Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Apr, 2025

By Ranina Sanglap and Cheska Lozano

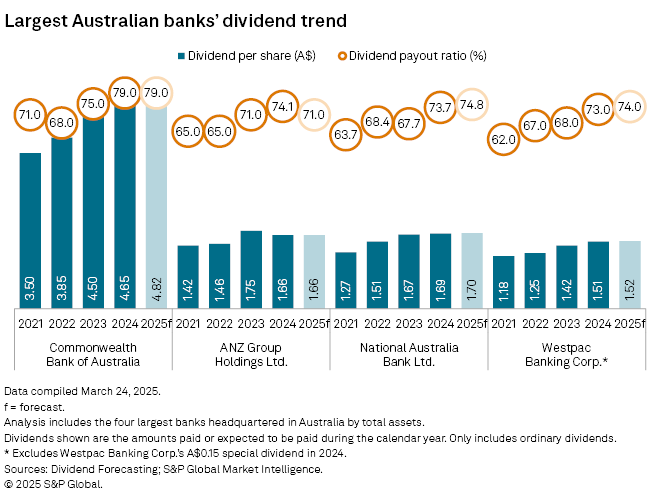

Australia's biggest banks are likely to maintain steady dividends in 2025 as they face pressure on their cash earnings in an environment of lower interest rates.

Dividend payouts for shareholders in ANZ Group Holdings Ltd., Westpac Banking Corp. and National Australia Bank Ltd. (NAB) will likely be flat in the fiscal year that started Oct. 1, 2024. Commonwealth Bank of Australia (CBA), whose fiscal year runs from July to June, raised its interim dividend 5% year over year to A$2.25 per share for the July-to-December period. The bank's dividend payout ratio is 73% of cash net profit, the bank said during its Feb. 12 half-year results announcement.

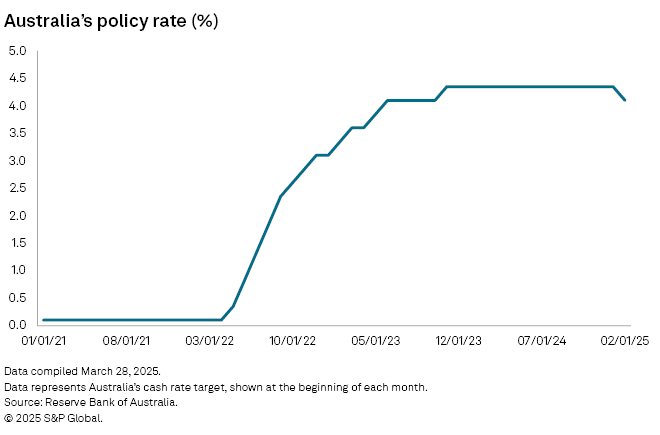

The Reserve Bank of Australia announced its first rate cut in February after 13 consecutive rate hikes in the last four years. The Australian central bank cut its benchmark cash rate by 25 basis points to 4.1%.

"With the lower interest rates, we anticipate additional strain on dividend payouts, especially as the payout ratios have already been stretched thin by existing dividend policies," Ralph Chen, senior research analyst for Asia-Pacific dividend forecasting at S&P Global Market Intelligence, said in a March 21 note. Australian banks' dividend growth slowed in the past two years as they grappled with diminishing interest rate margins due to "fierce competition within the domestic loan market and escalating operational costs," Chen said.

"One more thing to note is that the payout ratios by the respective dividend policy of the banks have already topped, imposing limits for the banks to increase ordinary dividends," Chen said in a separate email to Market Intelligence.

Market Intelligence expects NAB to maintain flat dividends for both interim and final distributions in fiscal 2025, with the payout at 85 Australian cents per share. Westpac should distribute 76 cents per share for both interim and final dividends in 2025. NAB's cash earnings payout ratio of 73.7% is on the high end of its target dividend payout ratio of 65% to 75% of cash earnings. Similarly, Westpac's payout ratio reached 73% in fiscal 2024, at the upper range of its 65% to 75% payout range.

Market Intelligence also anticipates a flat dividend payout from ANZ in fiscal 2025, although the lender could also surprise investors and distribute higher-than-expected dividends as its earnings per share is expected to rebound following the absence of a one-off charge for software amortization and credit impairment.

Chen expects CBA to offer a higher dividend to shareholders. "Again, CBA's payout also reached 79% in fiscal 2024, the top end of the range 70%-80% of the net profit. Thus, we expect limited potential for high dividend growth in the short term," Chen said.

The final dividend is forecast to be A$2.57 per share, a 2.8% year-over-year increase.

Commonwealth Bank of Australia"All of our balance sheet settings have remained at the conservative end of the spectrum, and that combination of profitability and balance sheet strength has provided the Board with the opportunity to distribute a higher interim dividend," CBA CFO Alan Docherty said during the bank's earnings release.

No more capital returns

In 2024, the banks favored capital returns due to their healthy capital and liquidity positions. Despite a lower cash profit, Westpac announced a fully franked special dividend and added A$1 billion to its share buyback. NAB added A$1.5 billion to its buyback in 2024, and ANZ announced a further A$2 billion in buybacks.

Banks may no longer implement these capital management measures as their capital ratios fell short of expectations. The banks' common equity Tier 1 ratio was an average 25 basis points below expectations, Market Index, a Perth-based independent information service provider, said in a March 27 report. The Australian Prudential Regulation Authority is also set to adjust capital rules, which could increase banks' target common equity Tier 1 ratios by 25 basis points to 11.25% to 11.75%.

"Our current view is that we do not expect any additional capital returns from the big four in 2025," Market Intelligence's Chen said. Westpac's special dividend was "a one-off case that the management intended to cheer up the shareholders," he said.

"Given the increasing margin pressures brought about by the interest cut as well as the intense competition in the domestic loan market, we expect the banks to remain conservative in the capital return plans," Chen said.