Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Apr, 2025

Global private equity and venture capital deal value in March surged to the highest monthly deal value in at least a decade, exceeding the previous monthly record set in June 2021, according to S&P Global Market Intelligence data.

Private equity and venture capital deal value in March totaled $141.93 billion across 952 deals, more than triple the $42.03 billion that 883 deals amassed in February.

The March value was higher than the $141.79 billion recorded in June 2021.

Looking at quarterly results, deal value jumped about 66.7% to $221 billion from $132.55 billion compared to first quarter 2024. Deal count was down slightly to 3,002 from 3,185 in the same period in 2024, Market Intelligence data showed.

– Download a spreadsheet with data featured in this article.

– Read our latest In Play reports on rumored deals.

– Explore more private equity coverage.

Favored sectors

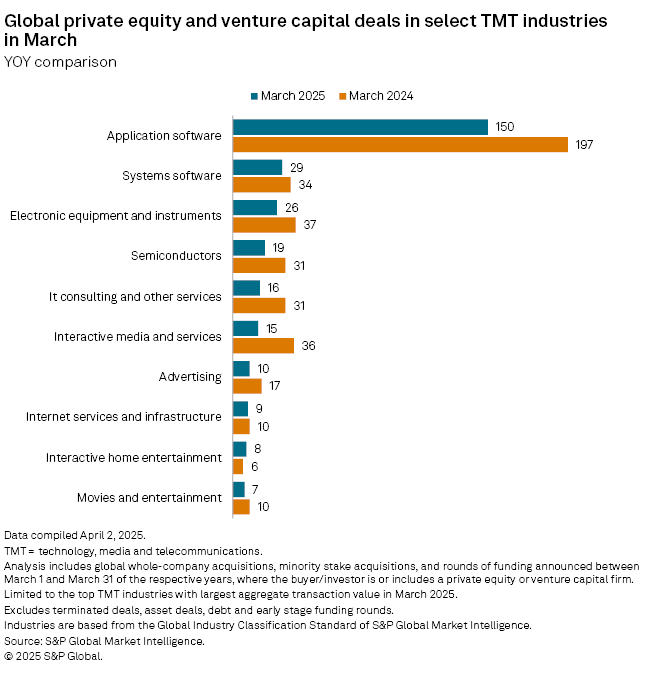

Technology, media and telecommunications (TMT) led global private equity and venture capital transactions in March with 314 deals totaling $66.27 billion, followed by the consumer sector with $46.46 billion across 77 transactions.

Application software remained the most invested segment within TMT, recording 150 deals. Systems software was a far second with 29 deals.

Top deals in March

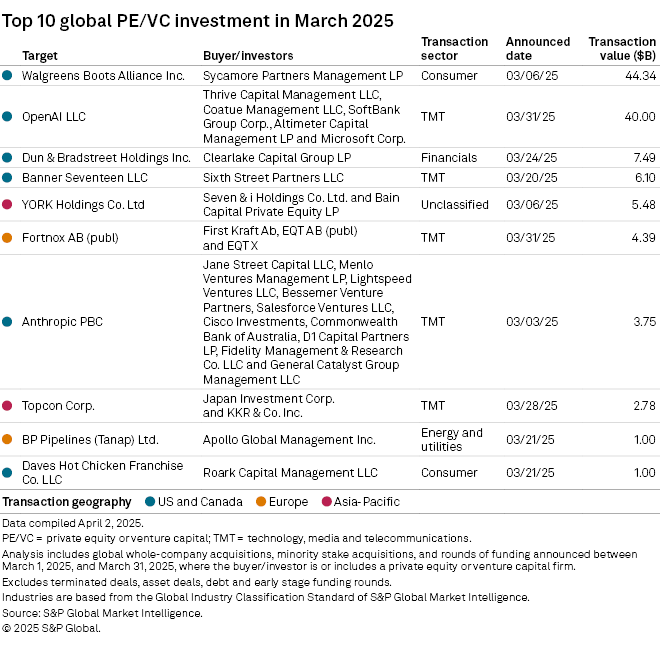

Six of the top 10 deals during the month were in the US and Canada. The largest private equity deal in March was Sycamore Partners Management LP's proposed acquisition of US-headquartered drug retailer Walgreens Boots Alliance Inc. for $44.34 billion, including debt.

The second-largest deal was a $40 billion investment in San Francisco-based AI developer OpenAI LLC with participation from Thrive Capital Partners Inc. OpenAI, which also received funding from technology giant Microsoft Corp., will use the proceeds to scale its computer infrastructure, among other developments.

Third-largest was Clearlake Capital Group LP's $7.49 billion take-private deal for US-headquartered business decisioning data and analytics provider Dun & Bradstreet Holdings Inc.