S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

01 Apr, 2025

By Yuzo Yamaguchi and Uneeb Asim

The at-risk loans of South Korea's largest banks increased year over year in the fourth quarter of 2024, highlighting the challenging outlook for the country's export-reliant economy.

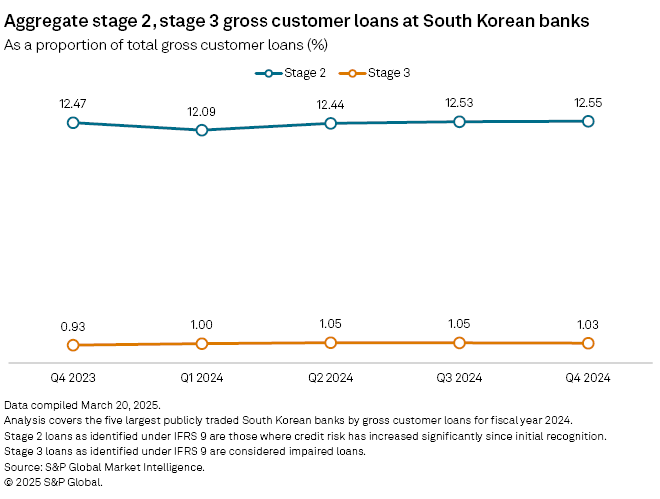

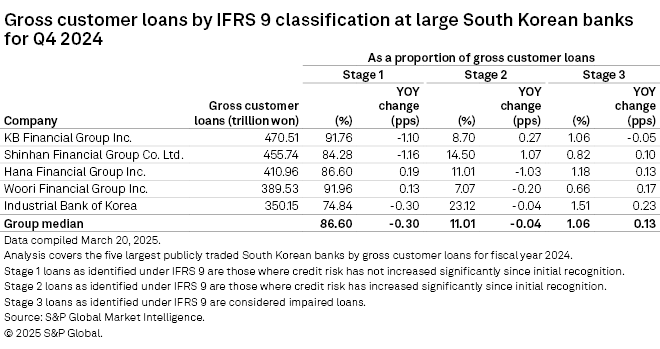

Aggregate stage 2 loans, classified under IFRS 9 as indicative of significantly increased credit risk, grew to 12.55% in the three months ended December 2024 for KB Financial Group Inc., Shinhan Financial Group Co. Ltd., Hana Financial Group Inc., Woori Financial Group Inc. and Industrial Bank of Korea, up from 12.47% a year earlier. The stage 2 loans increased for the third consecutive quarter over the previous three-month period, Market Intelligence data show.

During the same period, stage 3 loans, which are classified as credit-impaired under IFRS 9 standards, for the five financial groups also increased to 1.03% from 0.93% a year earlier.

Slowing economy

"The increase [in stage 2 loans] reflects the slowdown in Korea's economy in recent months," said Michael Makdad, an analyst at Morningstar. South Korea has cut interest rates to support its flagging economy even as the US Federal Reserve has stayed on hold for now, Makdad noted.

The Bank of Korea cut interest rates by 25 basis points to 2.75% in February, marking the third reduction since it began lowering borrowing costs from a 15-year high in October 2024. This placed the Korean rates about 150 basis points below the US target range of 4.25% to 4.50%.

Analysts expect two more rate cuts, bringing the rate down to 2.25%, by the end of 2025, despite a consensus that the Federal Reserve will likely make fewer cuts or possibly none at all in the upcoming months.

South Korea is grappling with the economic impact of US President Donald Trump's tariffs on key sectors such as automobiles, which is expected to drag on corporate profits. On March 26, Trump announced a 25% tariff on all imports of cars and light trucks, which will take effect April 2. Additionally, a similar tariff on auto parts will be implemented starting May 3.

Political unrest

Domestic political unrest following the brief declaration of martial law by impeached President Yoon Suk-yeol in December 2024 continues to dampen consumer sentiment, economists said.

"The unstable political situation is weighing on the economy," said Myoung-Jung Kim, a senior research fellow at NLI Research Institute. "But the biggest concern is how much the tariff that Trump imposed on auto imports will damage the economy."

The Bank of Korea cut its 2025 GDP growth forecast to 1.5% on Feb. 25 from its earlier estimate of 1.9%. The economy grew 2.0% in 2024, according to the central bank.

Similarly, the Organisation for Economic Co-operation and Development in March forecast South Korea's GDP to grow 1.5% in 2025, a downgrade of 0.6 percentage point from the December 2024 estimate of 2.1% growth. The OECD pointed to the increase in trade barriers imposed by the Trump administration as a contributing factor, highlighting the significant risk this poses to the nation.

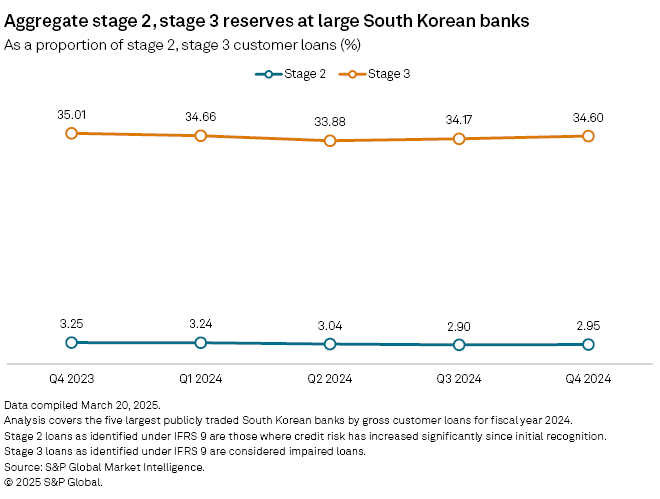

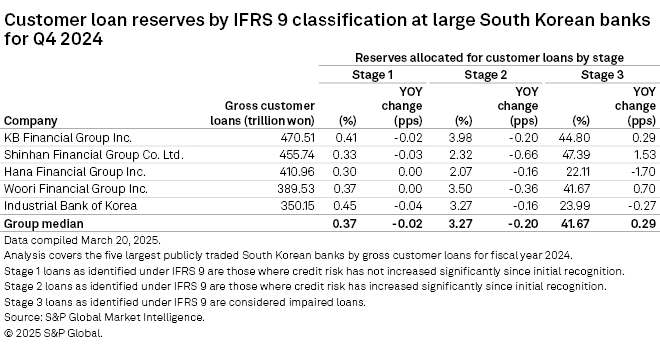

The five banks' aggregate reserves for stage 3 loans fell to 34.6% in the fourth quarter of 2024 from 35.01% a year earlier, while reserves for stage 2 loans declined to 2.95% from 3.25% during the same period, according to the Market Intelligence data.