Comptroller of the Currency.

On Sept. 12, 2024, Security Midwest Bancorp Inc., the proposed holding company for Springfield, Illinois-based Security Bank SB, filed an initial registration statement for a standard conversion.

In the filing, the company said it established a cannabis-related business (CRB) program in 2018, providing deposit and cash-management services to licensed cannabis-related businesses. It added that it offers depository accounts to customers with licensed cannabis businesses in Illinois, Michigan and Ohio. In December 2022, Security Bank began lending to cannabis organizations and their associated real estate entities.

According to an amended S-1 filing, Security Bank held $58.6 million of deposits from CRB customers as of year-end 2024, accounting for 29.4% of total deposits, as well as $23.3 million of loans to CRB customers and associated real estate entities, comprising 20.4% of total loans. One individual customer accounted for over half of the CRB deposits. Additionally, fee income related to CRB deposit accounts represented 48.5% of total noninterest income in 2024.

The company said in the amended filing that it intends to grow the CRB program "modestly."

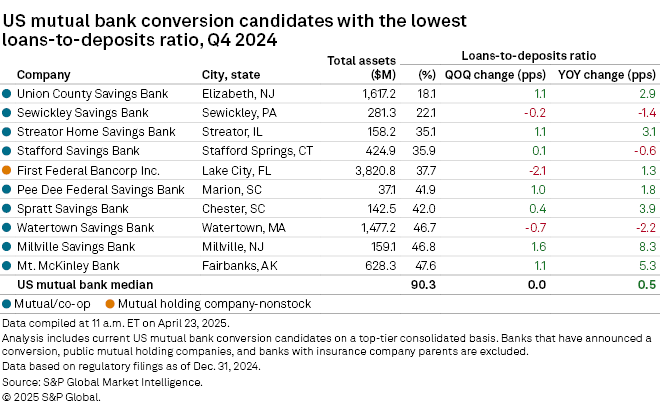

Download a template showing the conversion pipeline, market performance of recent conversions, valuations of mutual holding companies and a list of conversion candidates.

Other news stories about mutuals, mutual holding companies, recent conversions and activist investors

2 mutual banks in Massachusetts seek to keep independence while merging

New Hampshire community banks turn to M&A to compete against mutuals

FDIC rates Sewickley Savings, Community Bank of Raymore as 'need to improve' CRA

We encourage reader participation and feedback. Please forward any suggestions to ConversionNews@snl.com.