S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

04 Apr, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Accelerating economic growth across the European Union boosted Europe-focused private credit fundraising in early 2025.

Private credit funds targeting European deals raised $25.71 billion this year through March 20, more than two and a half times the $9.27 billion fundraising total for US-focused private credit funds, according to an S&P Global Market Intelligence analysis of Preqin Pro data.

Europe-focused private credit funds have consistently outraised their US-focused counterparts annually since at least 2020, but they have gotten off to a remarkably fast start in 2025, accumulating 55% of their 2024 fundraising total in less than three months. Investors may be anticipating an uptick in deployment opportunities after EU GDP in the second half of 2024 grew at its fastest pace in two years.

What kind of deals are private credit funds targeting?

Read more about Europe-focused private credit fundraising.

For further insight, listen to this interview with Howard Sharp, chairman and co-head of direct lending for Europe-headquartered alternative credit manager Alcentra Ltd., on the latest episode of S&P Global's Private Markets 360 podcast.

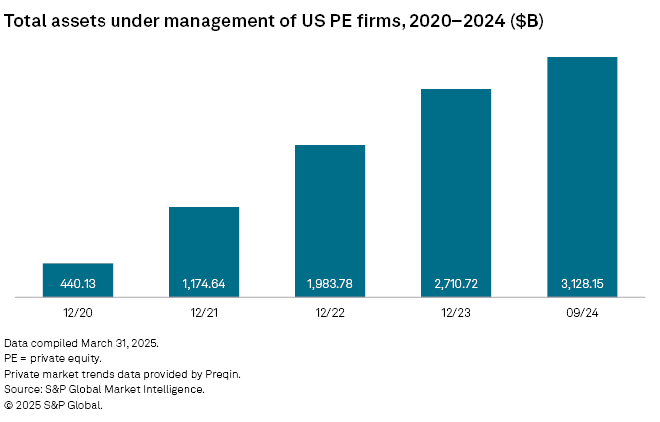

CHART OF THE WEEK: US private equity AUM tops $3 trillion

⮞ The total value of assets under management by US-headquartered private equity firms stood at over $3.1 trillion as of September 2024, according to Market Intelligence data.

⮞ Thirty-seven US private equity and venture capital firms more than doubled their AUM between 2022 and 2023.

⮞ The opportunity to produce higher fee revenue is a major incentive for private equity firms to grow, Steve Kaplan, a professor at the University of Chicago Booth School of Business, told Market Intelligence.

TOP DEALS

– ChatGPT developer OpenAI LLC raised $40 billion in new funding led by SoftBank Group Corp. Thrive Capital Management LLC also participated in the round.

– Insight Venture Management LLC, also known as Insight Partners, agreed to sell UK-based software developer Dotmatics Ltd. to Siemens AG for $5.1 billion.

– EQT AB (publ) fund EQT X and First Kraft AB made a bid to buy Swedish software developer Fortnox AB (publ) for 90 Swedish kronor per share in an offer valued at about 44.5 billion kronor.

TOP FUNDRAISING

– Waterous Energy Fund Management Corp. raised C$1.4 billion at the final close of its third private equity fund. Waterous Energy Fund III will invest in the Canadian oil and gas sector.

– Linden Manager LLC raised $400 million for Linden Structured Capital Fund II LP. The fund invests in middle-market healthcare companies.

– Revaia pulled in €250 million for its second fund, Revaia Growth II SLP, which invests in European technology companies.

MIDDLE-MARKET HIGHLIGHTS

– Audax Management Co. LLC acquired a majority stake in equipment parts delivery company Lanter Delivery Systems Inc. from Equity Group Investments Inc.

– NextGen Growth Partners LLC sold Door and Window Guard Systems Inc. to The Riverside Co.

FOCUS ON: EUROPE-FOCUSED PRIVATE EQUITY FUNDRAISING

Two Europe-focused private equity funds with at least $1 billion in capital have closed this week.

UK-based Investindustrial secured €4 billion for its flagship fund, Investindustrial VIII Scsp. The vehicle will invest in midmarket businesses across southern Europe. Investindustrial has 50 current direct investments in Europe valued at $3.41 billion, according to Market Intelligence data.

IK Partners closed its 10th midcap fund at its hard cap of €3.3 billion. IK X Fund invests in midmarket businesses across Europe. The fund's largest limited partner is Minnesota State Board of Investment, which committed $106.6 million in capital, Market Intelligence data shows.

Capital raised by Europe-focused private equity funds reached $54.77 billion in the first quarter, lower than $91.35 billion in the same period in 2024. The number of Europe-focused funds fell for a third straight year in 2024 amid liquidity issues.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter

______________________________________________

S&P Global Market Intelligence's 2025 Private Equity and Venture Capital Outlook report is now available to view.

One of the takeaways: Buyouts are the primary investment strategy this year for 42% of private equity general partners surveyed, while 23% said they are focusing on growth capital.

For venture capital professionals, growth capital (32%) and early-stage venture (25%) were most likely at the core of their 2025 investment strategy, followed by secondaries (14%).