S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Apr, 2025

By Meerub Anjum and Shambhavi Gupta

Global private equity and venture capital-backed rounds of funding reached their highest level in the past two years, driven by the outsized $40 billion round for OpenAI LLC.

The month's total transaction value reached $66.01 billion, more than 4x the transaction value in February, according to S&P Global Market Intelligence data. Similarly, the number of investment rounds jumped to 1,262 in March, compared to 1,147 in February.

On a quarterly-basis, the transaction value spiked 32.4% to $103.65 billion, compared to $78.25 billion in Q1 2024.

However, the number of investment rounds dropped to 3,771 from 4,104 in the same period last year.

– Download a spreadsheet with data featured in this article.

– Read about private equity's exit challenge

– Explore more private equity coverage.

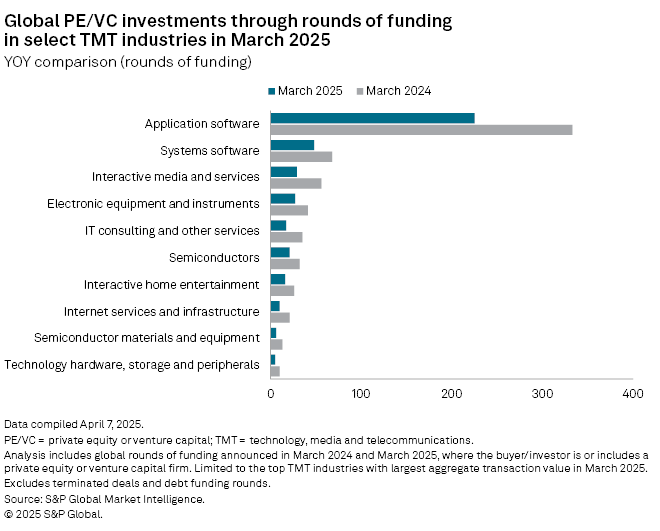

Technology, media and telecommunications (TMT) recorded the highest transaction value in March, receiving 81.6% of total investments. TMT raised $53.85 billion across 432 rounds of funding, followed by the healthcare sector, raising $4.8 billion.

Application software remained the most favored subsector within TMT, recording 225 deals, followed by system software with 48 deals. Deal volume across all TMT subsectors were down compared to March 2024.

Largest rounds of funding

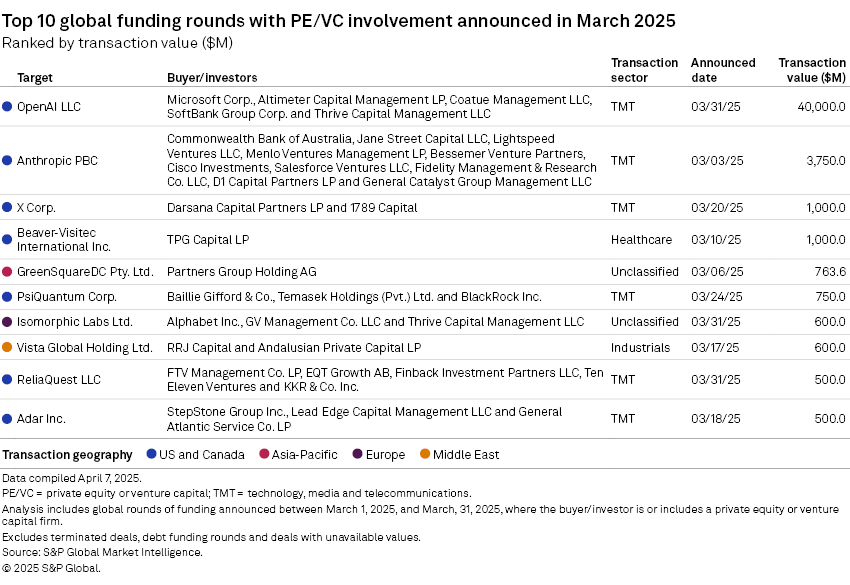

OpenAI LLC's $40 billion round of funding led by SoftBank Group Corp. drove the total transaction value in March. The transaction included participation from Coatue Management LLC, Microsoft Corp., Altimeter Capital Management LP and Thrive Capital Management LLC.

It was followed by Anthropic PBC's $3.75 billion series E round of funding led by Lightspeed Ventures LLC. Bessemer Venture Partners, Cisco Investments, D1 Capital Partners LP, Fidelity Management & Research Co. LLC, General Catalyst Group Management LLC, Jane Street Group LLC, Menlo Ventures Management LP and Salesforce Ventures LLC also participated.

X Corp.'s $1 billion round of funding, raised from Darsana Capital Partners LP, 1789 Capital and Elon Musk, was the third largest investment round in March.