Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Apr, 2025

Barclays PLC is well positioned to meet the medium-term performance targets set in its latest revamp despite the more volatile global environment, CEO C.S. Venkatakrishnan said after the UK bank delivered first-quarter earnings that surpassed analysts' expectations.

"Our strategy has been designed to deliver in a range of economic and financial environments, and I reiterate our confidence in achieving the targets which we have set out financially and operationally for 2025 and 2026," Venkatakrishnan said April 30.

The current uncertainty and market volatility "undoubtedly require attention," and Barclays continues "to provision prudently" across all divisions, while also protecting itself by actively managing risks, the CEO said.

"We have long-established programs to transfer and hedge risk, and we will continue to do so as warranted by this environment," he said.

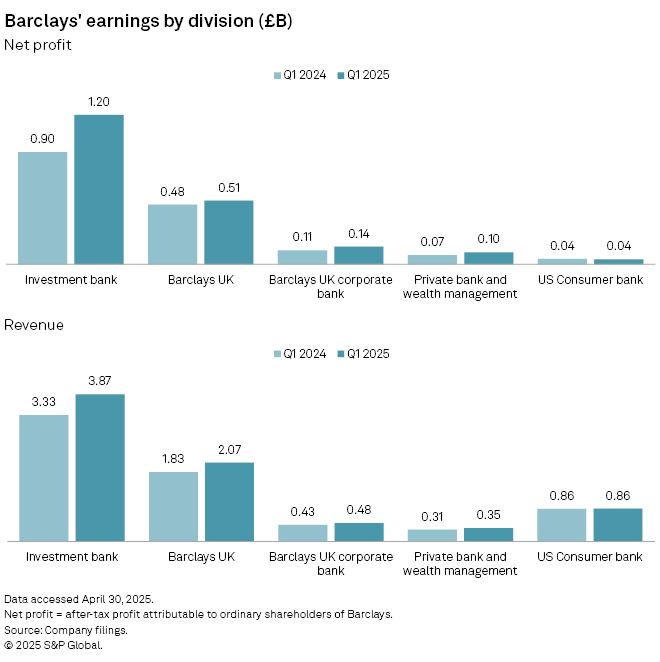

Barclays' first-quarter net profit rose to £1.86 billion from £1.55 billion from a year ago, beating consensus estimates of £1.72 billion compiled by Visible Alpha, a part of S&P Global Market Intelligence. The group's first-quarter revenue grew to £7.71 billion from £6.95 billion in the prior-year period, exceeding the Visible Alpha consensus estimate of £7.43 billion.

First-quarter earnings were boosted by a surge in fixed income trading revenues amid tariff-driven market volatility and higher net interest income (NII), supported by structural hedge gains, the bank said.

The investment bank achieved the strongest year-over-year growth among Barclays' business divisions, with a 33% surge in net profit and a 16% increase in revenue.

Targets update

"We expect net interest income to grow further and for markets revenues to be roughly commensurate with volatility. However, transactional and lending income could slow as companies and individuals become more cautious," Venkatakrishnan said.

Barclays raised its 2025 target for group NII, excluding the investment bank and head office, to above £12.5 billion from roughly £12.2 billion. Within this, Barclays UK's NII is now projected to grow to over £7.6 billion compared to roughly £7.4 billion targeted previously.

Barclays confirmed its target for group return on tangible equity (ROTE) of around 11% and cost-to-income ratio of 61% in 2025. It also reiterated the goals set in its latest restructuring plan of achieving over 12% group ROTE in 2026, reducing the share of investment bank risk-weighted assets to about 50% of the group's total, and paying out at least £10 billion to shareholders for the 2024–2026 period.

"These savings structurally improve our cost base and the level of consistency of our returns, including beyond 2026," the CEO said.

Barclays continues to allocate more capital to its higher-returning UK businesses, while taking measures to improve returns in lower-performing units such as the investment bank and the US consumer bank, Venkatakrishnan said.

First-quarter ROTE in the investment bank was 16.2%, exceeding the 2026 target of over 12% Barclays has set for the division. The US consumer bank's ROTE fell to 4.5% from 5.3% a year ago due to a 5% rise in operating expenses and a £74 million provision for risks linked to US macroeconomic uncertainty. Barclays aims to achieve ROTE of above 12% in its US consumer bank in 2026 too.

The performance of the US consumer book is "extremely robust" with no current change in consumer behavior and "relatively low and stable" delinquencies, CFO Anna Cross said during the earnings presentation.

"We are continuing to want to grow this business. We do think the opportunities are great," Venkatakrishnan added.

Shares in Barclays traded 1.46% lower around noon London time.